In recent years, the Financial Accounting Standards Board (FASB) has made two pronouncements that are expected to have a profound impact on the way nonprofit organizations, particularly social and human services nonprofits, recognize revenues. In May 2014, the FASB issued Accounting Standards Update (ASU) 2014-09, Revenue from Contracts with Customers, ASC Topic 606. This was followed in June 2018 by ASU 2018-08, Clarifying the Scope and the Accounting Guidance for Contributions Received and Contributions Made.

ASC 606 impacts all entities, including for-profit and nonprofit entities, while ASU 2018-08 is focused on nonprofit organizations. All nonprofits will be impacted by the new standards, but the standards may more profoundly impact social and human services nonprofits based on the sources of funding for these types of organizations.

In general, social and human services organizations receive a significant portion of their funding from government grants and contracts, with the remainder of revenues coming from a variety of sources, including donor contributions, membership agreements, contracts to provide reciprocal services, sale of goods and other exchange-type transactions. Since ASU 2018-08 focuses on the accounting treatment of contributions and grants and contracts, and ASC 606 focuses on contracts with a customer, it is important for the management of these nonprofits to understand the new standards and assess the impact on their organizations.

A nonprofit that receives cash, other assets, or services from individuals, for-profit entities, other nonprofit organizations, or governmental agencies recognizes the receipt of the inflows as one of three types of transactions: contributions, exchange transactions or agency transactions.

The FASB defines a contribution as “an unconditional transfer of cash or other assets to an entity or a settlement or cancellation of its liabilities in a voluntary nonreciprocal transfer by another entity acting other than as an owner.” A nonprofit recognizes contribution revenue when the contribution is received or unconditionally promised, or when the conditions have been met.

In contrast, exchange transactions are defined as “reciprocal transfers in which each party receives and sacrifices approximately equal value; from investments by owners and distributions to owners, which are nonreciprocal transfers between an entity and its owners; and from other nonreciprocal transfers, such as impositions of taxes or legal judgments, fines, and thefts, which are not voluntary transfers.”

Resources received from an exchange transaction are recognized as revenue when the obligation associated with the transaction has been met. For many social and human services nonprofit organizations, the revenues recognized from exchange transactions are proportional to the expenses incurred.

With respect to agency transactions, the FASB defines these transactions as “a type of exchange transaction in which the reporting organization acts as an agent, trustee, or intermediary for another party that may be a donor or donee.” Resources received from agency transactions in which the recipient does not hold variance power are recognized by the recipient only on the balance sheet, with no impact to the revenues and expenses.

Many nonprofit organizations, stakeholders, and practitioners noted difficulty in determining if a transaction is an exchange transaction or a contribution, or whether a contribution is conditional or unconditional. This has resulted in diversity in practice across the nonprofit industry. These challenges have long existed, but ASC 606 has placed an increased focus on these issues since the pronouncement adds new disclosure requirements and the accounting of revenues may be different under ASC 606.

Distinguishing whether a transaction is an exchange transaction or a contribution is important because it will determine which guidance should be applied. Contributions should be accounted for under the provisions of Subtopic 958-605, Not-for-Profit Entities — Revenue Recognition, whereas exchange transactions should follow other guidance, such as ASC 606.

Diversity in practice occurs in various types of grants and contracts, such as government grants and contracts and foundation grants. Most nonprofit organizations have accounted for government grants and contracts as exchange transactions based on the understanding that the governmental funding agency is providing resources to the nonprofit organization, and in return the nonprofit organization is providing services for the government by delivering services to the general public. This has been a matter of interpretation, since the FASB has not provided definitive guidance on the matter.

In contrast, grants received from private foundations are generally treated as contributions, as they are viewed as nonreciprocal transactions — a private foundation provides resources to a nonprofit organization but does not receive commensurate value in return. However, it is not uncommon for a foundation grant to contain certain terms and conditions that may result in the grant being interpreted as an exchange transaction.

These issues are even more profound for social and human services nonprofit organizations because these organizations generally receive a significant portion of revenues from government grants and contracts and foundation contributions.

In addition, there has been diversity in practice in determining whether a contribution is conditional or unconditional. The current guidance indicates that if the possibility of not meeting a condition is remote, then a conditional contribution is considered unconditional, and the revenue would be recognized immediately.

For certain conditions, such as routine reporting requirements, it is fairly straightforward to determine that the likelihood of not meeting the condition is remote, but for other conditions it may be more challenging. Also, determining when a contribution is conditional can be difficult when there is no specified return requirement for when the requirements are not met.

