Today’s economic environment is characterized by uncertainty. But amid the gray clouds of high interest rates, stubborn inflation and underwater stocks, there are also silver linings. For example, now is a great time to execute a gifting strategy. Whether your family is philanthropically inclined or looking for tax-efficient options to gift assets to family members, there are multiple ways to accomplish your objectives.

High-net-worth families also should be actively planning for the sunset of the historically high estate and gift tax exemption, which is scheduled to return to a baseline of $5 million adjusted for inflation (roughly $6-7 million) after 2025. That date might sound alarmingly soon, but don’t panic. Preparing for a lower exemption is an achievable goal, which can be done with some remarkably simple yet powerful strategies.

Table of Contents

Tax planning involves making decisions about the optimal timing of transactions. Historically, the general advice has been to defer income and accelerate deductions. This recommendation is more nuanced now and depends largely on individual circumstances. Your tax situation may benefit more from a deferral versus an acceleration or vice versa. An in-depth review with your tax professional will help you determine what actions you should take before the year’s end.

If deferral is the right plan for you, consider any opportunities to move income to 2024. For example, you may be able to defer a year-end bonus. Or you might delay the collection of business debts, rents, payments for services or even a sales transaction. Doing so may allow you to postpone paying tax on the income until next year. If there’s a chance that you’ll be in a lower income tax bracket next year, deferring income could mean paying less tax on the income.

Similarly, be sure to consider ways to accelerate deductions into 2023. For instance, if you itemize deductions, you might accelerate deductible expenses like medical expenses and qualifying interest. Or make next year’s charitable contributions this year — essentially doubling your charitable deduction. (See further details about this strategy in the section on gifting).

Then again, it may make sense to take the opposite approach — accelerating income into 2023 and postponing deductible expenses to 2024. For example, that might be the case if you can project that you’ll be in a higher tax bracket in 2024.

Spreading income over the next few years may result in the best overall tax planning for your situation. If so, a careful review of both income and deductions projected forward could be the best option to minimize tax liability overall.

Although the alternative minimum tax (AMT) doesn’t affect as many taxpayers as it used to, it’s an important consideration for 2023 tax filings if you’re subject to it, since traditional year-end actions, like deferring income and accelerating deductions, can have a negative effect. That’s because the AMT — essentially a separate, parallel income tax with its own rates and rules — effectively disallows several itemized deductions and adds back certain non-taxable items.

The AMT exists to ensure everyone pays a “minimum” level of tax. It‘s a complex calculation where income is recalculated based on AMT rules, and the higher of regular tax or tentative minimum tax is paid.

Items that trigger the AMT are sometimes controllable, so careful planning is a must if you’re subject to this tax. Many AMT add-backs are limited or no longer deducted for regular tax purposes (such as state tax and miscellaneous itemized deductions). Other adjustments remain in play, like the exercise of incentive stock options (ISOs) and tax-exempt interest earned on certain private-activity municipal bonds. Note that adjustments could also come from Schedule K-1s received.

There’s a significant planning opportunity with AMT calculations when exercising ISOs. When your regular tax is higher than the AMT, you may want to exercise enough ISOs to increase AMT to bring it close to the regular tax (optimum point). This will allow you to exercise ISOs without paying any additional tax dollars.

Also, if you have already exercised ISOs that resulted in a significant AMT, you may want to consider selling some ISOs that are exercised within the year (disqualifying disposition) to increase regular tax to the optimum point, so you have the cash to pay for the taxes. Further planning opportunities may be available where prior year ISO exercises occurred.

The AMT exemption is indexed for inflation. For the 2023 tax year, the AMT exemption amount increased to an adjusted gross income (AGI) of $126,500 for married filing jointly taxpayers and to $81,300 for single individuals. The exemption phases out if your AGI exceeds $1,156,300 for taxpayers who are married filing jointly or $578,150 for single taxpayers.

Currently, the top marginal tax rate (37%) applies to taxable income that exceeds $578,125 in 2023 ($693,750 if married filing jointly, $346,875 if married filing separately or $578,100 if the head of household). Your long-term capital gains and qualifying dividends could be taxed at a 20% rate if your taxable income exceeds $492,300 in 2023 ($553,850 if married filing jointly, $276,900 if married filing separately or $523,050 if the head of household).

