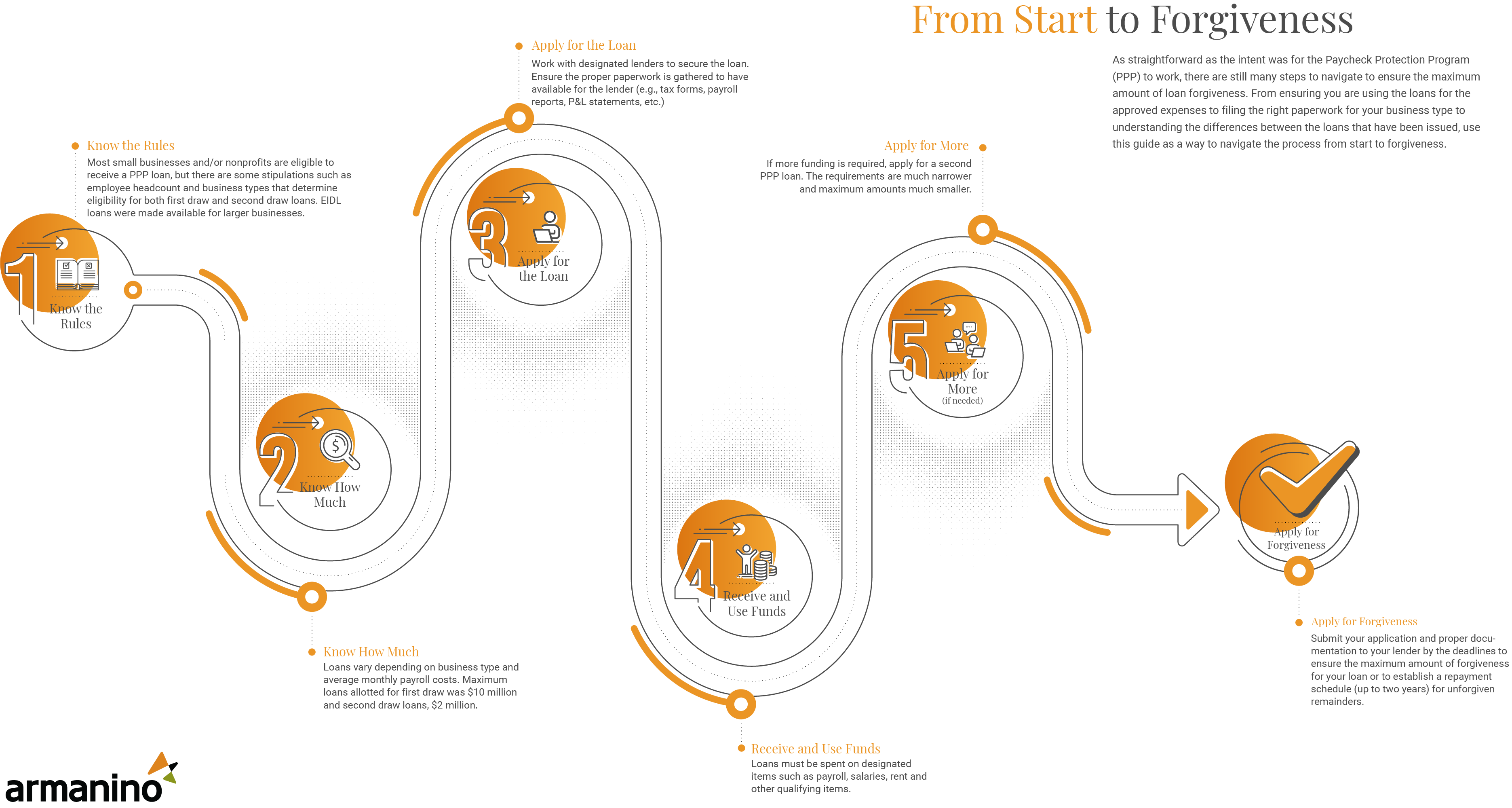

As straightforward as the intent was for the Paycheck Protection Program (PPP) to work, there are still many steps to navigate to ensure the maximum amount of loan forgiveness. From ensuring you are using the loans for the approved expenses to filing the right paperwork for your business type to understanding the differences between the loans that have been issued, use this guide as a way to navigate the PPP loan process from start to forgiveness.

Want to display this infographic on your site? Copy and paste the following code. Please include attribution to www.armanino.com with this graphic.

Covers: the basic definition of PPP, loan requirements and rules, what the loan can be used for, eligibility and a loan calculator to help determine how much loan you are eligible or qualify to receive based on your business type.

The Paycheck Protection Program (PPP) is part of the Coronavirus Aid, Relief and Economic Securities Act (CARES Act) and was created as a relief fund so businesses could continue paying their workers through what may have been an economic downturn. The program featured two sets of loans, referred to as first draw and second draw, both that could be forgiven if the company kept employee counts and wages consistent.

Covers: loan deadlines, PPP application instructions and documentation needed to apply.