Given the current diversity in practice, the goal of ASU 2018-08 is to provide clarity and uniformity when evaluating whether a transaction is a contribution or an exchange transaction and when determining whether a contribution is conditional.

Distinguishing between exchange transactions and contributions

ASU 2018-08 clarifies how a nonprofit organization determines whether a resource provider is participating in an exchange transaction, by stating the following:

This clarification is significant for recipients of government grants and contracts because the common rationale to classify government grants and contracts as an exchange transaction has been that the benefit received by the public is commensurate to the value received by the resource provider. As such, certain government grants and contracts that were previously accounted for as exchange transactions may now be accounted for as contributions.

The FASB noted that ASU 2018-08 will likely result in more grants and contracts being accounted for as contributions. This change in classification is important because it will determine whether a grant or contract should be accounted for under the provisions of ASC 606 or Subtopic 958-605.

The amendments in ASU 2018-08 also clarify that, consistent with current GAAP, in instances in which a resource provider is not itself receiving commensurate value for the resources provided, an entity must determine whether a transfer of assets represents a payment from a third-party payer on behalf of an existing exchange transaction between the recipient and an identified customer. If so, other guidance — such as ASC 606 — would apply.

Determining whether a contribution is conditional

ASU 2018-08 requires an entity to determine whether a contribution is conditional based on whether an agreement includes both of the following:

Either a right of return of the assets transferred, or a right of release of the promisor from its obligation to transfer assets, must be determinable from the agreement. The presence of both a barrier and a right of return or a right of release indicates that a recipient is not entitled to the assets until it has overcome the barriers.

In addition, ASU 2018-08 includes the following indicators to guide the assessment of whether an agreement contains a barrier:

Many of the government grants and contracts that a social and human services nonprofit organization receives are on a cost reimbursement basis. As noted above, government grants and contracts will likely be classified as contributions under the new standard. As such, if it is determined that the agreement constitutes a contribution, the agreement would also generally meet the criteria of being conditional.

The measurable performance-related barrier is that the entity must incur an allowable expenditure, and if an expenditure is not considered allowable or if the entity does not meet other compliance requirements of the grant or contract, then the entity would be required to return the funds.

The determination of whether the grant or contract is conditional is important because it may impact the amount and timing of revenue recognition. Also, consistent with the disclosure requirements of conditional contributions, nonprofit entities will now need to disclose the remaining amount of conditional funds to be spent on their government grants and contracts.

It is also important to note that the new standard does not include a probability assessment about whether it is likely a recipient will meet the stipulations in an agreement. Under current guidance, it was common for organizations to assess the likelihood of not meeting certain stipulations as remote, and then account for the agreement as unconditional. The new standard removes the term “remote” and includes indicators of barriers, which prevents entities from assessing the likelihood of a condition being met.

Effective dates

Most nonprofit organizations that serve as the resource recipient should apply ASU 2018-08 on contributions received to annual periods beginning after December 15, 2018. Most nonprofits that serve as the resource provider should apply ASU 2018-08 on contributions made to annual periods beginning after December 15, 2019.

The amendments in the update should be applied on a modified prospective basis. Retrospective application is allowed. Under the modified prospective basis, the amendments should be applied in the first set of financial statements following the effective date for agreements that are either not completed as of the effective date, or entered into after the effective date. An agreement is considered completed when all the revenue of a recipient or expense of a resource provider has been recognized before the effective date. In addition, no prior-period results should be restated.

Most grants, contracts or agreements between a resource provider and a nonprofit are classified as either an exchange transaction or a contribution, with some transactions to a lesser extent meeting the criteria of an agency transaction. Proper classification of the transaction is important in order to apply the proper accounting guidance. Contributions are to be accounted for under Subtopic 958-605, and most exchange transactions will be accounted for under the new provisions of ASC 606.

Revenue streams

Most revenue streams that nonprofits generate under exchange transactions are considered revenue from contracts with customers and will be subject to ASC 606. Some common examples of transactions to be evaluated under the new revenue standard include memberships, subscriptions, program fees, sale of goods, sponsorships, advertising, and government grants and contracts.

ASC 606 also identifies certain contracts with customers that are excluded from the new revenue standard, including lease contracts, insurance contracts, financial contracts and guarantees. Investment income revenue streams are also not impacted by ASC 606.

Five-step model

The core principle of the new revenue standard is that an entity should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled in exchange for those goods or services. ASC 606 moves away from the previous rules-based approach to a principle- based focus.

