Sales commissions and software development costs (including website or application development costs) continue to be among the top expenditures for software-as-a-service (SaaS) companies. Chief financial officers (CFOs), chief accounting officers (CAOs) and other finance and accounting executives of SaaS companies need to continually evaluate and monitor the industry for emerging trends pertaining to the accounting of these costs. Our annual SaaS survey provides a useful tool to gauge how your organization compares to its peers in these key areas.

The 2020 survey includes over 100 of the top publicly traded SaaS companies (ranked in terms of market cap). We collected the survey information from participants’ most recently filed Form 10-Ks, reflecting data for fiscal years ending in calendar year 2019. In addition to looking at capitalization over time, we also looked at capitalization by revenue and by auditor.

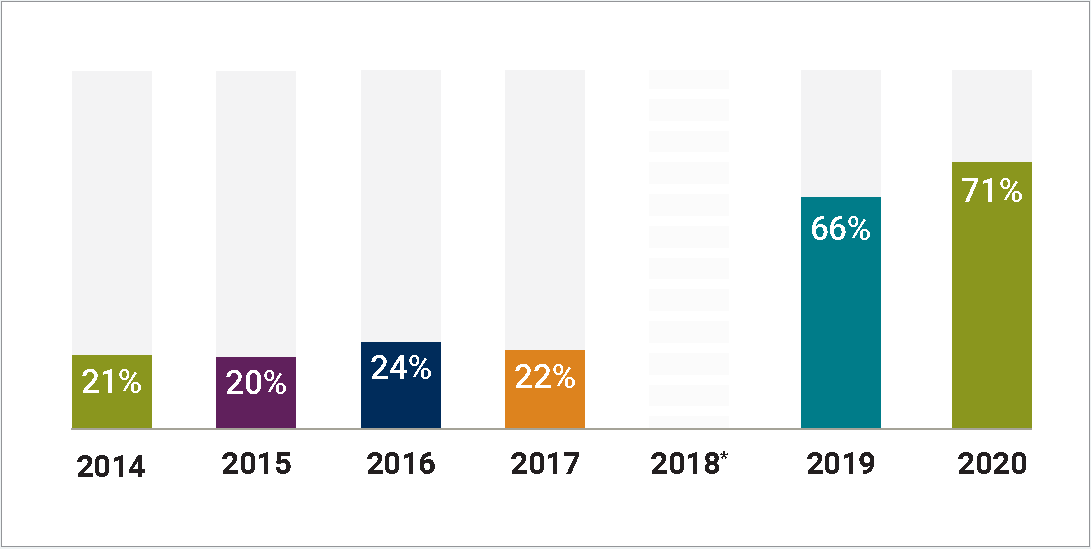

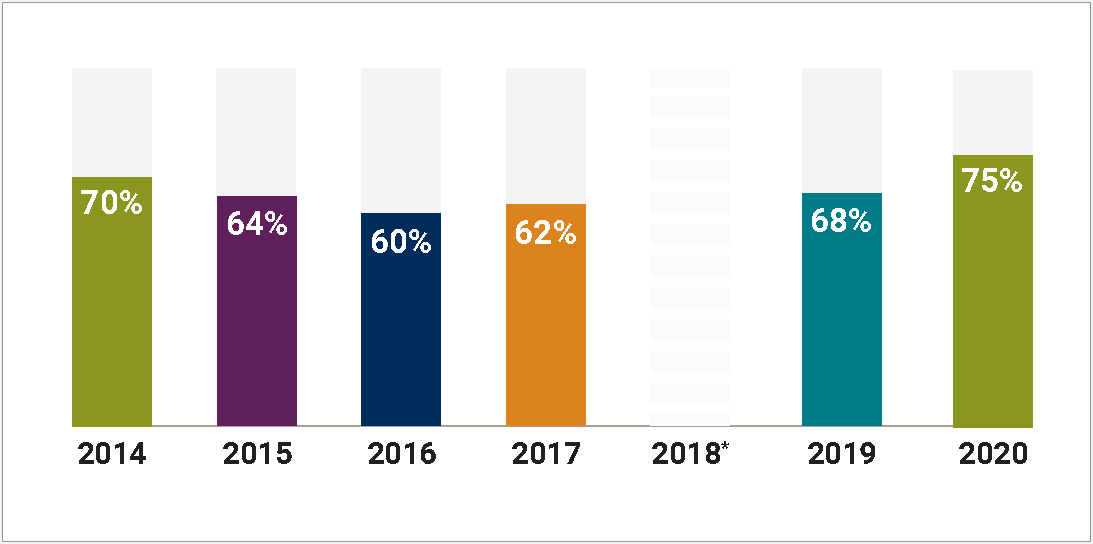

At a high level, the survey results show that the percentage of companies capitalizing commissions paid to sales professionals rose sharply, more than tripling compared to our survey three years ago (71% in 2020 versus 22% in 2017).1 This is not surprising, given that the new revenue recognition rules (ASC 606) took effect for public companies in 2018. The percentage of companies capitalizing development costs, which are not impacted by ASC 606, also increased during this same period (75% in 2020 versus 62% in 2017).

For reference, here are the rules specific to development costs and commissions capitalization.

Development Cost Capitalization

SaaS development costs are subject to “internal use” software capitalization rules, which typically have a longer window of time for eligible costs to be capitalized, versus the “external use” rules for software licensing companies. Brief summaries of the applicable Financial Accounting Standards Board (FASB) rules are shown in the table below:

| SaaS | ||

|---|---|---|

| Internal Use Software | Subtopic 350-40 | Capitalization of costs begins when the preliminary project stage is completed, management has committed to funding the project, and it is probable that the project will be completed and the software will be used to perform the function intended. Capitalization ceases at the point in which the project is substantially complete and is ready for its intended purpose. |

