One challenge many companies face is their ability to maintain a current and accurate aging of their accounts receivable. Collectors are judged on their ability maintain low DSO (Days Sales Outstanding) statistics, so keeping amounts out of the 60+Day buckets on the A/R Aging is a common goal. Receivables Management and Collections Management allow users to print A/R Aging reports, send customer letters and track collection progress on past due balances. But what can be done for the common over or underpayment by a customer?

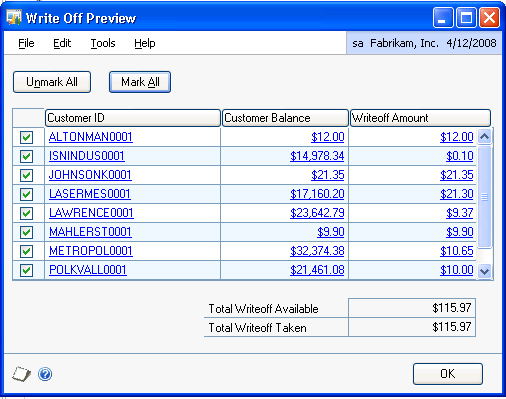

Let's say a customer's balance on an invoice is $3,499.29. The customer pays only $3,499.09 (the customer may have short-paid the invoice because they have a dispute over the additional $.20, but just as often there are data entry errors on the part of the customer's accounting department). Whatever the reason for the payment shortage, you are left with a $.20 amount which, if left unhandled, will continue to age into the 30, 60, 90 Day buckets and beyond on the A/R Aging Report.

When setting up Dynamics GP and training users, it is important to consider all of the options for handling these kinds of payment differences:

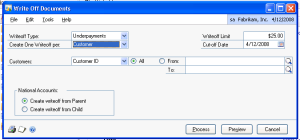

How to access the Write-Off Routine: Tools->Routines->Sales->Write-off Documents

One thing to keep in mind when allowing users to perform write-offs, whether during cash receipt entry to using the Over/Underpayments Utility, is that the default settings in GP Customer Classes and Customer Cards is to NOT allow write-offs. I've often seen users try to use the Utility, only to receive a message that leads them to think there are problems with the Utility when in fact their own settings in the Customer Card and/or Customer Classes have not been customized.