Revenues from contracts with customers are to be accounted for under a five-step approach, as follows:

Step 1: Identify the contract with a customer. Step 2: Identify the performance obligations. Step 3: Determine the transaction price.

Step 4: Allocate the transaction price to the performance obligations.

Step 5: Recognize revenue when or as the entity satisfies performance obligations.

Application of the new revenue standard will require management to make more estimates and use more judgment. For instance, Step 1 requires an entity to determine whether an agreement with a customer constitutes a contract that creates enforceable rights and obligations, and whether it is probable that the entity will collect substantially all of the considerations to which the entity will be entitled.

Based on the feedback of entities and practitioners that have already adopted the new revenue standard, Step 2 has been the most challenging and the step requiring the highest degree of judgment and assumptions. A performance obligation is a promise to deliver a distinct good or service to a customer. A good or service is distinct if (1) the customer can benefit from the good or service on its own or together with other resources that are readily available to the customer and (2) the entity’s promise to transfer the good or service to the customer is separately identifiable from other promises in the contract.

Challenges arise when a contract contains multiple performance obligations. For example, a nonprofit may enter into a membership agreement with a customer that provides the member with multiple benefits, such as a monthly magazine, use of facilities, and attendance at membership-only events.

Under the legacy revenue guidance, a nonprofit generally would have recognized the membership dues as revenue ratably over the membership period. Under the new revenue standard, the nonprofit entity will need to evaluate each of the benefits and determine if each benefit is considered a separate performance obligation. The entity would then need to determine the price of the membership dues (Step 3) and each separate performance obligation would be allocated a portion of the membership dues (Step 4). The revenues would then be recognized as each obligation has been satisfied (Step 5).

Effective dates

For nonprofits that have not issued or are not conduit bond obligors for securities traded, listed or quoted on an exchange or over-the-counter market, the new revenue standard takes effect in annual reporting periods beginning after December 15, 2018.