| Website Development Costs | Subtopic 350-50 | Costs incurred to purchase software tools, or costs incurred during the application development stage for internally developed tools, shall be capitalized. |

| Traditional Software License | ||

|---|---|---|

| Costs of Software to Be Sold, Leased, or Marketed | Subtopic 985-20 | Development costs of software to be sold, leased, or otherwise marketed are subject to capitalization beginning when technological feasibility has been established and ending when the product is available for general release. |

Commissions Capitalization

The new revenue recognition standard (ASC 606) mandates that companies capitalize sales commissions if such costs are expected to be recovered through future revenues, unless the amortization period is one year or less. The capitalization of costs incremental to obtaining a contract and determining the period of amortization is one of the most significant areas affected by the new standard, as companies no longer have the option to immediately “expense as you go.”

Sales Commissions

ASC 606 dramatically changed the revenue recognition landscape in 2018, effectively mandating that companies capitalize commissions, if material. As a result, the rate of capitalization in the 2019 survey (66%) tripled compared to the 2017 survey (22%). This further increased in 2020, climbing 500 basis points to 71%.

In 2020, companies that did not disclose commissions capitalized (either claimed commissions were immaterial or were related to deals of less than one year) represented 29% of companies surveyed, down from 34% in 2019. This remains a higher than expected number, given that most SaaS companies pay significant commissions, and sales teams typically focus on multiyear deals.

Not surprisingly, the SEC has issued comment letters to certain registrants in connection with similar costs to obtain contracts under ASC 606. Examples of such comments (adapted) are as follows:

Development Costs

The percentage of companies capitalizing software development costs jumped to 75% in 2020, continuing a multi-year trend. But given the apparent diversity in capitalization shown in the survey, this may be an area where auditors/regulators should seek to enforce greater consistency.

* We elected not to publish a survey in 2018 because 2017 was a crossover year for the transition to ASC 606.