Additionally, a 3.8% net investment income tax (unearned income Medicare contribution tax) may apply to some or all of your net investment income if your modified AGI exceeds $200,000 ($250,000 if married filing jointly or $125,000 if married filing separately).

High-income individuals are subject to an additional 0.9% Medicare (hospital insurance) payroll tax on wages exceeding $200,000 ($250,000 if married filing jointly or $125,000 if married filing separately).

One of the fundamentals of tax planning is to take full advantage of tax-advantaged retirement savings vehicles. Traditional IRAs and employer-sponsored retirement plans such as 401(k) plans allow individuals to contribute funds on a deductible (pre-tax) basis.

Contributions to a Roth IRA or a Roth 401(k) aren’t deductible (they are not made with pre-tax dollars), so there’s no tax benefit for 2023. However, qualified Roth distributions are completely free from federal income tax, which can make these retirement savings vehicles appealing. (Note: Married taxpayers filing a joint return with an annual income exceeding $218,000 and single taxpayers with an annual income exceeding $138,000 cannot contribute to a Roth IRA.)

For 2023, you can contribute up to $22,500 to a 401(k) plan ($30,000 if you’re age 50 or older) and up to $6,500 to a traditional IRA or Roth IRA ($7,500 if you’re age 50 or older). The window to make 2023 contributions to an employer plan typically closes at the end of the year, while you generally have until the April tax return filing deadline to make your 2023 IRA contributions.

Under the SECURE Act, individuals may contribute to a traditional IRA during or after the year they turn 70½.

SEPs allow a small business or sole proprietor to contribute the lesser of 25% of each eligible employee’s salary or $66,000 for 2023. The contribution must be made by the due date of the employer’s federal tax return, which can be as late as October 15 of the following year. The 25% calculation for self-employed individuals is based on “net” self-employment income, which includes adjustments for self-employment taxes and other items.

RMDs are the minimum amount you must annually withdraw from your retirement accounts if you meet certain criteria. Planning ahead to determine the tax consequences of these distributions is important, especially for those who are in their first year of RMDs. If you also make charitable contributions, see the contribution discussion for another planning opportunity.

Original account owners turning 72 in 2023 must begin taking distributions when they turn 73 in 2024. Previously, the required beginning dates were 70½ and then 72. Changes to the RMD beginning dates do not apply to individuals who were previously required to start taking RMDs. For example, if you turned 72 in 2022, you were required to begin taking RMDs, and you must continue taking them even though the RMD age has now changed to 73.

Also, participants in an employer-sponsored retirement plan, such as a 401(k), generally do not have to begin taking RMDs from that plan until they retire, under certain circumstances.

In general, RMDs must be taken by December 31 of each year. However, the first year RMDs start for an individual, they may defer that distribution until April 1 of the following year. This results in doubling up of two years’ RMDs into that second year.

Original account owners turning 72 in 2023 must begin taking distributions when they turn 73 in 2024.

If you turned 72 in 2022, you were required to begin taking RMDs, and you must continue taking them even though the RMD age has now changed to 73.

On December 29, 2022, Congress passed the SECURE 2.0 Act, which builds upon the reforms of the original SECURE Act of 2019. SECURE 2.0 is primarily focused on increasing Americans’ readiness for retirement by expanding coverage, increasing savings and simplifying and clarifying retirement plan rules.

Here are the changes that take effect in 2023:

SECURE 2.0 held some good news for Americans who turn 72 in 2023. Starting January 1, 2023, the starting age for RMDs is 73. The original SECURE Act had increased the starting age from 70½ to 72.

The legislation reduces the penalty for failure to take RMDs to 25% of the amount not taken as a distribution. Previously, the penalty was 50% of the amount not taken. If the failure to take the RMD is corrected in a timely manner, the penalty is further reduced to 10%.

