It’s a digital race to the future of finance. The next generation in finance focuses on speed, agility, robust insights and cost-effectiveness. Business leaders must embrace artificial intelligence (AI), automation, cybersecurity and more — or risk being left in the dust.

Explore our page of the trends, technologies and strategies that will help you prepare for the road ahead.

Want to display this infographic on your site? Copy and paste the following code. Be sure to include attribution to armanino.com with this graphic.

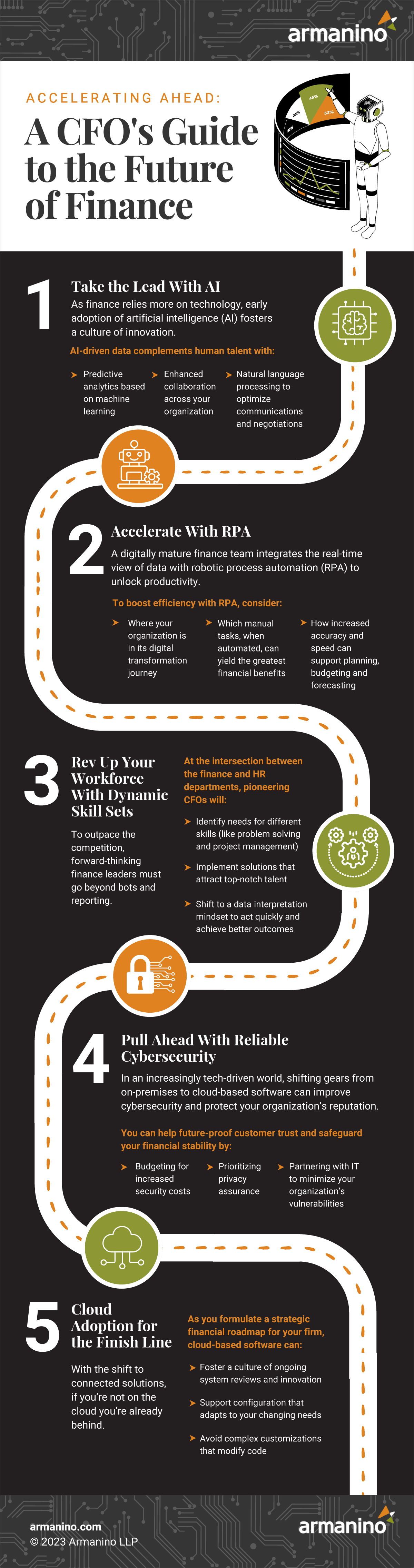

As finance teams increasingly incorporate technology into their organizational strategies, early adoption of cutting-edge technology like AI helps you stay relevant and competitive.

By transforming how you use data, AI-powered tools can increase data accuracy and strengthen forecasting capabilities. For instance, when you perform anomaly detection on a dataset, you can uncover irregularities or inconsistencies in your financial information. As you flag and remove the anomalies, your data quality improves.

This AI-driven approach delivers more valuable and impactful data, helping you go beyond mere reporting of past results to instead harness your data to drive future decisions and predict the best course of action. To safeguard against disruption, adopt a mindset of continuous planning. If you’re conducting a standard three-month review of your financials to identify trends, you’re already three months behind.

Predictive analytics (based on machine learning) allows your finance team to gain deeper insights into historical trends, patterns and correlations. This opens the door for collaborative discussions and strategies, helping you chart accurate forecasts, make informed decisions about budgeting, investments and resource allocation and proactively seize growth opportunities. You can also streamline business communications and negotiations with AI-driven data and natural language processing, which enables computers to understand and interpret human language.

Robotic process automation (RPA) is another game-changing technology that drives cost savings and significantly impacts your bottom line by improving accuracy and reducing manual efforts across the organization.

RPA functions as a task-driven software robot that can help you automate time-consuming, resource-intensive tasks, including account reconciliation, data entry and validation and financial report generation. It can extend your team’s productivity, serving as a digital coworker and simplifying cross-department communication and decision-making. By integrating RPA with AI, you can unlock even greater benefits, employing machine learning and natural language processing to streamline processes, improve efficiency and minimize manual interventions.