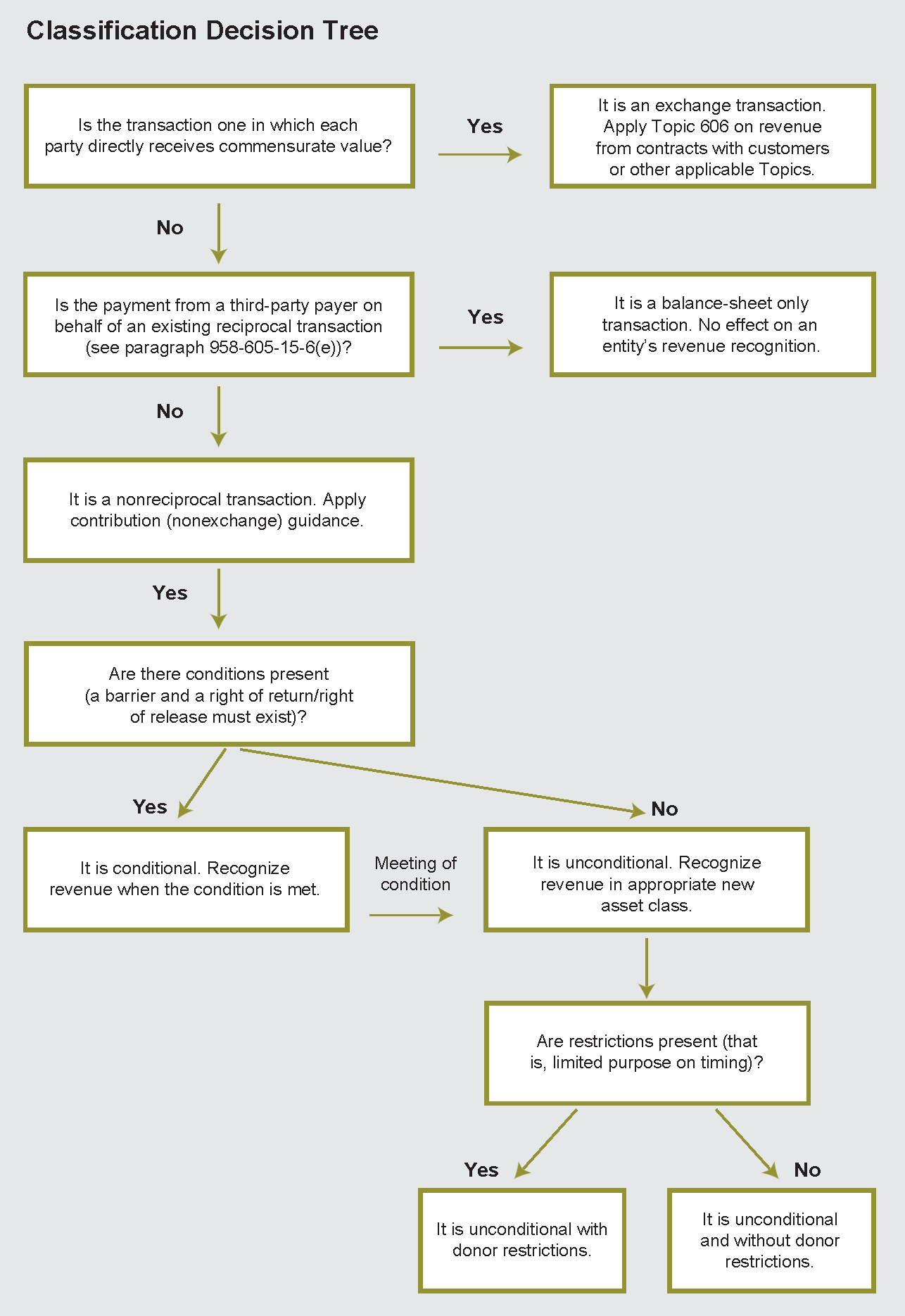

Given the distinct approaches for recognizing revenues under the different accounting guidance, it is important to first properly classify the transaction. The flowchart below is a useful tool to help with the classification.

Happy Families is a nonprofit organization that provides a variety of programs for low-income families. The organization applied for and was awarded a $1,500,000 cost reimbursement grant from the U.S. Department of Health and Human Services (HHS). The grant requires Happy Families to follow the rules and regulations established by the Office of Management and Budget. The organization is required to incur allowable expenses to be entitled to funding, and any unspent funds are to be returned to the HHS. It incurred allowable expenses of $1,000,000 in Year 1 and $500,000 in Year 2.

Analysis

The first step is to determine whether both parties receive direct commensurate value. In this example, the federal government does not receive direct commensurate value in exchange for the funding provided to Happy Families. The primary benefit is received by the general public, and as ASU 2018- 08 clarifies, a benefit received by the public is not equivalent to commensurate value received by the resource provider.

As such, the transaction is not an exchange transaction, and the next step is to determine if the transaction is a contribution or agency transaction. The transaction is determined to be a nonreciprocal transaction between the HHS and Happy Families, and therefore the contribution guidance would apply.

Next, the grant needs to be evaluated to determine whether it is conditional. Given the facts and circumstances and general nature of federal awards, the grant is considered a conditional contribution because the grant contains a barrier (grant funds can only be used on allowable expenses) and a right of return of assets transferred (unspent funds or funds spent on unallowable expenses must be returned).

Under current accounting guidance, the grant would be treated as an exchange transaction and revenues would be recognized as allowable expenditures are incurred. Under new accounting guidance, the grant is treated as a conditional contribution and revenues are recognized as the conditions are met. Although the classification is different, the amount and timing of revenues recognized remains the same. Happy Families would recognize revenues of $1,000,000 in Year 1 and $500,000 in Year 2 under both the current and new accounting guidance.

Veterans United provides various services and programs to the veteran community. The organization receives an up-front grant of $500,000 from a foundation for its job training program. The grant requires Veterans United to provide training to at least 1,000 qualified veterans. It contains a right of return of funds received for the ratable portion of veterans not receiving training.

Analysis

Veterans United determines that this grant is conditional because it contains a measurable performance-related barrier (to provide training to 1,000 qualified veterans) and a right of return. Veterans United will recognize the $500,000 as donor-restricted revenue ratably as a qualified veteran completes the training program. The likelihood of providing the training is not a consideration when assessing whether the contribution is deemed conditional.

Second Chance operates a homeless shelter that provides individuals with housing, meals and counseling. The organization receives a $200,000 grant from a foundation to support its meals program. The grant agreement includes a right of return as part of the foundation’s standard grant terms, and a requirement that a report explaining how the funds were spent be filed at the end of the grant period.

Analysis

Second Chance determines that the grant is not a conditional contribution. There are no requirements in the grant that would indicate a barrier exists. Second Chance also determines that the reporting requirement is not a barrier because it is an administrative task and not related to the purpose of the grant. This example illustrates a grant containing a right of return that is not considered conditional because there is no barrier to be overcome. Second Chance would recognize the grant as a restricted contribution upon receipt of the grant.