Account owners who are 70½ and older can make a one-time election to include a charitable remainder unitrust or a charitable remainder annuity trust, and for a charitable gift annuity as an eligible charity and may direct that such distributions be made directly from their IRA. The distributions under this one-time election may not exceed $50,000 in the aggregate, and an election may not be made if an election is in effect for a preceding taxable year.

Employers of domestic employees (nannies, housekeepers, etc.) can provide retirement benefits for those employees under a SEP.

SECURE 2.0 also made several changes with effective dates in 2024 and later, including:

Beginning in 2024, the $1,000 catch-up contribution limit for individuals aged 50 and older will be indexed for inflation in increments of $100.

Currently, the catch-up contribution for individuals aged 50 and older is $7,500. Starting January 1, 2025, individuals who reach ages 60 to 63 will be able to make catch-up contributions up to the greater of $10,000 ($5,000 for SIMPLE plans) or 50% more than the regular catch-up amount in 2024 (2025 for SIMPLE plans). The dollar amounts are indexed for inflation beginning in 2026. (Note: Individuals aged 64 and over do not get this increased catch-up limit.)

Beginning with distributions made in 2024, the 10% penalty does not apply to withdrawals for:

Year-end is an appropriate time to evaluate whether converting a tax-deferred savings vehicle like a traditional IRA or a 401(k) account to a Roth account makes sense. When you convert a traditional IRA to a Roth IRA or a traditional 401(k) account to a Roth 401(k) account, the converted funds are generally subject to federal income tax in the year that you make the conversion (except to the extent that the funds represent nondeductible after-tax contributions).

If a Roth conversion makes sense, you’ll want to consider the timing of the conversion. For example, if you believe you’ll be in a better tax situation this year than next (you would pay tax on the converted funds at a lower rate this year), you might think about acting now rather than waiting. Whether a Roth conversion is right for you depends on many factors, including your current and projected future income tax rates.

If you have net operating losses (NOLS) available, they could offset most or all of the tax liability of a Roth conversion.

SECURE 2.0 made several changes that affect Roth accounts. Some changes include:

Starting in 2026, all catch-up contributions must be made to a Roth account in after-tax dollars. Individuals earning $145,000 or less (indexed for inflation) are exempt from this requirement.

The IRS recently delayed (by two years) the deadline for plan sponsors to comply with its requirement under the SECURE 2.0 Act of 2022, that catch-up contributions made on behalf of certain eligible participants be designated as Roth contributions.

SECURE 2.0 requires employers to allow participants in 401(k), 403(b) and 457(b) plans to receive some or all matching contributions and nonelective contributions as designated Roth contributions. This is optional at the employee’s discretion and applies only to the extent that a participant is fully vested in these contributions.

Starting in 2024, Section 529 college savings account beneficiaries can make direct rollovers to a Roth IRA without tax or penalty. The amount moved into a Roth IRA in a given year must be within annual IRA contribution limits, and the lifetime limit for such rollovers is $35,000. The 529 account must have been in place for at least 15 years and funds must move directly into a Roth IRA for the same individual who was the beneficiary of the 529 plan. Any 529 plan contributions made in the previous five years and any earnings attributed to those contributions are not eligible to be rolled into a Roth IRA.

This year saw a continuation of the trend in people returning to the office and increased business travel. Mileage reimbursement rates increased to 65.5 cents per mile for business travel. Since the temporary 100% deduction for business meals expired at the end of 2022, business meals are back to their previous level of 50% deductible.

If your business travel increased this year, these reimbursements could help you minimize your tax liability for 2023.

If you hold any virtual currency (also known as cryptocurrency or digital assets), it’s important to understand the tax implications of those transactions.

Cryptocurrency is known for its market swings but continues to be a more common allocation for high-net-worth investors. Form 1040 has a question regarding virtual currency, which is just the first step in the IRS’s increased scrutiny of these transactions.

Many types of virtual currencies exist, such as bitcoin, ether and non-fungible tokens (NFTs). The sale or exchange of virtual currencies, using such currencies to pay for goods or services or holding such currencies as an investment, generally has tax impacts and should be considered in tax planning. The most significant areas of movement in this space are:

Tokenized dollars are an attractive way for investors to hold, move and earn a yield on dollar holdings. However, they aren’t free from capital gains or income tax treatment. In fact, some of the most complicated crypto tax matters arise from investors deploying stablecoins and other cryptocurrencies to decentralized finance (DeFi) protocols for lending or borrowing.

