Updated August 09, 2022

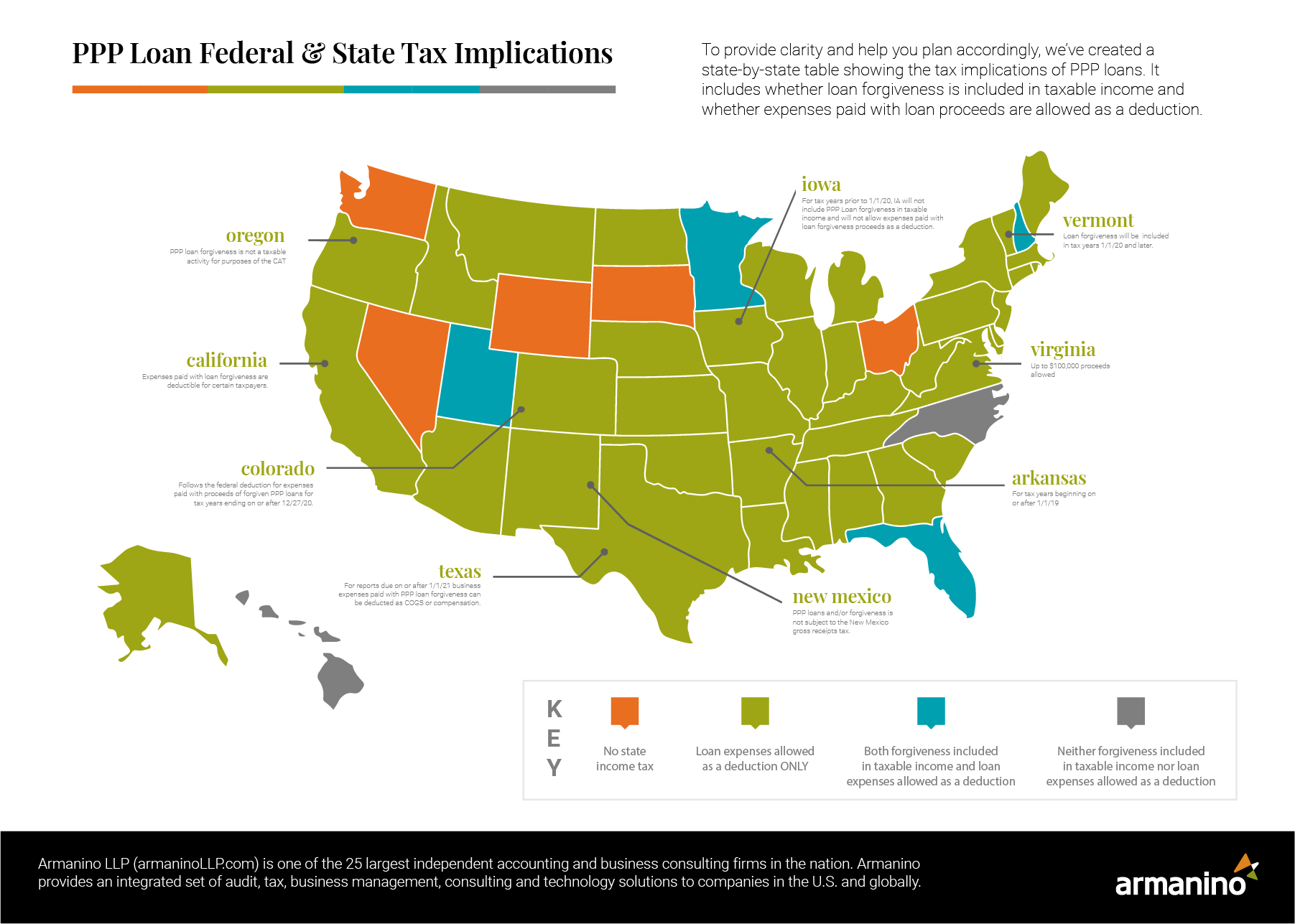

If you’ve received a Paycheck Protection Program (PPP) loan, you may now be planning to file your 2020 tax returns. One common question we hear is, “Is PPP loan forgiveness taxable?” The answer as to whether the loan amount is viewed as income and whether loan expenses are deductible varies by state, and deductibility can be a source of confusion. To provide clarity and help you plan accordingly, we’ve created a state-by-state table showing the tax implications of PPP loans shown in the section below.

