We often help clients with issues related to inventory costing in Dynamics 365 for Finance and Operations (D365 F&O). One area that is sometimes confusing is the concept of physical and financial cost amounts of manufactured goods inventory transactions. The physical cost amount is a temporary value that is being used until the actual inventory cost is known and the financial cost is updated.

This post highlights the options in D365 F&O for determining the temporary cost amount for manufactured goods. The information is applicable when the costing method of the finished good is Weighted Average, Moving Average, FIFO or LIFO.

The system gives us two options for the physical cost amount of goods reported as finished:

I will walk through some of the concepts in D365 F&O and give some examples on when it may be beneficial to use estimated cost price instead of default cost price.

The concept of physical and financial update supports a common scenario where the cost of the item is not known when the product is physically received but the product is available to be consumed in production or to be shipped to a customer. The inventory transaction is updated with a physical cost amount, which could be considered a best guess of its correct inventory cost amount for financial statement purposes.

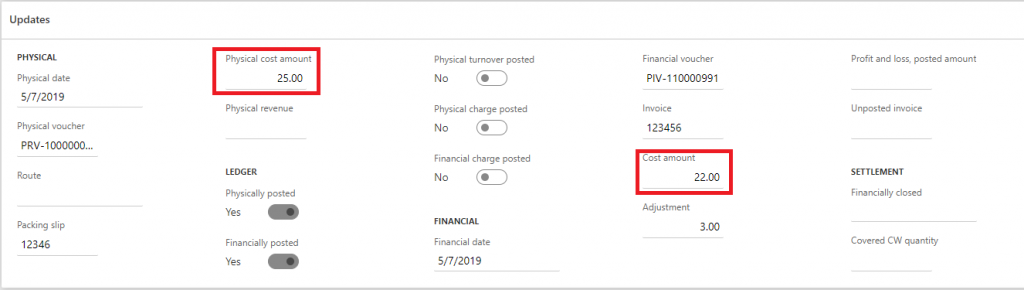

The physical cost amount of purchased goods is replaced with financial cost at the time of purchase order invoicing, and the physical cost amount of manufactured goods is replaced with the financial cost at the time of production order ending. Financial update reverses the voucher transactions posted at the time of physical update and posts new voucher transactions with the financial costs. During the inventory closing process, the previously posted transactions are adjusted to correctly reflect the financial cost.

Below is an example of an inventory transaction with different physical and financial cost amounts.

In D365 F&O, manufactured goods are moved from production to inventory when a quantity is reported as finished. The system allows reporting a partial quantity as finished before consuming all raw materials or recording processing time against the route. This design allows the flexibility to consume and ship finished subassemblies and finished goods as soon as the product is ready. At this point, the finished good is updated with a physical cost amount.

Once the production order is completed, the production order can be ended. Ending the production order calculates the total cost of the finished products based on the value of consumed cost components and updates all inventory transactions financially. At this point, physical voucher transactions are reversed. If the finished good is standard-costed, the production variances are posted when the production order is ended.

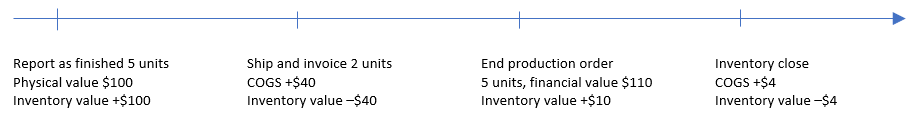

In the example below, a production order is reported as finished with 5 good units. The physical cost amount is $20 per unit. Two units are shipped and invoiced immediately, and the COGS is posted at $20 per unit. The cost accountant reviews the production order and ends it after confirming that everything looks correct. The actual total value of the cost components is $110 ($22 per unit) and the inventory transaction is updated with the financial cost amount. When the inventory closing process is run, the COGS is adjusted with $2 per unit and the inventory value is reduced accordingly.

The WIP is increased with the physical cost amount of raw materials consumed and with the route costs recorded against a production order. The WIP is reduced with the physical cost amount of the finished goods at the time of reporting as finished. If the physical cost amount of the finished good does not reflect the value of the cost components, the WIP may be either overvalued or undervalued. When the production order is ended, all inventory transactions are updated with financial cost, and the physical voucher transactions are reversed, automatically reconciling the WIP account.

If the time between reporting as finished and production order ending is long, the impact of the physical value may be significant both for valuation of WIP and for the finished goods.

