An opportunity zone is a federally designated low-income area that offers tax incentives for investment in qualified local businesses and property. Also called a "Qualified Opportunity Zone" or "QOZ," they were created by the 2017 Tax Cuts and Jobs Act (TCJA) to encourage long-term, private investment in economically distressed communities.

The opportunity zone program was conceived by tech entrepreneur Sean Parker and his Economic Innovation Group. The program had bipartisan support and resulted in two new sections in the Internal Revenue Code: 1400Z-1 and 1400Z-2.

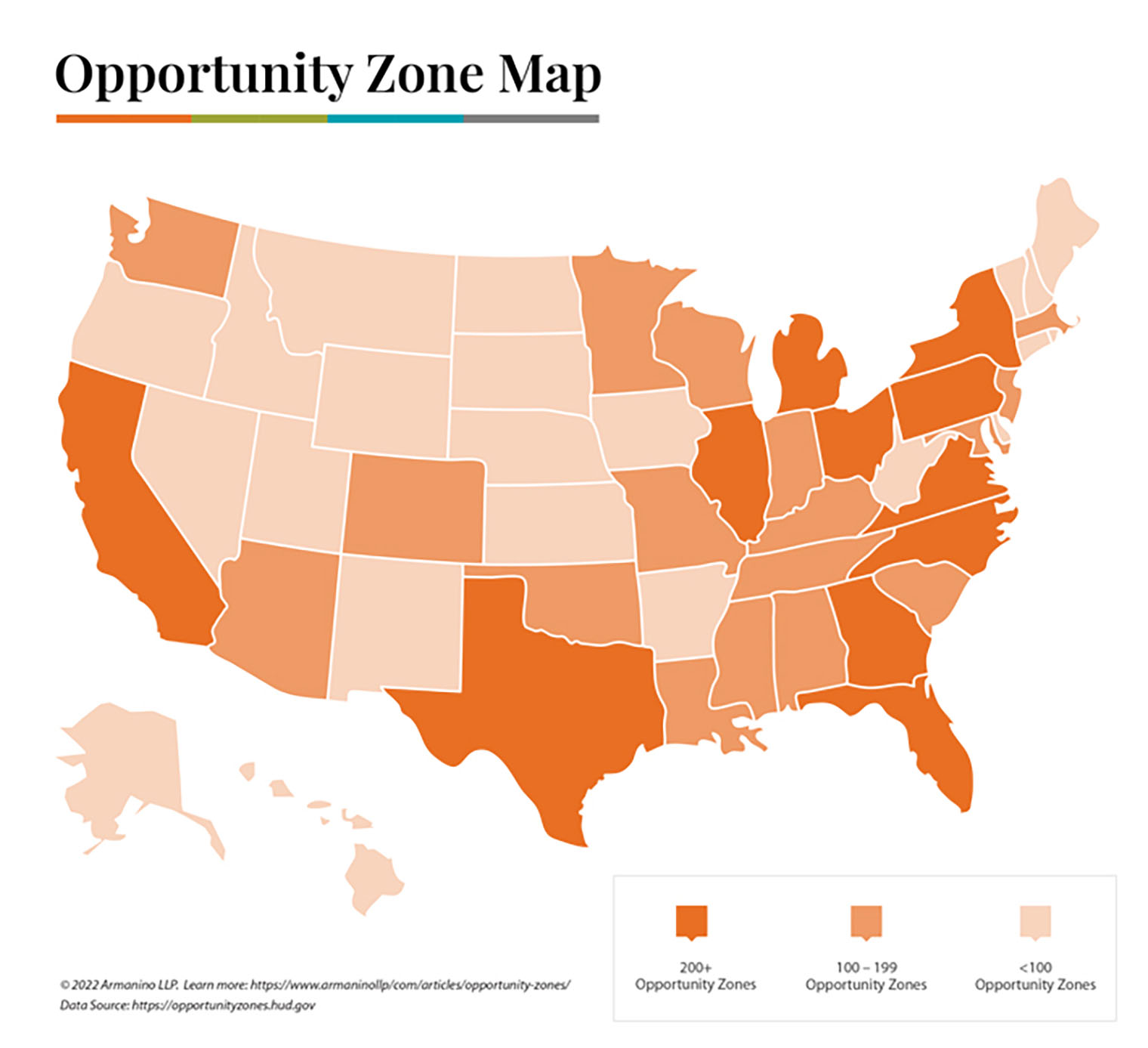

There are 8,746 opportunity zones in the U.S. and U.S. territories. Check out the official HUD Opportunity Zone website for additional detailed resources.

