Updated April 21, 2023

Third-party relationships are critical to your company’s success in today’s business environment. However, the inherent nature of contractual agreements with these third parties means that without effective controls and monitoring, you could be setting your organization up for increased risk and missing opportunities to benefit your bottom line.

This guide will provide you with an understanding of how contract compliance can mitigate your risk and help you avoid leaving money on the table.

Table of Contents

A contract compliance program is designed to assess if your business partners are adhering to the agreed-upon terms and conditions set forth in your executed contract. Typically, the process involves a high-level risk review of the total population of third parties, a targeted contract review of a risk-based sample of third parties, and a limited selection of third parties for an in-depth assessment or desk audit.

Effectively managing your contracts is key to minimizing business disruptions, mitigating risks and deriving the most value from your vendor relationships. A contract compliance program can help you ensure that you are getting the full benefits from your negotiated contracts and third-party business partners.

You can minimize your contract compliance risk and benefit your bottom line by addressing four key areas:

Organizations devote significant time, energy and resources to finding and nurturing vendor relationships. But even the best business partnerships may not always go as planned.

Perhaps you have a feeling that you’re being overcharged but can’t pinpoint how. Maybe performance targets aren’t generating the value you planned or expected. Whatever the situation, you may suspect that you’re missing out on revenue but aren’t sure how to approach the issue – or how to quantify how much you are being overcharged.

When it comes to recovering lost revenue, there are two unique areas to consider: retroactive cost recovery and revenue share/royalty recovery.

Most businesses fail to realize the full value of their third-party relationships, resulting in contract value leakage(i.e., money to which you are entitled, but which you paid in error or has not been paid to you). If you think you’re missing revenue but aren’t sure where to begin, ask yourself the following questions:

After investing time and energy into preparing and executing a contract with a third-party vendor, it can be easy to let contract governance fall by the wayside. However, contracts are complex and require oversight.

You may have negotiated a price in your contract, but that price may not be as static as you think. For example, there could be automatic price increases built into the contract, which don’t require your approval. Perhaps there are volume-based rebates at the end of the year that would affect the price you’re paying, but no one is monitoring to make sure you’re getting the benefit of that. And when it comes to things like rebates, if you don’t proactively claim the retrospective payment you’re owed, you’ll miss out entirely.

Contract language “drift” also comes into play. You might start off with a consistent contract template that was agreed upon by all internal stakeholders, but over time there can be amendments that add or remove contractual terms, which may cause a lack of alignment. New internal contract and relationship owners might interpret contract language differently. As new third-party relationships are formed, language might get tailored for each vendor. All these little changes add up and could ultimately result in big changes to the benefits you thought you were entitled to.

How long has it been since you revisited contract terms? Are they still sufficient as-is? If there’s lost revenue at stake, the answer could be no.

Many organizations are reluctant to question a third party’s authority, not wanting to rock the boat or jeopardize a good working relationship. But whether it’s a result of human error, inefficient processes or controls, or even fraud, mistakes happen. And losing even a fraction of a percent of revenue can result in millions of dollars lost in profit.

Perhaps your vendor is overcharging you for services rendered and nobody’s catching the discrepancy. Or maybe they’re marking up products incorrectly, and you don’t have visibility into their markups. Moreover, the invoices you receive don’t necessarily tell the full story.

For example, let’s say your contract includes a dedicated senior resource, but your vendor is accidentally using a junior staffer and charging for them at a senior level. Your invoice may just have a single line item that says “resource – $100 per hour.” That could be all the visibility you get into that resource fee unless you explore the issue further. And unless you ask the vendor for more details on your resource’s qualifications and how the vendor reached that hourly rate, you may never realize that you’re not getting the level of expertise you were promised.

If you have revenue share or licensing agreements with third parties (licensees), you may find yourself blindly relying on vendor self-reporting to validate compliance with your executed agreements.

Let’s take music licensing and royalty agreements, for example. If you are an artist working with a record label, this record label has an obligation to find all sources of potential royalty revenue if a song gets played. But artists typically don’t have visibility into the mechanics of this process. Is the record label exploring every source they should? Is it collecting at the correct rate? Is it getting all the different forms of royalties owed? Is it outsourcing the collection process and subtracting third-party costs from the revenue pool?

For artists seeking these answers, there is little clarity. Without proper insight into the royalty collection process, you have no idea if the revenue pool is being maximized. If it is not, you could be missing out on significant profits and cost recovery opportunities.

As with cost recovery, contractual complexities also come into play when trying to maximize your portion of shared revenue. You may have several different escalations built into the contract, however, there’s no incentive on the side of the licensee to pay those escalated rates.