Want to display this infographic on your site? Copy and paste the following code. Be sure to include attribution to armanino.com with this graphic.

Are you a California resident? Check out our more detailed article regarding California PPP loan deductible expenses.

There has been a lot of conflicting information about the tax implications for PPP loan recipients. While it’s clear at the federal level, it’s not as straightforward for individual states. Our PPP experts walk you through the details regarding which states aren’t offering forgiveness and where your loan is tax deductible and offer guidance for organizations operating in multiple states.

Keep in mind that a PPP loan audit will require information and documents, including income and employment tax returns, as well as other loan information such as payroll and banking records. So keeping tax records becomes an important factor to ensure a smooth audit process (if audited).

With the rapid adoption of city and county shelter-in-place rules and state lockdowns (e.g., Hawaii) many employees found themselves working from locations that they never expected to be working from and for much longer than expected. Now employers have begun to ask, “Where are my employees working from? And what do I need to consider as a result of having almost, if not all, my employees now be remote employees?”

Unfortunately, the answer isn’t easy or straightforward. Having employees working remotely can potentially impact the employer’s state income tax withholding and business activity taxes (e.g. income, franchise and gross receipts).

Generally, state income tax withholding is required in the state where the employee is providing services, NOT the state the employee resides. There are exceptions to this rule, for example, if there is a reciprocal agreement between the state of residence and the state where the work is performed. Reciprocal agreements, most commonly seen on the east coast, allow residents in a neighboring state to not have to file and pay income taxes on wages earned in the non-resident state. However, due to COVID-19, many employees are now working from their homes or maybe wherever they were when the shelter-in-place or lockdown rules were executed.

Having employees performing work in these new jurisdictions may require employers to register with the state and begin withholding payroll taxes on that employee’s wages.

But at what point is that required? After the employee has been there a week, two weeks, a month, two months, longer? Unfortunately, many states remain silent on the length of time that an employee must be working from that state to create a withholding requirement.

The good news though is that the states that have started addressing this question via guidance or law changes, have said that so long as the employee’s telework location is temporary and a result of the COVID-19 pandemic, the state will NOT seek to impose withholding requirements. However, employees that choose to continue working from their remote location after an applicable work from home order has been lifted could be subject to state tax withholding in that state/city.

Income tax/BAT nexus can be established by physical presence and/or economic nexus. Numerous states have some sort of economic nexus rule or have set economic nexus thresholds, but regardless of whether or not a state has an economic nexus standard, the physical presence of an employee working within the state generally establishes income tax/BAT nexus. That being said, what happens now that employees are working from states that they have never worked from before? Does that employee’s inability to travel to their normal office location (which may be in another state) now create income tax/BAT nexus in the state or city that they are now working from?

Prior to COVID-19, states had taken a pretty hard line that having one employee in the state, even if for only one day, could subject that business to the state’s business tax (income/franchise/gross receipts). Some states had expanded physical presence to mean the employee had to be in the state/city in excess of seven days to create physical presence nexus, with other states defining it as 10 days. Now with COVID-19 shelter-in-place currently approaching 10 weeks in some areas, businesses must now consider what new jurisdictions they might have income tax/BAT nexus and whether they will need to file any additional 2020 state/locality tax returns due to the location(s) of their remote employee(s).

Similarly, some states recognized the implications of remote employees on business taxpayers and have provided COVID-19 nexus relief stating that the state’s tax department will not use someone’s temporary location as the basis for asserting BAT nexus in the state. Georgia even went so far as to say that an employee’s temporary location would not void Public Law 86-272 protection for that employer so long as that employee’s location is temporary and there remains an “official work from home order issued by an applicable federal, state, or local government unit.”