A few states, including California, Massachusetts, Mississippi and North Carolina, do not conform to the federal opportunity zone tax rules. Investors from nonconforming states do not get state tax benefits for their opportunity zone investments, and would therefore only benefit from the federal program. In those states that do conform to the federal opportunity zone tax rules, the applicable capital gains tax for both federal and state is deferred and avoided.

Opportunity zones provide tax benefits to individuals or corporations who reinvest short-term or long-term capital gains in a Qualified Opportunity Fund (QOF). To get the maximum tax benefit, the gains must stay invested in the QOF for at least 10 years. The opportunity zone designations expire at the end of 2028, but investors have until 2047 to dispose of their QOF investment and make basis step-up elections.

Individual investors must attach IRS Form 8997 on their tax return for the year when they invest. This Form 8997 must then be filed every year that the investment stays in a Qualified Opportunity Fund. Investors should also use IRS Form 8949 for the first year in which they invest to report the capital gain investment, offset by a negative number that’s equal to the invested capital gain, which tells the IRS that they do not have to pay tax on the invested gain. For beneficiaries of a trust or estate, there is also a Schedule Form K-1 (IRS Form 1041) for reporting distributions, and then this information is uploaded on the income tax return.

The opportunity zone program created three main tax benefits for investors, one of which (the increase in cost basis) expired as of the end of 2021:

A Qualified Opportunity Fund (QOF) is an investment vehicle (corporation or partnership) created for investing in opportunity zones (OZs). The QOF must invest at least 90% of its assets in qualified OZ businesses or qualified OZ property, including investments in new or substantially improved commercial buildings, equipment and multifamily complexes. This is calculated by averaging the percentages held in the QOF at the midpoint and end of the QOF’s tax year.

For example, if the QOF (partnership) has $1 million of assets, $900,000 must be considered OZ assets (e.g., the OZ project’s building, etc.). That means that $100,000 (10%) could be simply cash or any other non-QOZB asset (investment in property in a non-OZ).

A Qualified Opportunity Fund (QOF) must file IRS Form 8996 with its annual federal income tax return.

QOFs can directly own Qualified Opportunity Zone (QOZ) business property or invest in qualified opportunity zone businesses. They cannot invest in another QOF.

Tangible property owned by a QOF must meet these requirements to qualify:

Tangible property is generally valued for the 90% test based on its undepreciated cost. However, if a QOF has an Applicable Financial Statement (AFS), the value of the property as reported on the AFS may be used by the OZ Fund for its 90% test.

Leased property used by a QOF must also be considered in its 90% test even though leases and leased property are generally not valued or reported as assets for tax purposes.

The value is determined based on the present value of the future lease payments, discounted using the IRS Applicable Federal Rate (AFR). Once the lease is initially valued (when the lease is entered into), its value remains unchanged for all future testing dates. If a QOF has an AFS that reports leased property as assets, the AFS value can be used if it is also used in calculating the value of tangible property owned.

Additionally, to qualify, leased property must meet the following requirements, among others:

An investment in a QOF must be an equity interest, including preferred stock or a partnership interest with special allocations. A debt instrument doesn’t qualify. An investor can, however, use a QOF investment as collateral for a loan.

To qualify for deferral, investors must invest in a QOF within 180 days of the sale or exchange that generates the gain or the date that the gain would otherwise be recognized for federal income tax purposes.