Prevalence and attractiveness of returns has driven more users into DeFi. IRS guidance is far from clear on this area, and the tax treatment methods and approaches to compliance vary widely. However, DeFi transactions often involve a capital gain and an income component, and proper cost basis tracking is paramount to ensuring risk-reduced tax compliance filings.

The power of blockchains and tokenization has created a wellspring of new investment opportunities. Some investors have taken advantage of token pre-sales, which provide access to tokens from a crypto startup before they are available to the general investing public. Similarly, some investors are entering the market through SAFTs. For planning purposes, it’s important to note that capturing a long-term gain benefit may require first receiving the token allocation and then waiting for the long-term period to expire before disposition. Lastly, tokenized equity and securities investments are also on the rise. Again, these gains may be attractive, but they can create tax pitfalls if the transactions are not properly documented and managed.

Whether you think it’s a short-lived craze or a revolutionary way to disrupt the ownership of artwork and music, NFTs are increasingly part of the mainstream. Investors are holding “blue chip” NFTs or even less valuable NFTs simply to show their interest in a given artist, musician, company or organization. Again, the IRS has no specific guidance for individuals engaging in NFT transactions. However, a reasonable extension of current guidance means that these assets are subject to both capital gains and income tax, depending on how the individual transacts.

Many retail platforms where you can buy and hold crypto are starting to produce 1099 forms. These 1099s go to the IRS directly and to the taxpayer via their exchange, custodian or marketplace provider. Look out for 1099s in your mailbox soon and make sure your 1040 and other tax forms match the information the IRS has on file.

Each family has many reasons for making charitable gifts, including making a difference in a community or to individuals, creating a family legacy and reducing income tax liability. The intent that comes up most frequently at year-end is tax liability reduction and determining the most efficient assets or vehicles to use to make a charitable gift.

As we near the end of the year and your 2023 income and deductions become more solidified, layering in an intentional year-end gift can reduce your tax liability. For those who itemize, gifts to charity offset your income taxed at the highest tax bracket first, which in 2023 is as high as 37% (or 28% if you are subject to the AMT). For those who may not itemize each year, “bunching” two years of contributions into one tax year may increase the tax impact of this tax deduction.

Although no above-the-line charitable deductions are currently available, individuals who itemize can deduct contributions made to IRS-qualified public charities, such as religious organizations, art museums, the American Red Cross and other publicly supported organizations. For the 2023 tax year, cash gifts are limited to 60% of your AGI. Appreciated property (such as publicly traded securities or artwork) held for more than a year and a day is deductible up to 30% of your AGI.

Donor-advised funds allow the donor to gift cash or appreciated property to their fund and recommend grants to be distributed out of the fund to various public charities either in the year of the gift or in future years. The donor-advised fund is held at a religious-based or community foundation. It allows for the family making the contributions to name the fund — for instance, The Smith Family Charitable Fund.

Many taxpayers are attracted to donor-advised funds because they want many of the benefits of a private foundation without the additional level of oversight. At this time, there isn’t a distribution requirement for donor-advised funds. Contribution limits are the same as the limits for other contributions to public charities (60% of AGI for cash gifts and 30% of AGI for appreciated property).

Private foundations have their own contribution limits: Cash gifts are limited to 30% of your AGI and gifts of appreciated property are limited to 20% of your AGI. Private foundations have many additional layers of administration required each year by the families and support staff operating them. These organizations pay a minimum excise tax of 1.39% on their net investment income and have annual distribution requirements.

Using the qualified charitable distribution (QCD) to donate to charity may be a tax-efficient strategy for taxpayers with large IRAs. A QCD is a direct transfer of funds from the IRA custodian to one or more public charities, up to a limit of $100,000 per year. The transfer results in a reduction of the taxability of your IRA distribution. Donor-advised funds and private foundations don’t qualify as QCD recipients. QCDs are still available to those over 70½ years old, although RMDs now aren’t required until age 73. If you are 73 or older, you may include any QCDs in your RMD calculation. You may transfer more than the $100,000 per year limit, but the amount in excess of $100,000 will be considered a taxable distribution.