The fact that Georgia addressed P.L. 86-272 implications is much appreciated as most states have remained silent on this even if they have provided general COVID-19 nexus guidance. Re-evaluating P.L. 86-272 protection is something any business that has previously claimed protection should do, as having non-sales employees within a state is considered an unprotected activity and will void any P.L. 86-272 protection previously applicable to the business taxpayer. Consequently, it may cause business taxpayers to not only have additional state income tax liabilities but also impact the amount of sales subject to throwback to the state of origin (if goods are shipped from a state with a throwback rule).

The key to ensuring than an employee’s remote location does not create income tax/BAT nexus is to make sure the employee’s location is in fact temporary. If an employee chooses to remain in their remote location after an applicable work from home order has been lifted, the COVID-19 nexus relief may no longer be applicable. However, it is less clear if even a temporary remote location will void P.L. 86-272 protection, especially as states have more recently pushed against the application of P.L. 86-272 protection in general, as it limits their ability to tax out-of-state taxpayers.

Similar to BAT taxes, sales and use tax nexus has historically been created by having even just one employee visit the state, let alone reside there for multiple weeks. While the Wayfair case created economic nexus rules for most states and many localities, the state’s physical presence rules remain in place post Wayfair. Having employees temporarily reside within a state where the business is not already collecting and remitting sales/use tax may now subject that business to new sales/use tax registration, collection and filing requirements.

Most states that have considered the implications from COVID-19 remote employees to payroll tax withholding and BAT nexus have also recognized the need to address the impact on sales/use tax nexus. These few states have issued guidance that sales tax nexus will be “waived” so long as no other factor created sales/use tax nexus – meaning if the jurisdiction’s economic nexus thresholds are met, or if the taxpayer had property in the state in addition to the remote employee, then the state would not waive sales tax nexus.

The most important step is making sure you know where your employees are working from and then monitor their time in that location. Employers should also continue to monitor the guidance issued by states where they have employees currently located.

Employees should keep track of the time spent working at their temporary telework location, monitor payroll tax withholdings on their paystubs, and inform their employer if their current location is expected to continue once shelter-in-place/lockdown rules are lifted. Becoming more knowledgeable about their current location, state of residence, normal office location payroll withholding and personal income tax rules will help employees review their payroll tax withholdings and assist them as they consider any new state tax filings for 2020.

Ideally, the hope is that instead of waiting on all the states to each issue their own guidance on payroll withholding, BAT nexus, and sales/use tax nexus, there would be some level of federal guidance, as COVID-19 is a global pandemic that has implications for everyone in every state and is not a “natural disaster” limited to one or even a few states. However, it is unknown if that will happen and for now, we must rely on each jurisdiction’s approach to providing relief to taxpayers whose workforce may be unexpectedly more dispersed across the country or even the world due to COVID-19.

The Paycheck Protection Program (PPP) continues to cause challenges to borrowers almost eight months after the CARES Act passed. As many borrowers have recently completed their loan forgiveness applications or are nearing a point where they are ready to file, one large looming tax question has been how to handle the deduction of allowable expenses included in the loan forgiveness application.

The Internal Revenue Service (IRS) initially caused a stir with Notice 2020-32 (Notice), announcing the position that the expenses included in loan forgiveness are not deductible since they are related to the forgiven income that the CARES Act, specifically excluded from federal income. Many practitioners questioned the correctness of this interpretation but hoped that it would be legislatively fixed.

IRS Chief Counsel Michael Desmond recently mentioned at an American Bar Association tax meeting that the IRS has heard the criticism of its deductibility in the Notice, and he was asked whether the IRS would change its position. In response, he indicated that the IRS has received “a lot of questions on that, and we are certainly considering those questions.” He continued to note that the IRS was considering issuing guidance. If anyone thought this guidance would result in a favorable resolution for taxpayers, they will be disappointed with Revenue Ruling 2020-27 and Revenue Procedure 2020-51. These rulings offer clarity in how to treat non-deductibility from a tax return perspective, but they maintain the IRS’ previous position.

This Revenue Ruling amplifies the Notice and sets out two factual situations, one where the borrower applies for loan forgiveness in 2020 and another that files in 2021. The ruling sets out the legal framework of support for the IRS’ position. Ultimately, the Revenue Ruling indicates that it doesn’t matter if a taxpayer applied for forgiveness in 2020, or waits until 2021, since the amount is foreseeable in both situations. Therefore, taxpayers can’t deduct the expenses on their 2020 tax return.