Are there automatic rate escalations, for example? Perhaps your contract states that once you sell a certain number of units the royalty payment rate increases by 1%. Maybe your percentages differ based on the units you sell in varying geographic areas. Maybe there is a marketing allowance that the licensee has exceeded which is now decreasing the shared revenue. With so many moving parts and revenue sources, opportunities to maximize royalties paid are often missed.

An independent audit of your contracts can identify areas of non-compliance with your vendors, distributors, licensees, suppliers, franchisees, joint venture relationships and other business partners. Implementing a contract compliance program can help you recover third-party overbillings or licensee underpayments and can enhance relationship transparency.

In addition to financial risks, companies face a wide range of non-financial risks. Though often overlooked because they’re not as directly tied to concrete dollars, non-financial risks can also leave you vulnerable to revenue leakage.

Before you can begin to mitigate these risks, you must first be able to identify your organization’s highest risk areas. While there are many types of non-financial risk, the three key areas to assess are performance risk, regulatory risk and reputational risk.

In many contracts, service-level agreements (SLAs) or key performance indicators (KPIs) are used to determine whether a third party is meeting different performance metrics throughout a specified duration of a contract. If the third party does not meet those performance metrics, there are varying repercussions built into the contract, ranging from financial penalties to revoked bonuses or even contract termination.

These SLAs and KPIs are meant to track vendor performance, encourage continuous improvement, and mitigate some control risk. However, because third parties are responsible for self-reporting that they are meeting these metrics, you have no visibility into the accuracy of that self-reporting. And if a penalty or bonus is on the line, inaccurate reporting can become a direct source of revenue leakage. If your company’s own performance relies on your third parties meeting their obligations, missed performance targets or inaccurate reporting can snowball into an enterprise-wide risk.

As a business leader, you are depending on the accuracy of your vendor’s performance information to make financial decisions. But if you don’t have proper visibility into the third party’s data or self-reporting process, there’s no way to validate performance on those metrics. If performance data becomes open to interpretation and prone to error, your company could be forced to make strategic relationship decisions without being fully informed.

Regulatory risk refers to the possibility that you are not meeting your obligations under current laws or regulations, or that changes in laws or regulations could result in unforeseen consequences for your organization. A major challenge you might encounter is the lack of verification that your third parties are compliant with the regulations noted in your contract. For example, your contract might stipulate that a third party must have adequate controls to comply with various data privacy and consumer protection statutes. But are you taking any steps to validate that sufficient controls are actually in place?

If your contract uses vague words like “reasonable” or “adequate,” this can open you up to additional risk. What qualified as reasonable and adequate five years ago might not be the same as what qualifies as such today, or a contract owner and a third party might have different interpretations of what reasonable or adequate entails. Unless your third parties’ processes have evolved to meet changing standards, there could be a disconnect in your expectations versus reality.

Reputational risk, i.e., the threat to profitability or sustainability of an organization caused by an unfavorable perception of its products or services, can become a major issue for your business, especially when third-party contracts are involved.

Sometimes a third party makes a mistake or causes a problem that, to your customer’s eye, looks like the fault of your organization. Ultimately, any failures on the part of the third party fall on your shoulders. Though you can hold third parties financially accountable if they fall short of expectations, those failures will largely be seen as your responsibility. Your customers will look to you for answers and will ultimately hold you liable for any unmet expectations.

Contracting with third parties can help your organization operate more efficiently and effectively. But if you don’t have the proper safeguards in place to manage third-party contracts, it can also open you up to increased process risk. Improving your control environment today helps ensure the stability and sustainability of your current and future operations. Key steps include:

Third-party relationships inherently expand your company’s potential exposure to risk. Are your internal controls sufficient to combat that risk? Review the checks and balances you have in place to protect your organization against third-party risk. Establish formal internal control processes and institute a segregation-of-duties policy to maintain sustainable risk management within your organization.

A strong control environment is essential to protecting data used in your third-party relationships. As organizations increasingly leverage third parties, this also increases the number of parties with access to your systems and data, which in turn increases the number of potential cyber threats looking to take advantage of these relationships. If your third parties don’t have proper controls in place, they could become a target for hackers who will now have easy access to your company’s or your customers’ data.

You also need to have comprehensive monitoring controls in place to detect non-compliance by third parties and prevent non-compliant behaviors before they occur. Put people who have access to your data under a special level of scrutiny. Include data breach reporting in your contract, define classifications of risks and incidents and how to prioritize the highest risks for remediation, implement third-party risk assessments and exercise your audit rights when needed. And be sure to revisit these requirements on a regular basis to ensure they are still adequately addressing potential risk.