In addition to direct gifts of property that generate an immediate tax deduction, there are other giving options that benefit both the donor and charitable organizations.

This trust allows a donor to contribute assets (generally low-basis marketable securities), receive a tax deduction for the present value of the charitable beneficiaries’ remainder interest and collect an annuity stream back from the charitable remainder trust. The trust is terminated at the end of its term with a residual donation to one or more charities. Donors might choose this charitable trust if they would like to receive a tax deduction for a contribution and receive an annuity stream back over the term of the trust.

This trust allows the donor to contribute to the trust and benefit from a substantial tax deduction in the year of contribution. An annuity stream is paid out over the term of the trust to the charitable organizations (which can include public charities, donor-advised funds and private foundations). The remainder interest in the trust at the end of the term transfers to the residual beneficiaries (either individually or in trust) gift or estate tax-free.

This is a great option if you have organizations you want to donate to annually and have a potential pool of assets to transfer to your heirs without utilizing any of your lifetime gift and estate exemption. If you have maxed out your lifetime exemption with recent estate and gift planning, a charitable lead trust could be used to transfer additional amounts to family members, while also benefiting charity, without incurring additional estate or gift tax.

It takes time to establish these charitable trusts and select the correct assets to contribute. They also have annual split-interest trust tax returns that you must file with the IRS. Consult your tax and estate planning advisors if either of these split-interest trusts sound like solutions for your personal, estate, gift and charitable goals.

For all gifts in excess of $250, the charitable organization (including donor-advised funds and your private foundation) should issue a receipt letter detailing the gift the organization received. The receipt should be in writing (emails are sufficient), state the amount or value of the cash or property donated, describe the nature of any non-cash donation (such as XX shares of ZZ company stock) and disclose any goods or services provided by the organization to the donor in return for the gift provided.

The holding period of the donated property can make a large difference in your tax deduction. For appreciated property, the tax deduction for the gift is the fair market value, but only if you held the property for at least one year and one day (long-term holding period). If the holding period is short-term, only the cost basis of the appreciated property can be used as the tax deduction. Consult your investment advisor to discuss the holding period of any marketable security donated to a public charity, donor-advised fund or private foundation before the asset is donated.

As long as the gift you’re donating is initiated before midnight on December 31, 2023, the gift is considered complete in 2023 for tax deductibility purposes. If you mail a donation to an organization and postmark the gift on December 31, 2023, the gift is considered made in 2023, even if the charitable organization doesn’t process the gift until several days later in the following year.

Always use certified mail when mailing donations near the end of the year to substantiate the timing of the gift. If you’re making a year-end contribution to a donor-advised fund, confirm that the fund is open on December 31, 2023 – they may only be open until Friday, December 29 (the last business day of the year).

While cash is generally easy to gift up until the last day of the year, if the gift you intend to donate is more complex or more difficult to value, start the discussion with the charitable organization receiving the contribution as early as possible. Many public charities and donor-advised fund sponsoring organizations have specific dates when they will no longer accept donations of complex assets.

Complex assets can include partnership or LLC interests, stock in a private company or hard-to-value art or jewelry. If you intend to donate marketable securities to a charitable organization, speak with the organization by mid-December to ensure they have the correct accounts set up to receive the donation.

If you make a gift of an asset (other than cash or a marketable security) that’s worth more than $5,000, the IRS requires that you attach signed documentation from a qualified appraisal to the tax return to substantiate the gift. This applies to gifts of artwork, land, partnership interests and stock in a private company, to name a few. You should seek the qualified appraisal as near as possible to the date of the gift.

Since the Tax Cuts and Jobs Act of 2017 (TCJA) increased the standard deduction, some taxpayers find it beneficial to “bunch” charitable contributions for two years into one year. This is a strategy that can be implemented with religious organizations for tithing, as well.