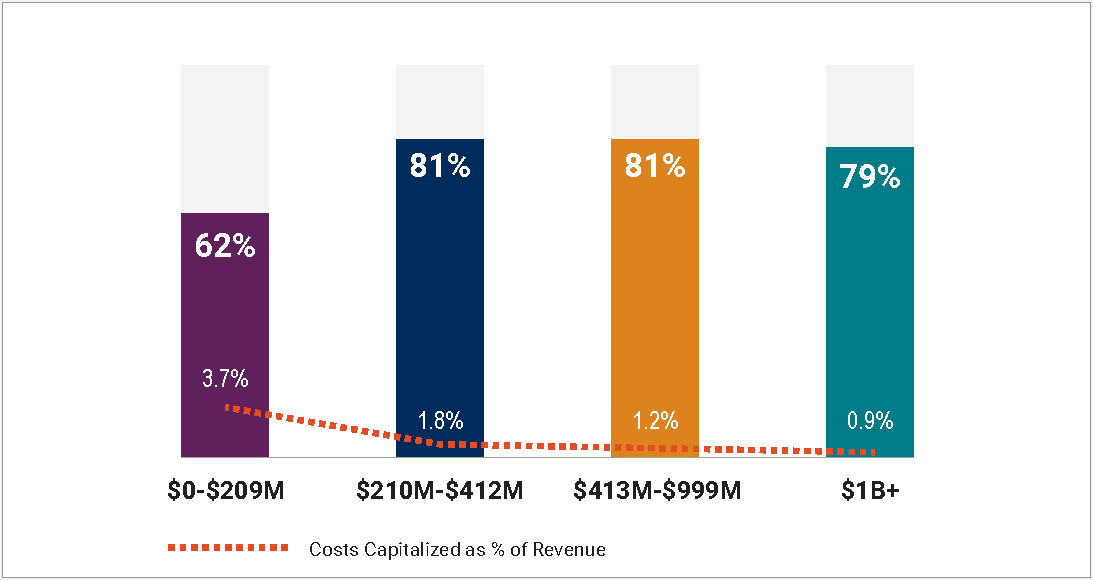

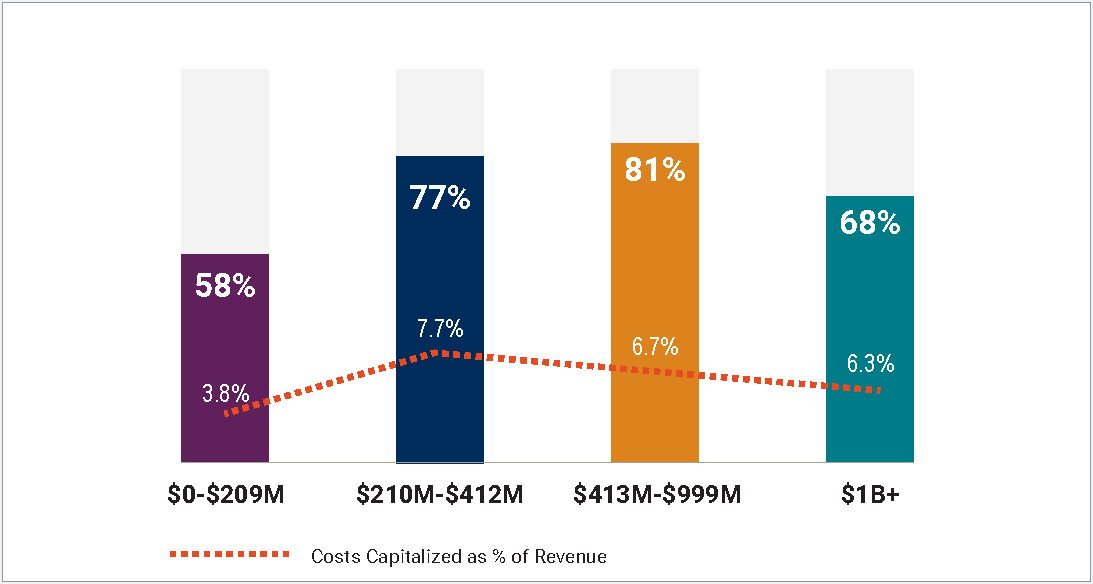

This year we also sorted the firms by revenue into four brackets, with roughly 25 firms in each bracket: $0 to $209 million, $210 million to $412 million, $413 million to $999 million, and $1 billion and over.