This Revenue Procedure outlines the safe harbor situations where you can deduct these expenses in 2020. To do so, the taxpayer must meet the following:

If a taxpayer qualifies for the safe harbor, they can deduct on the following returns:

There is a specific statement that needs to be attached (details in the Revenue Procedure) to the tax return in order for a taxpayer to take the deduction, so taxpayers taking advantage of this safe harbor should be aware of this to ensure deductibility.

Members of Congress, practitioners and taxpayers have called on the IRS to change its position and allow the deductibility of expenses included in PPP loan forgiveness applications. However, these IRS determinations make it clear that it is up to Congress to pass legislation that allows for deductibility and allows for taxpayers who apply for forgiveness to deduct those expenses on their tax returns.

Here are a few things we suggest you review, as appropriate, going into year-end:

Granting of forgiveness will no longer disqualify a business from electing to take payroll tax deferrals under the CARES Act.

Form 990 reporting of PPP loans and EIDL advanced grants should be consistent with both the book treatment of the loans or grants and the required treatment of the loans and grants from governmental entities. Form 990 presentation will generally follow the audited financial statements.

Part VIII, statement of revenue, line 1e government grants (contributions): PPP loan forgiveness should be reported on line 1e as contributions from a governmental unit in the tax year that the amounts are forgiven. The forgiven PPP loan should not be reported as “program service revenue” or “miscellaneous revenue.”

Schedule A, public support testing: Under both IRC Section 170(b)(1)(A)(vi) and IRC Section 509(a)(2), PPP loan forgiveness should be treated as a contribution and reported on Section A public support line 1 as a “contribution,” consistent with the reporting on Part VIII. Since it is a government grant, the amount will not be treated as an excess contribution consistent with the treatment of other government grants.

Schedule B, Schedule of Contributors: Report the name, amount, the date the loan was received, and the mailing address of the SBA if the PPP loan exceeds the Schedule B reporting threshold.

If the forgiven PPP loan exceeds $5,000, the nonprofit should report the name, amount, the date the loan was received, and the mailing address of the SBA on California Form 199. If the nonprofit is required to file the California Form RRF-1, the nonprofit should check “Yes” to Form RRF-1, Part B, Question 5, “During this reporting period, did the organization receive any governmental funding?” and report the name, mailing address, contact person name and phone number of the SBA.

EIDL Advance: As part of the Economic Aid Act, the COVID-19 EIDL advance provides up to $10,000 for small businesses (including private nonprofit organization) in low-income communities. The advance doesn’t have to be repaid and the nonprofit recipient no longer receives a reduction in PPP loan forgiveness for the amount of EIDL advance received. The EIDL advance should be reported as a grant on Form 990, Schedules A and B, similar to PPP loan forgiveness.

Given the unique nature of the PPP, many states and localities are issuing specific guidance. CAUTION: If you find guidance, be careful as it may be outdated and require updating for the Federal changes discussed in PPP Update #19. Some states released guidance regarding the treatment of the loan forgiveness but likely did not address the deductibility of PPP expenses. Recall the IRS previously disallowed expenses by equating the PPP funds with tax-exempt income. Some states and localities have similar rules to the IRS and may thus be required to provide a similar one-time exception for forgiveness of debt income and deductibility of expenses paid with PPP funds.

Many states and localities have different rules for different types of taxpayers. Typically, C corporations are subject to corporate income tax rules while pass-through entities (partnerships and S corporations) are usually subject to personal income tax rules. It is not uncommon in the world of state and local taxes (SALT) for the two sets of rules to differ from one another. For example, a state may indicate that a C corporation can deduct the PPP expenses, while limiting the deductibility of PPP expenses to partners of a partnership.

The interaction between federal tax laws and state and local tax laws is commonly referred to as conformity. There are three types of conformity:

It is important to note that despite conformity, even on a rolling basis where changes are automatically incorporated, a state can choose to decouple from any federal provision.