Contract compliance is everyone’s job. But ambiguous expectations and ineffective communication can lead to misaligned directives and confusion about who has what roles and responsibilities.

Your internal stakeholders work closely with many third parties, and some of them likely have formed longstanding relationships. If you’re working with the stakeholders for the purpose of auditing some of their third parties, make sure you obtain their buy-in. Getting internal alignment prior to audit ensures that your organization is aligned on the importance of mitigating third-party risk.

Emphasize to stakeholders that “trust but verify” is the best course of action to protect the assets of your company from future risks. This isn’t about looking over someone’s shoulder or being mistrustful; it’s your fiduciary responsibility to audit third parties. Set the tone by getting buy-in from as many key stakeholders as possible, both internal and external.

Building a culture of trust and transparency is essential to minimizing your risk. But it’s not a one-size-fits-all approach, and it certainly doesn’t happen overnight.

Your organization can only be as successful as the quality of your relationships. Invest in those relationships by staying proactive, being communicative and empowering your internal team.

When it comes to third-party visibility, you don’t know what you don’t know. That is why proactivity is paramount. The best defense is a good offense. Third-party contract management should start before you even sign on the dotted line. Flag any potential issues or risk areas before executing a contract to save your organization time and trouble down the road.

The more you learn about your contract relationships and their complexities, the better equipped you are to manage risks. Putting procedures in place to manage and monitor contractual relationships prior to contract execution helps ensure that your future operations will run more smoothly.

Keeping an open line of communication is essential to fostering positive relationships and cultivating a culture of transparency. After your contract becomes effective, continue to nurture and monitor your third-party relationships.

Meet with your vendors periodically to address any of their questions or challenges and to ensure that your goals still align with their understanding. Be receptive to concerns and address any issues immediately. This will keep frustrations to a minimum and prevent any vendor connections from turning sour, which could lead to a damaged relationship, a breakdown in communication and even litigation.

Make sure that any internal team members who manage third-party relationships are empowered to do their jobs effectively. Do your people have a good grasp on contract risks and the critical contract terms and conditions? Have they been educated on the complexities of the business partnership? The more you encourage your team to ask the right questions and help them become knowledgeable on any contract nuances, the more galvanized they will be to build strong third-party relationships.

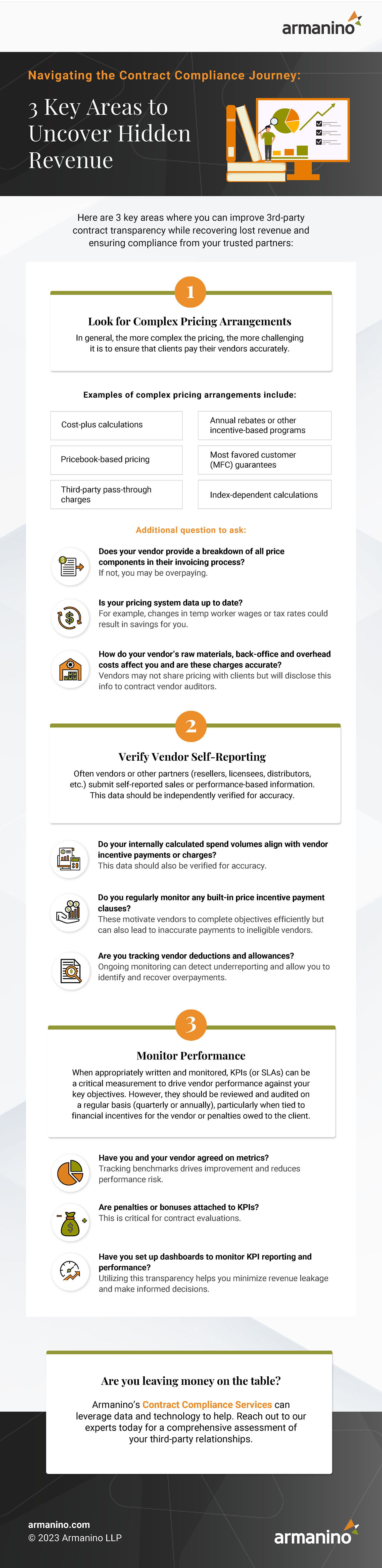

The more you know about contract compliance, the better you can manage and mitigate your risks. The following are three key areas where you can maximize benefits, recover lost revenue and enhance transparency in your vendor relationships.

Want to display this infographic on your site? Copy and paste the following code. Be sure to include attribution to armaninollp.com with this graphic.

Keeping these areas in mind to establish a contract compliance program can help you further leverage your relationships to maximize your revenue today and in the future.