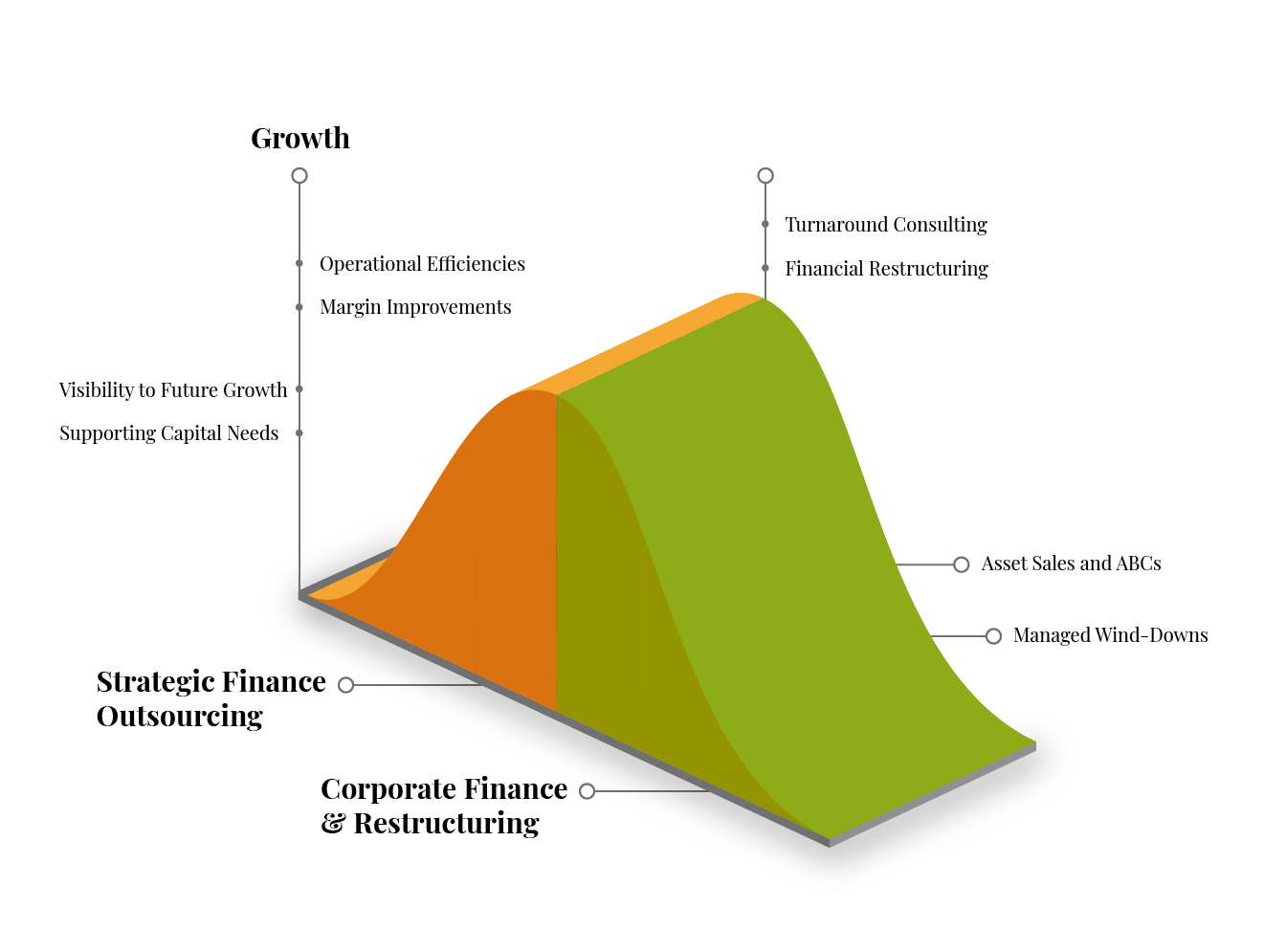

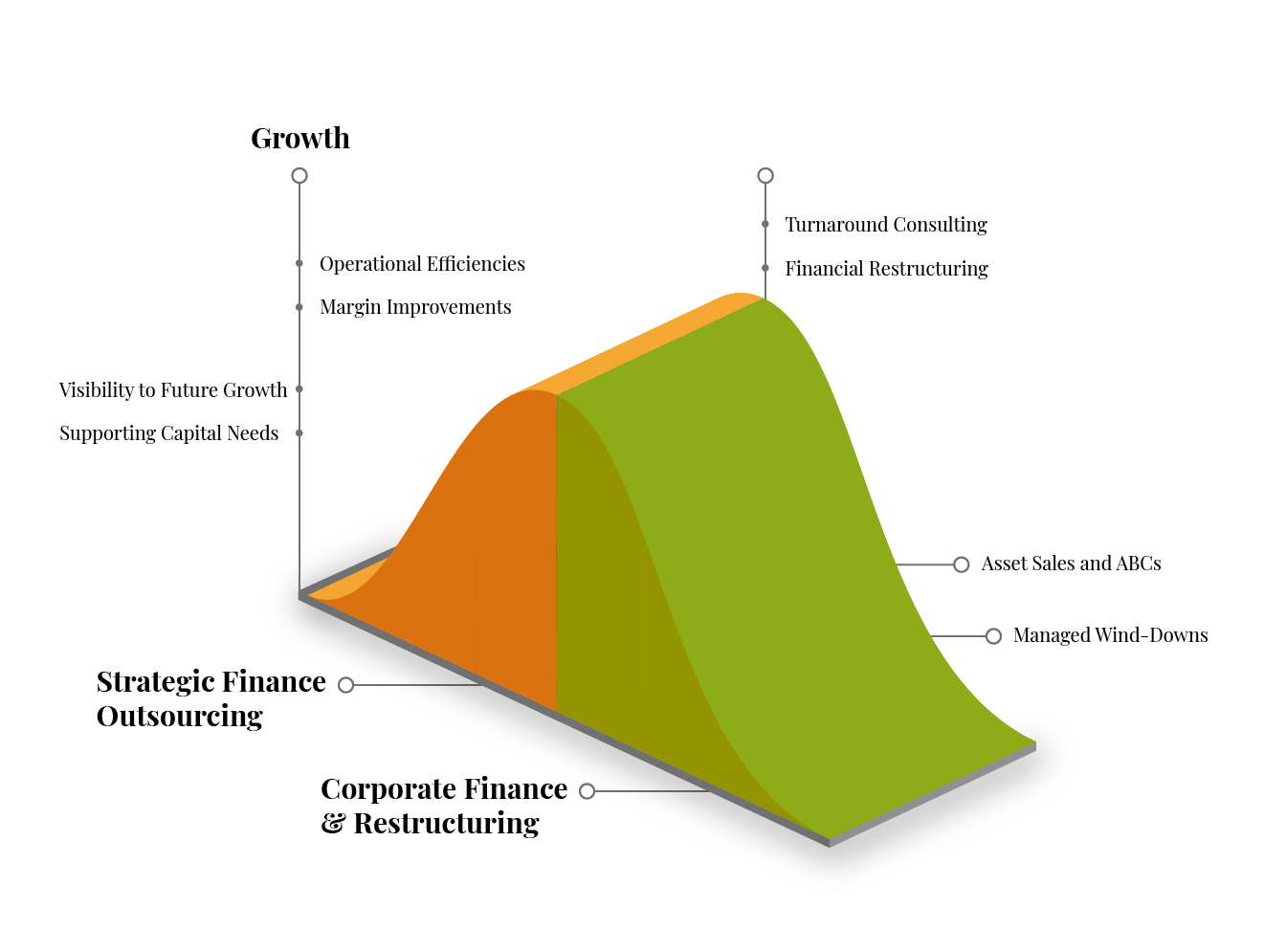

Whether it’s a turnaround, wind down, liquidation or other restructuring, we can be your trusted advisor and operator, taking an active role in helping you through the transition process.

Learn moreOptimize your outcomes and reduce risk with expert guidance for complex transactions such as acquisitions, mergers and divestitures. Whether sell side or buy side, we can help with valuations, modeling, negotiations, due diligence and more.

Learn moreYour Needs

Whether you’re facing a shortfall, crisis, disruption, loss of momentum or other turn of events, we can help you understand what needs to happen next.

Our Team

You can rely on our restructuring and corporate finance experts to guide you through successful transactions.

Our Services

If you have any questions or just want to reach out to one of our experts, use the form and we'll get back to you promptly.