Development Cost Capitalization

The data shows that companies with higher revenue tend to capitalize software development costs more often than companies with lower revenue. For example, in the $0 to $209 million revenue range, only 62% of the companies capitalized software development costs, while in the $1 billion and above revenue range, roughly eight out of 10 companies did so.

The amount of software development costs capitalized, relative to revenue, is lower for companies with higher revenue. For example, average capitalized software development costs relative to revenue decreased 280 basis points, from 3.7% to 0.9%, as companies’ revenue increased. We believe this is due to the absolute amount of capitalized software development costs being higher for companies with more revenue, but the amount of capitalized software development as compared to revenue is relatively lower.

Commission Capitalization

Companies with mid-to-higher revenue also tend to capitalize sales commission costs more often than companies with lower revenue. For example, in the $0 to $209 million revenue stratum, 58% of companies capitalized commission costs, while in the $1 billion and over revenue stratum, 68% of companies did so. Capitalization is highest in companies in the $413 million to $999 million revenue bracket, with 81% capitalizing sales commissions.

The amount of commission costs capitalized relative to revenue also trended upward, from roughly 5% in the previous year (except for firms in last year’s $150 million to $400 million revenue bracket, where it was 8.5%) to approximately 6% to 8% in the current year (except for the lowest bracket). Interestingly, the lowest revenue bracket ($0 to $209 million) only capitalized commissions at a rate of 3.8% of revenues, which is about half of the highest capitalization rate (the $210 million to $412 million stratum).

Auditor Correlation to Costs Capitalized

We also analyzed capitalization practices based on the companies’ independent registered public accounting firms (auditors). The data showed a wide disparity in practices based on the audit firm.

