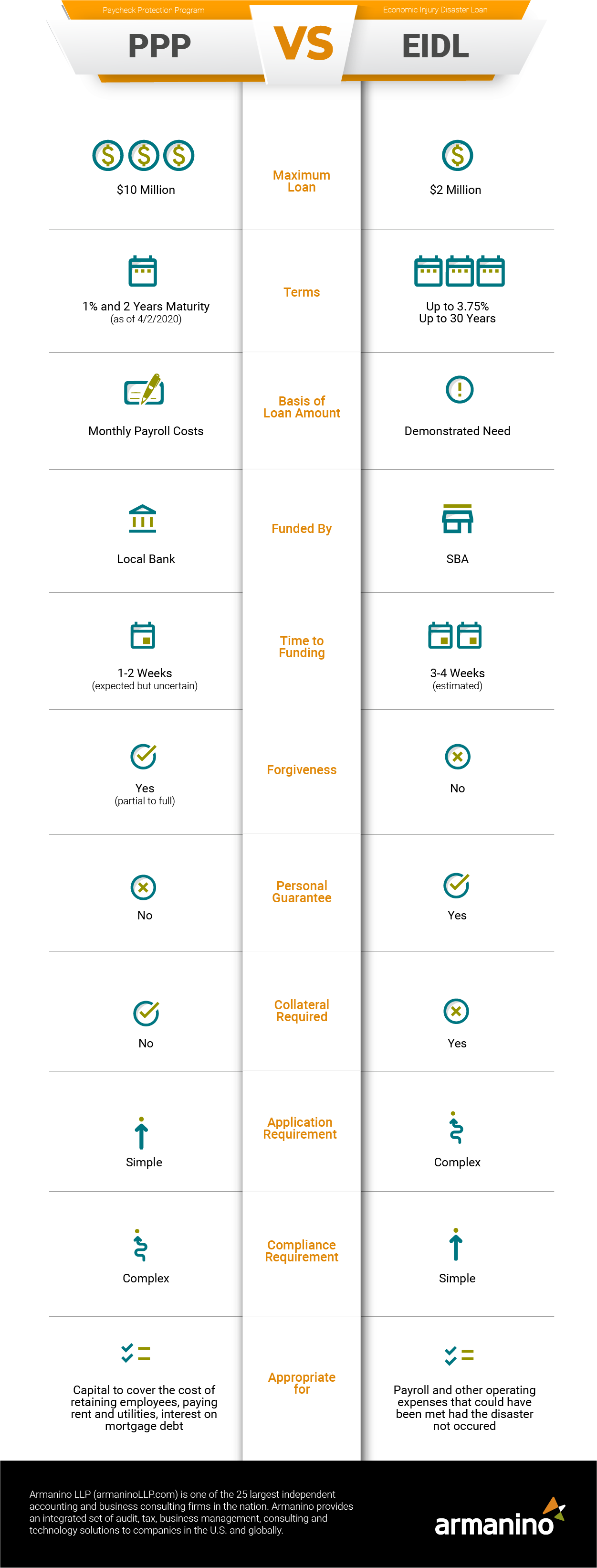

The SBA has two loan programs to help businesses impacted by COVID-19, the Economic Injury Disaster Loan (EIDL) program and the Paycheck Protection Program (PPP).

Want to display this infographic on your site? Copy and paste the following code. Be sure to include attribution to armanino.com with this graphic.

UPDATE: The SBA announced on 4/16/20 that they are no longer accepting applications for PPP loans or Economic Injury Disaster Loans (EIDLs), due to funding limits being reached. They did advise that any EIDL loan applications already received will continue to be processed on a first come-first served basis. See PPP Loan Updates for a timeline of milestone changes.

If you have applied for a loan but not yet received approval, you need to ask the bank if they received an “SBA #” for the application. If they have one, it means they got the allocation. If not, the application is on hold until/unless there is more funding.

The EIDL can provide up to $2 million of financial assistance (actual loan amounts are based on amount of economic injury) to small businesses or private, non-profit organizations that suffer substantial economic injury as a result of the declared disaster, regardless of whether the applicant sustained physical damage.

An EIDL can help you meet necessary financial obligations that your business or private non-profit organization could have met had the disaster not occurred. It provides relief from economic injury caused directly by the disaster and permits you to maintain a reasonable working capital position during the period affected by the disaster. EIDLs do not replace lost sales or revenue.

Any business is eligible including agricultural cooperatives, aquaculture businesses and most private, nonprofit organizations with the following exceptions:

Agricultural Enterprises: If the primary activity of the business (including its affiliates) is as defined in Section 18(b)(1) of the Small Business Act

See Covid Tax Relief for additional assistance options.

A borrower can apply for one or even both loans (EIDL and/or PPP), providing the funds are used for different purposes. The PPP loan can be forgiven if funds are used to pay specifically designated expenses. There are no personal guarantees, and the basis is 2.5x the average payroll expense in the last year or $10 million, whichever is less. The EIDL loan is up to $2 million, so it’s perhaps less money than the PPP, but the application is much more rigorous and consistent with typical SBA emergency loan standards.

The EIDL also comes with the opportunity to get a quick $10,000 advance feature. It will be forgiven if the loan application is denied. If the applicant applies for a PPP loan, this $10,000 EIDL advance will be added to the PPP loan basis and deducted from any loan forgiveness.

EIDL and PPP loans were aimed at small to mid-sized businesses, so Title IV was created to enable larger companies to apply for loans. Title IV of the Act, starting with Section 4001, provides for loans for companies with more than 500 employees. Section 4002(4)(B) includes any U.S. business, and Section 4003(c)(3)(D) provides for loans to businesses with 500-10,000 employees (“Mid-Size Business”) with interest at no more than 2%, and no payments due for the first six months.

However, there is no loan forgiveness like there is for PPP loans. Assistance received under Title IV will be treated as indebtedness for tax purpose, even if the government acquires warrants, stock or other equity interests.