To apply for a loan, you will need several documents to ensure a smooth process and optimal consideration. Instructions are straightforward but it’s advised to gain assistance either from your accountant or a proper bank representative. Deadlines for applying have passed but understanding the process, should any other loans follow, could be important for long-term planning.

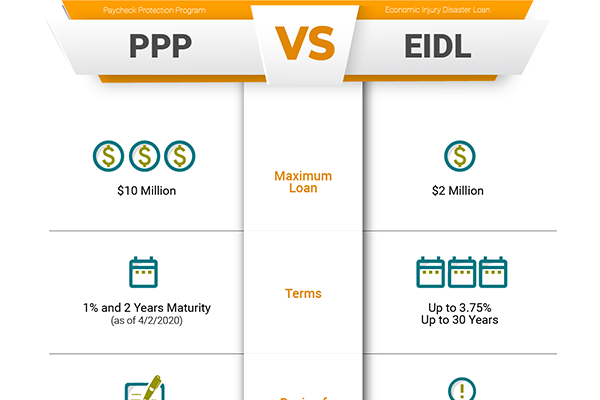

Covers: EIDL versus PPP loan comparison chart (pictured), EIDL and PPP loans together and Title IV loans.

Two loan programs were created in the CARES Act, the Economic Injury Disaster Loan (EIDL) and the Paycheck Protection Program (PPP), to assist businesses as a result of the COVID-19 pandemic, each with their own set of stipulations and benefits. This section helps outline the differences between each loan program to help guide which one might be right for your business or if you should apply for both (which is technically permissible). Title IV is also covered here which gives larger companies the ability to apply for loans as well, since EIDL and PPP were aimed more towards small to mid-sized businesses.

Covers: Qualifications, first draw versus second draw loans, second draw requirements, second draw loan calculation and second draw forgiveness.

First draw PPP loans were exhausted fast, and many loans were taken from businesses who could have sustained themselves on their current revenue. To compensate, a second loan was offered with tighter stipulations than the first draw loans with a lower loan maximum and lower maximum number of employees allowed.

Covers: What loan forgiveness is, the rules, application and deadlines for filing for forgiveness, a calculator to determine how much can be forgiven and details on certain reduction factors.

In order to encourage businesses to not lay off workers or cut wages, loan forgiveness was introduced as a way to forgive either partial amounts of a business loan for payroll and other qualified expenses or forgive it completely. There were certain deductions and gray areas within the laws that are discussed here, as well as the application and deadlines in order to take advantage of the forgiveness. In addition, we provide specific guidance on how to account for nonprofit loan forgiveness to ensure all the proper steps are followed and to answer any outstanding questions nonprofits had.

To ensure a thorough and properly submitted application for loan forgiveness, we put together guidance packages that help step through the process. Since there were many updates throughout the rollout of the PPP loans, having the proper guidance will ensure you are filling out all proper forms and providing the correct documentation to take advantage of the maximum forgiveness amount.

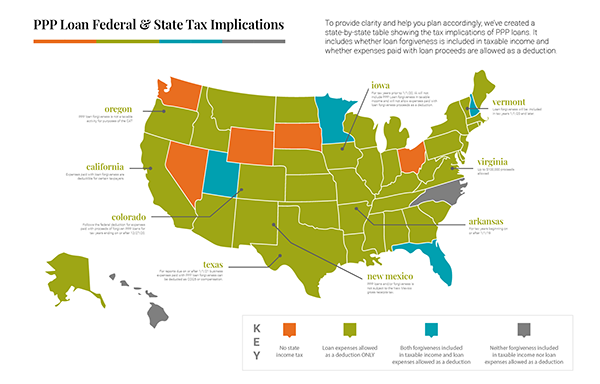

Covers: PPP expense deductions, tax implications by state (pictured), remote worker stipulations, tax deductions and 990 reporting instructions for nonprofits.

Tax deductions can be tricky with PPP loans and most are mandated at the state level, which will determine the tax implications that will apply to you or your business. Also classification of remote workers may also have an impact on state income tax withholding and business taxes such as income, franchise or gross receipts. Examine detailed tax information here and learn how best to understand your tax implications of PPP loans. In addition, California outlined its deduction allowance that is covered in California PPP Loan Deductible Expenses update.

Cover: Background of audit, SBA requirements, outstanding questions and actions to do now to prepare for an PPP loan audit.

When larger companies began gaining media attention for applying for and receiving PPP loans in late April 2020, the SBA and Treasury announced those who received loans of $2 million or more would be subject to audit to assess whether there was “economic need” to justify the loan. The SBA outlined what they were looking for in the audit and companies who are subject to the audit should prepare to account for the loan spent to avoid potential prosecution of fraud.

As the government continues to make ongoing changes to the PPP loan process, it’s important to get the latest up-to-date information regarding PPP loans and PPP loan forgiveness. Use this as your one-stop area to find out exactly what is happening and when and track important deadlines to ensure proper compliance or action necessary for next steps.