UPDATE April 16, 2020: The SBA announced they are no longer accepting applications for the Paycheck Protection Program (PPP) loans due to funding limits being reached. See PPP loan updatesfor a timeline of milestone changes.

A second draw PPP loan was added on January 13, 2020 with a maximum value of $2 million. The loans also feature forgiveness in which all or a portion of the loan can be forgiven if the business keeps employee counts and wages consistent. This is the closest thing to free money, and even if there is a portion of the loan that remains unforgiven, only a one percent interest rate is applied to the remaining balance.

Most small businesses or nonprofit organizations are potentially eligible to receive a PPP loan if the organization employs 300 employees or fewer (versus the initial requirement of 500 or fewer). This was to encourage businesses that needed it most to get the relief in funding.

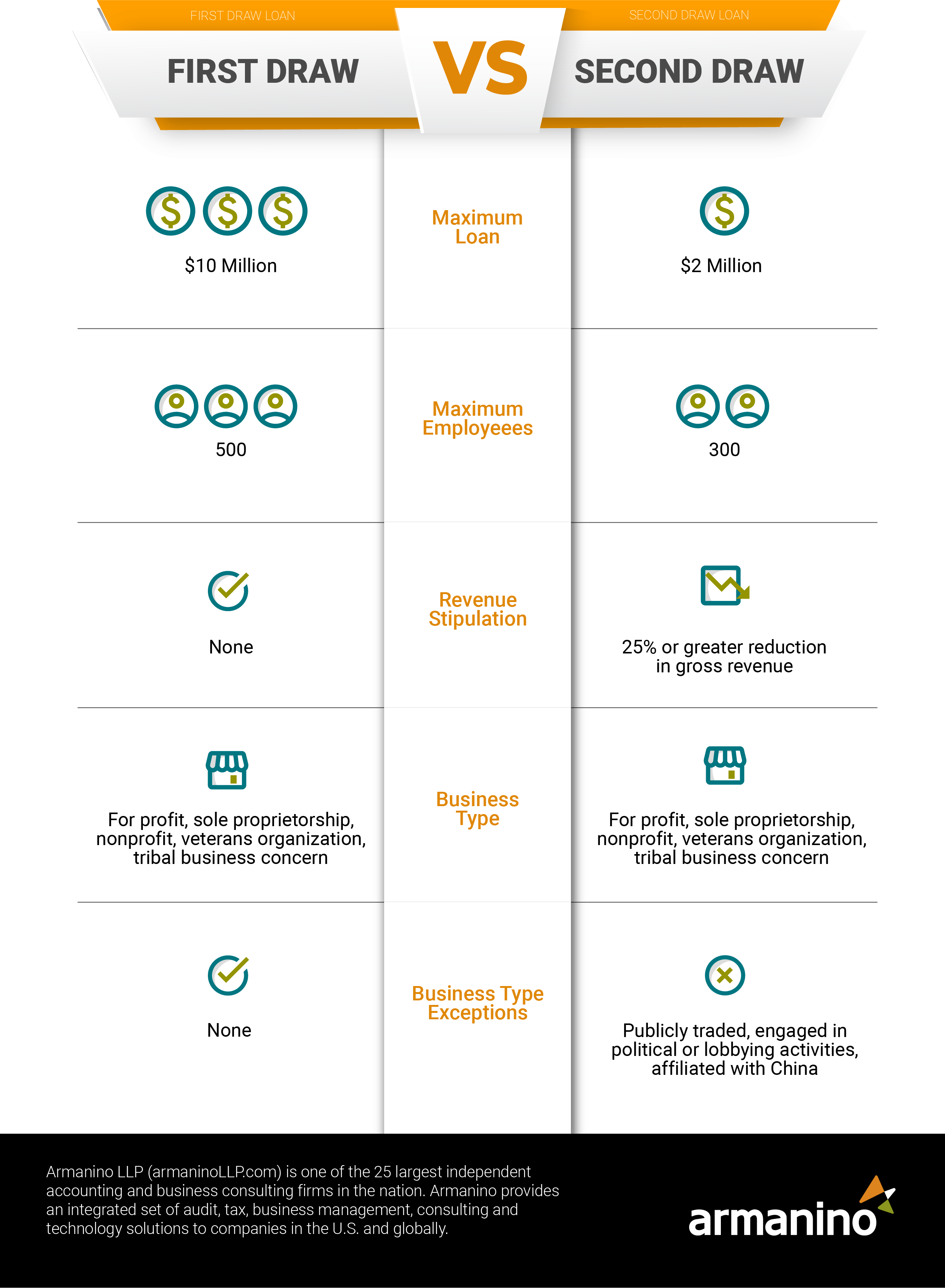

Although the second draw loans resemble the first draw loans with the original terms and conditions, there are several distinct differences between the two loans. The second draw loan contains narrower eligibility requirements than the first draw to ensure the right businesses received funds.

Watch a quick 15 minute video to gain more insight into the differences.

The following infographic illustrates a side-by-side comparison of loans:

Want to display this infographic on your site? Copy and paste the following code. Be sure to include attribution to armanino.com with this graphic.

Second draw loans were similar in requirements to first draw loans with a few differences. The specific for second draw loan requirements are outlined below:

For a second draw loan, the basis for calculating the PPP loan amount is 2.5 times the average monthly payroll costs (see below for Payroll Costs defined) incurred or paid during 2019 or the 12 months prior to the loan date.

Includes:

Excludes:

The most common calculation steps and formula is outlined below (covering S and C corporations). Refer to the sba.gov site for specific steps and calculations for your specific business type.

Step 1

Compute 2019 payroll costs by adding the following:

Step 2

Calculate the average monthly payroll costs (divide the amount from Step 1 by 12).Step 3

Multiply the average monthly payroll costs from Step 2 by 2.5Step 4

Add the outstanding amount of any EIDL made between January 31, 2020 and April 3, 2020 that you seek to refinance. Do not include the amount of any advance under an EIDL COVID-19 loan (because it does not have to be repaid).

1 Note that employer contributions for group health, life, disability, vision, and dental insurance for S-Corporation employees who own more than a 2 percent stake in the business (or employees who are family members of such owners) are not included in this figure as such contributions are already included in gross wages.Alternately, you can try using this calculator to estimate your loan amount eligibility:

To qualify for full PPP loan forgiveness on second draw loans during the 8- to 24-week period following loan disbursement ALL requirements below must be met:

A portion of the loan is forgivable if the following conditions are met:

The total of the following costs incurred, and payments made during the covered period can be forgiven:

Learn how to prepare for loan forgiveness in this video which digs into the known and unknown variables and takes a deeper look into the qualifications for forgiveness.