Students First is a nonprofit organization that helps high school students in the community graduate high school and reach college. The organization receives an up-front foundation grant of $100,000 to be used for its tutoring program. The grant agreement includes certain guidelines regarding the ways Students First could use the funds (such as to purchase school books, to hire tutors and to purchase computers and tablets) but does not specify that Students First’s entitlement to the $100,000 is dependent upon Students First meeting any of the specific guidelines indicated in the grant agreement. The agreement also contains a right of return for funds not spent on the tutoring program.

Analysis

Students First determines that the grant is not conditional. The grant does not contain a barrier to overcome to be entitled to the funds. The grant contains guidelines for how Students First could spend the funds, but the agreement does not specify that entitlement to the transferred assets is dependent upon meeting any of the guidelines. Because the guidelines in the grant agreement were not required to be met to be entitled to the funding, the agreement does not contain a barrier to overcome. Students First should recognize the entire $100,000 as a donor- restricted contribution upon receipt of the funds.

The YMCA offers a $600 annual membership that provides members with the following benefits: access to fitness facilities, unlimited group exercise classes and free childcare while the member is working out. The YMCA has determined that the fair value of the annual membership is $600. In an effort to increase membership, the YMCA launches a promotion that provides new members with two personal training sessions with a certified personal trainer. Personal training sessions are also offered individually and are available to members and nonmembers for $100 per session.

To illustrate the impact of the new revenue recognition standard, assume a member enters into a new one- year membership in January 2020. The YMCA has a June 30 year-end.

Analysis

Under legacy accounting guidance (pre-ASC 606), the YMCA would likely account for the membership ratably over the membership period and recognize membership revenues of $300 during fiscal years 2020 and 2021. Under ASC 606, the revenue recognition process may prove to be more challenging. Under the new standard, the benefits specified in the membership agreement represent goods and services that the YMCA has promised to provide to the members. The promises are considered “performance obligations” and the $600 membership price must be allocated to each distinct performance obligation.

To keep things simple, the YMCA has determined that the original pack of membership benefits (access to facilities, group classes and childcare) represents a bundle of services and regards them as a single performance obligation. The promotional offering of two personal training sessions is considered a separate performance obligation.

The new revenue standard requires the YMCA to allocate the $600 membership price to each of the two performance obligations on their relative “stand-alone selling price.” For simplicity, the YMCA assumes a 100% probability that a member will utilize the two free training sessions. Allocation of the membership price would be as follows:

| Value of standard membership | $450 (($600/$800) × $600) |

| Value of two free training sessions | $150 (($200/$800) × $600) |

Under legacy accounting guidance, the YMCA would recognize revenues of $50 a month. Under the new revenue standard, the YMCA would recognize revenues as each performance obligation is satisfied. The accounting entries would be as follows:

| To record the receipt of membership dues | |

| Cash | $600 |

| Contract liability — membership | $450 |

| Contract liability — personal training | $150 |

| To record monthly membership revenue | |

| Contract liability — membership | $37.50 |

| Membership revenue | $37.50 |

| To record use of one personal training session | |

| Contract liability — personal training | $75 |

| Membership revenue | $75 |

The illustration above is just one example of how an organization may interpret the new revenue standard and account for the membership revenues. The new standard may require significant judgment, assumptions and estimates.

For instance, an organization may determine the childcare services to be a separate performance obligation and therefore would allocate the membership price to three performance obligations. Also, an organization may estimate that the likelihood of a member utilizing both personal training sessions is 50%, thus the allocation of the contract value to the training session would be reduced. It is important to exercise reasonable judgment when applying the new standard.

The new revenue recognition standards will impact all nonprofit organizations but may have a more profound impact on social and human services nonprofits based on their revenue streams. In particular, ASU 2018-08 will change the revenue recognition and classification considerations for government grants and contracts and conditional contributions, and ASC 606 will impact the revenue recognition associated with exchange transactions such as membership agreements and other contracts to deliver goods and services.

As with any new accounting pronouncement, it is important for the organization to understand the new guidance and assess the impact of the new standard to its financial reporting. It is vital to consider how the new accounting standard will impact various stakeholders, such as the board of directors, lenders, funding agencies, foundations and other donors.

We recommend that nonprofits start the implementation process sooner rather than later. An implementation plan should include consultation with the organization’s auditors, accountants and legal advisors, as well as training of personnel, determination of resource needs, consideration of whether to implement internally or to outsource, and assessment of internal controls.

Organizations that experience a smooth transition to the new revenue standards will be those organizations that start the implementation early. There is no time like the present, so start now!