It’s important to evaluate whether you should make a taxable gift to reduce your estate tax exposure. The TCJA changed the estate and gift tax regimen by increasing the amount of assets an individual may pass to their heirs tax-free (referred to as the “lifetime exemption”). In 2023, the amount of assets that can pass without being subject to the estate and gift tax is $12.92 million per person ($25.84 million per married couple). This number is set to sunset in 2026 to $5 million per person ($10 million per couple), indexed for inflation (which will be roughly $6-7 million).

As a result, making a taxable gift could help you avoid paying gift and estate taxes and reduce the size of your estate, which could shift future appreciation out of your estate.

Given the short amount of time left in the year, it can become overwhelming and difficult to make any kind of decision on what your focus for 2023 estate and gift tax planning should be. Here are the top considerations you should focus on:

One potential planning strategy to consider is making large gifts, either outright or in trust, in order to fully utilize remaining lifetime exemptions prior to the sunsetting of current estate/gift laws. Here are some suggestions to use the exemption to make outright gifts to individuals or gifts to be held in trust for individuals:

Before you make any large gifts, carefully consider the overall estate makeup, cash flow considerations and intentions of yourself and your family. In addition, if you own a business with outstanding Paycheck Protection Plan (PPP) loans, take care if you’re considering gifting interests in the business. See your tax advisor for additional guidance.

Currently, you can set up a trust that is a grantor trust for income tax purposes but a completed gift for estate and gift tax purposes. This means that, though the assets won’t be included in your estate at your death, the income tax rules treat the trust as a disregarded entity, and you are taxed on all the income of the trust. This allows the trust to grow, free from income tax, while you pay the taxes that the trust would pay itself in a non-grantor trust context/structure.

Similar to selling assets and gifting the cash, this is the equivalent of making additional gifts to the trust each year because you’re paying the taxes on the trust income without any gift tax implications. Though it’s possible to fund the trust with a gift to the trust, you can also sell assets to the trust. And, since the trust is ignored for income tax purposes, the sale of assets to the trust doesn’t cause a gain at the time of sale.

There are also other possible benefits to grantor trust status, depending on the provisions included in the trust agreement. Many trusts are drafted to include powers of substitution, allowing the grantor to swap assets of equivalent value to allow for income tax and cash flow planning. A grantor may also release the grantor trust powers in order to “toggle off” grantor status when appropriate to shift the income tax burden back to the trust.

It’s best to have flexibility in the trust, should there be future legislation that would eliminate some of the advantages currently available in this structure or changes in your circumstances. Ask your tax advisor to help you create this flexibility and plan for changes that can occur.

If you’re married and have decided that you’ll gift $10 million or less in your lifetime, consider having one spouse use their lifetime exemption and the other spouse use zero of theirs.

Example:

A husband and wife decide to gift $10 million to a trust for their children in 2023. If they split the gift, the husband will use $5 million of his exemption and the wife will use $5 million of her exemption.

In 2026 (or possibly sooner), when the lifetime exemption is reduced to an estimated $6 million per person (or even less), the husband will have used $5 million of his exemption (leaving $1 million) and the wife will have used $5 million of her exemption (leaving $1 million).

If the husband had made the gift alone and used $10 million of his exemption, in 2026 he would have zero exemption remaining, while the wife would have the full $6 million remaining. This would allow the couple to shield another $4 million of assets from the estate tax even after the law changes.

If you have incomplete estate planning documents, take this opportunity to address them. This includes wills, trusts or advanced healthcare directives. If you have completed those documents but haven’t updated them in the last few years (or you have had changes to your circumstances), be sure to review them and make necessary revisions.

Confirm that all trust assets are in the name of your living trust to avoid probate at your death. Setting up the trust doesn’t avoid probate for any assets not transferred to the trust.

If the trust allows the trustee the discretion to make distributions to the beneficiaries, you or your advisor should complete an analysis to determine if it makes sense to make beneficiary distributions. A careful review of the current 1041 income tax rates versus those of the individual beneficiary can help determine the income tax benefit to making these distributions. For complex trusts, distributions made within 65 days of the trust’s year-end can be made for the prior income tax year.

Reasons you might delay making distributions to the beneficiaries include:

Take care when determining whether distributions should be made, but it’s worth looking at to see if it makes sense.