To boost efficiency with RPA, first consider where you’re at in your digital transformation journey and identify the manual tasks that, when automated, can yield the greatest financial benefits. Pinpoint areas where increased speed and accuracy can support your budgeting, planning and forecasting. This review will help you determine how to best use RPA for peak productivity and profitability.

To outpace the competition, forward-thinking finance leaders must go beyond simply implementing the right technology and automation tools. It’s equally vital that you reassess how your teams work and embrace the dynamic skillsets required to unleash the potential of human-machine collaboration.

AI and RPA can reduce manual task overload, giving you and your team more time and resources for strategic, value-added work. This allows your people to redirect their focus toward activities that require critical thinking and precise decision-making. To achieve this shift, you need to stay in tune with the evolving skill sets necessary for success in each role and reassess how you can attract and retain top-notch talent.

One critical need? Hiring individuals who understand how to interpret data and act on the resulting outcomes. Advocating for this expertise helps your staff become indispensable assets to your organization and drives smoother, faster workflows and increased job satisfaction and retention.

The increasing prevalence and complexity of cybersecurity attacks threaten organizations of all sizes and in all industries. Cybersecurity hacks can harm your company’s reputation and introduce financial losses or even legal liabilities. As hackers become more sophisticated and global regulations tighten, establishing a robust cybersecurity program becomes an ever-higher priority for finance leaders.

To combat these threats effectively, you must prioritize measures to safeguard data and ensure continued customer confidence. This includes increasing budgets to invest in advanced technologies, security audits and employee training programs. It’s also crucial to hire a chief information officer to oversee your IT people, processes and technology and implement a cybersecurity strategy that minimizes your organization’s vulnerabilities.

Adopting a cloud finance solution is another key cybersecurity strategy for future-proofing customer trust and safeguarding your financial stability. Cloud solutions typically have a higher security level than individual on-premise solutions. Because cloud providers are responsible for protecting thousands of customers’ data, they must uphold comprehensive security measures to retain user trust.

A typical ERP cloud provider allocates substantial resources to bolster their security infrastructure, going far beyond what a single organization could accomplish independently. The bottom line: Your organization will likely be much better protected under cloud security.

Outdated technology is a significant roadblock to keeping up in today’s volatile marketplace because legacy finance systems lag in functionality and hinder efficient decision-making and data analysis. That’s why the ongoing shift from on-premise software to cloud adoption will continue. If you haven’t already made the switch, now is the time to drive cloud adoption across the finish line.

Cloud-based software delivers automatic system reviews and innovation. By leveraging the cloud, your organization can easily update and upgrade software. This ongoing update schedule eliminates the need for complex and cumbersome system maintenance.

A cloud environment also supports configuration that adapts to your changing business needs and allows you to scale up or down. If you’re customizing an on-premise system, on the other hand, every level of customization adds a level of complexity that modifies code and hinders agility.

Finance leaders must adapt and shift their focus toward higher-quality data and profound business insights. But what does that look like?

We embraced our own finance transformation by moving to the Workday platform to meet changing customer expectations and make better-informed decisions faster. Get tips from Armanino CFO John Kogan and Workday Professional Services Industry expert Carrie Augustine as they discuss our Workday migration journey.

You’ll learn how to:

Today’s SaaS companies must innovate and streamline to keep pace with their competition – and the rest of the world. Adapting quickly to emerging technologies like machine learning and AI is key to automating manual processes and getting better data insights faster.

Explore the transformative potential of these new technologies and how they can help you enhance outcomes while maximizing resources. Our experts share tips for optimizing workflows that allow your finance team to focus on analysis rather than simple transaction processing.

You’ll also learn how to:

Your first steps are critical ones. Need some help determining how and where to start your digital race to the future of finance? Explore our white paper to see key lessons we learned optimizing our own business tech stack, and contact our award-winning Business Application Consulting experts to learn more about how you can start smart, avoid technology missteps and keep accelerating.

Don’t be left behind in defining your financial future. Act now to ensure you can thrive amid uncertainty and seize opportunities for lasting success. Connect with our Business Application Consulting experts to request a finance health check to start mapping your path to innovation, speed and agility.