As noted earlier, the physical cost amount of manufactured goods can be either of the following:

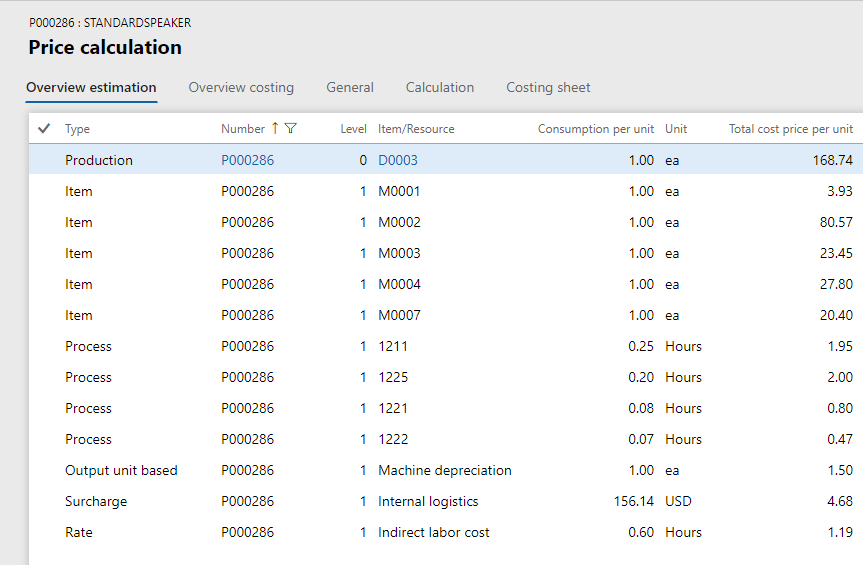

The estimated cost price is calculated by the system based on the production BOM or formula, production route and costing sheet when the production order is estimated. The result of the calculation can be seen on the production order by selecting View Calculation Details.

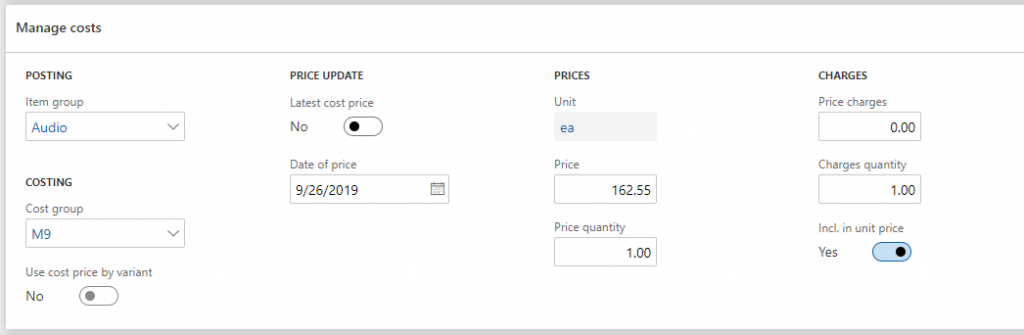

By default, the system uses the current cost price when the product is moved from production to inventory. The cost price is specified on the released product on the Manage Costs FastTab.

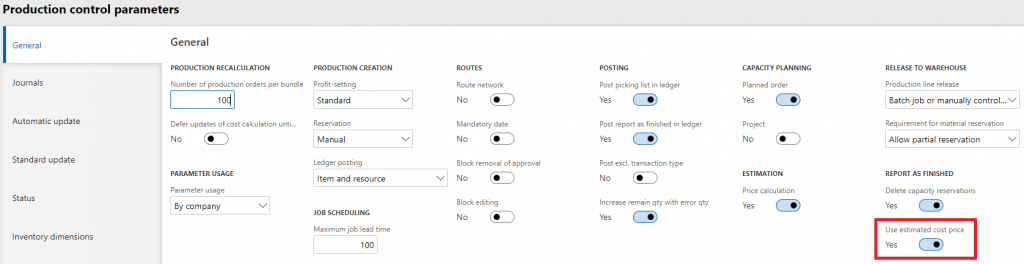

The parameter to enable use of estimated cost price is in the Production Control Parameters.

In the examples above, the estimated cost amount is $168.74, while the cost price is $162.55.

It is recommended to use the option that more accurately represents the actual cost of the finished product.

Some reasons for using the default cost price are:

Some reasons to use estimated cost price:

Note: If the production orders are ended immediately after the products are moved from production to inventory, the impact of physical cost amount to WIP or inventory value is minimal, since it gets overwritten when the production order is ended.

Discover more tips, tricks and helpful hints throughout the Armanino Dynamics blog on with Armanino's team of Dynamics experts.