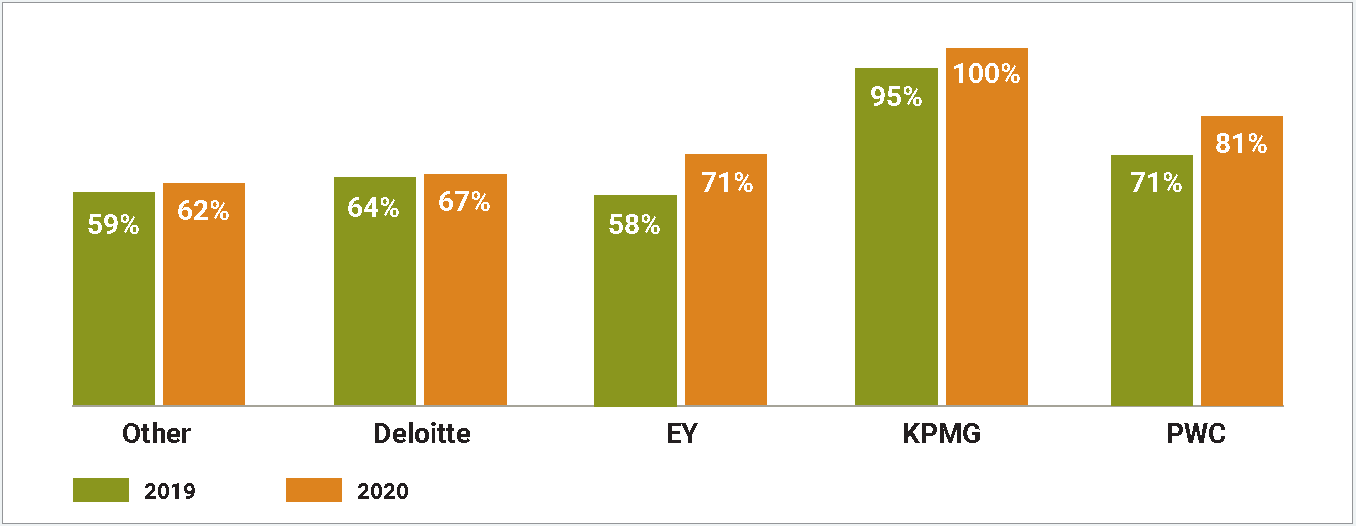

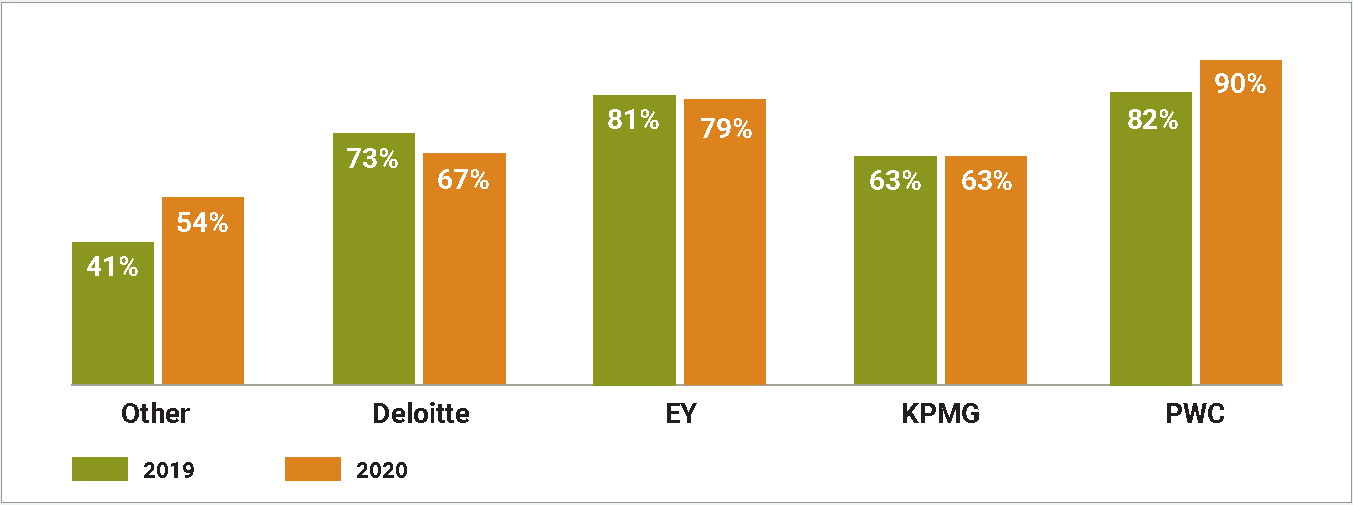

Of the 106 companies surveyed, 80 used Big 4 auditors. The tables below show the capitalization practices of companies for each Big 4 auditor, and for the 26 companies that did not use a Big 4 audit firm.

Among the registrants audited by the Big 4, 100% of KPMG’s clients capitalized software development costs in 2020, while Deloitte had the lowest percentage at 67%. Notably, the percentage of EY clients capitalizing software development costs increased from 58% in 2019 to 71% in 2020. Among registrants audited by other (not Big 4) firms, 62% capitalized software development costs.

Among the registrants audited by the Big 4, PWC had the highest percentage of clients (90%) that capitalized commissions in 2020, while KPMG had the lowest percentage at 63%. Notably, Deloitte and EY had client capitalization declines of 600 basis points and 200 basis points, respectively, from 2019 to 2020. Among registrants audited by other firms, 54% capitalized commissions.

In light of the survey findings and the new ASC 606 standard, SaaS companies should continuously evaluate their decisions on capitalizing software development and commission costs, as there are several short- and longterm implications. They should also consult with their auditors and, ultimately, adopt the method they believe most closely aligns with the intent of the rules.

August 11, 2020