Although interest rates have increased multiple times this year and may continue to rise, some estate planning techniques could still be beneficial:

Finally, your year-end planning discussion with your advisor should explore how life insurance may serve as both an asset class and as part of your overall estate plan.

While not as popular as they once were, irrevocable life insurance trusts (ILITs) are still a part of many estate plans and may rise again in popularity with potential decreases to the estate tax exemptions.

If you’ve already utilized ILITs, or if you are a trustee for one of those vehicles, there are several things to keep in mind as 2023 comes to a close.

These are not “set it and forget it” structures. The end of the year, in conjunction with other planning, is a perfect time to take another look at the policies held by the trust. Beyond being good practice, the trustee of an ILIT is responsible for reviewing and evaluating the insurance regularly.

Some of the areas to discuss with your advisors are:

Existing ILITs can also be used for year-end gifting goals. Pre-funding several years’ worth of premium payments for those ILITs with ongoing premium responsibilities may be beneficial. However, to avoid any unintended income tax consequences, it’s important to engage a trusted tax professional to review the tax status of each ILIT before making any gifts.

When evaluating your wealth strategies, it’s important to take a few steps back and consider the big picture. Why do you do what you do? What’s important to you? What is your purpose for preserving wealth? Only by digging into these important questions can you arrive at a tax-planning strategy that truly works for you.

Tax planning shouldn’t be just about making year-end adjustments to minimize income tax. It should be a year-round, collaborative process that involves regular meetings with your CPA, estate planning attorney and financial advisor. Your estate planning team should get to know your family so that the strategies you design together fit your unique philosophies, preferences and family dynamics.

Reach out to your estate planning team today and set up a regular meeting schedule to keep your plan in alignment with your objectives. The more frequently you communicate with your team, the more likely you’ll be positioned to take advantage of opportunities, avoid pitfalls and achieve your goals.

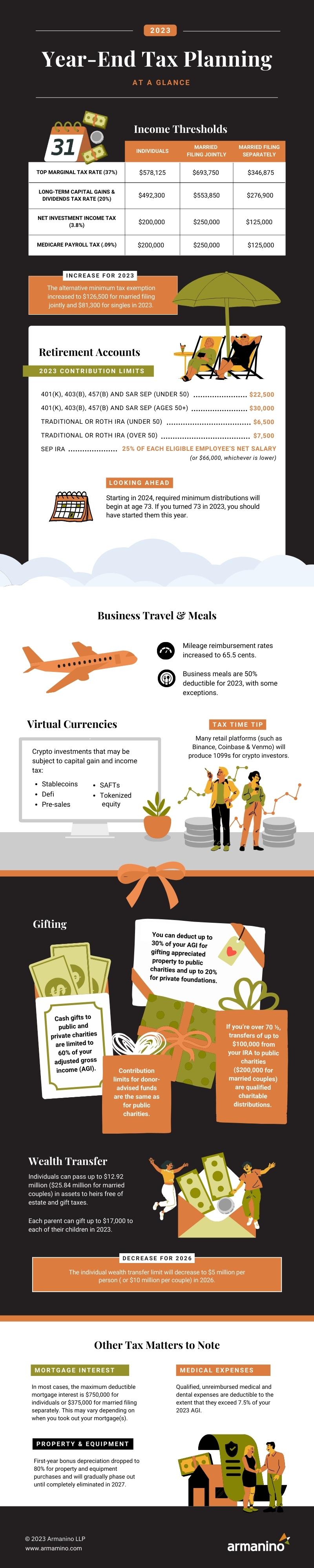

The following infographic provides some key action items from this year’s in-depth year-end tax planning guide:

Want to display this infographic on your site? Copy and paste the following code. Be sure to include attribution to armanino.com with this graphic.

Year-end tax planning can seem daunting, especially in the current economy, but the tax specialists at Armanino are ready to help you meet your goals. Contact our private client tax advisors today to learn more about how to implement powerful year-end tax strategies that make sense for you.

Published November 2023

In this guide, we describe the laws in effect at the time of publication. Consult with your tax professional to learn the latest tax legislation.

Checklist