For gains experienced by pass-through entities (a partnership, trust/estate or S-corporation), the rules generally allow either the entity or the partners, shareholders or beneficiaries to elect deferral. For partnership gains not deferred by the entity, a partner’s 180-day period generally begins on the last day of the partnership’s taxable year. If a partner knows the date of the partnership’s gain and the partnership has decided not to elect deferral, the partner can begin their own period on the same date as the start of the entity’s 180-day period. The same rules apply to other pass-through entities.

If an investor disposes of their entire original interest in a QOF, they can continue the deferral by reinvesting the proceeds in a QOF within 180 days.

A QOF has 12 months to reinvest its proceeds from the return of capital or the sale/disposition of property in qualified opportunity zone property. If the QOF’s reinvestment plans are delayed due to a federally declared disaster, it has an additional 12 months to reinvest.

QOFs are tested for rule compliance semi-annually, with the initial testing date on the last day of the sixth month after the fund’s taxable year begins and the second testing date on the last day of the fund’s taxable year. A QOF with a calendar year for tax purposes is generally tested Jun 30th and Dec 31st each year.

However, in a QOF’s initial tax year, its first testing date isn’t until six months after it elects to be a QOF. A QOF that makes its election after June has only one testing date in its first tax year, Dec 31st.

While delaying the election may push back or eliminate a QOF’s first testing date, a fund must initially elect to be a QOF by the time it receives its first eligible equity investment. If not, the investor would not be considered to have made an investment in a QOF and would not be eligible to receive any of the related tax benefits.

A critical review and analysis of a QOF’s balance sheet prior to its mid-year testing date is crucial, as well as having records to support the results of the mid-year test.

A QOF’s balance sheet must be closely reviewed prior to a testing date to determine which property qualifies. Significant portions of the law and regulations are dedicated to defining qualifying property and, as with all tax law, there are general rules and exceptions.

For a trade or business to be a qualified opportunity zone business, at least 70% of its owned or leased tangible property must be qualified opportunity zone business property, and it must comply with specific rules.

Qualified opportunity zone business property is tangible property that a QOF acquired after 2017 and uses in a trade or business and that satisfies both of these tests:

Land is not included in the determination of whether a building has been substantially improved. For example, if a QOF buys a $3 million property, with $2 million for the land and $1 million for the building, it’s required to invest only $1 million to improve the building.

Qualified opportunity zone businesses must meet all of the following “tests”:

A qualified opportunity zone business’s working capital assets are treated as "reasonable in amount,” and are not nonqualified financial property, if the business follows a written plan and uses the working capital to develop a business in an opportunity zone within 31 months. Qualified opportunity zone businesses located in a federally declared disaster area have an additional 24 months to deploy their working capital.

Cash is generally NOT a qualifying working capital asset, unless:

This is a hugely beneficial safe harbor that only applies to Qualified Opportunity Zone Businesses -- Qualified Opportunity Funds (QOFs) cannot use this safe harbor if they hold cash directly.

If you invest in an opportunity zone REIT, the distributions will be taxed as ordinary income. Distributions in a partnership are tax-free.

If the Qualified Opportunity Fund is generating losses, which most will at the beginning, those get passed on to the partners on a Schedule K-1. You can use those passive losses to offset other passive gains as well as carry forward indefinitely any amount that wasn’t utilized.

Once you sell your investment, you do not have to pay back tax on that depreciation, which you normally would under what’s called depreciation recapture.

Distributions of debt financing generate basis, and therefore are tax-free.

You take those losses, harvest them in between the time you invested your gain and 2026, and offset the deferred capital gain that’s being recognized on your 2026 return, which is the earlier gain that you invested.

On your federal Form 1040, you show the IRS that you’re taking advantage of the opportunity zone program and do not have to pay federal capital gains tax. On your California form, you would have to pay the California capital gains tax on that.

If you’re an out-of-state investor investing in a California-based Qualified Opportunity Fund, you will not have to pay your state capital gains tax on that investment, assuming you’re not in the few states that do not conform with 1400Z-2. Keep in mind that because the property you’re investing in is in California, after that 10-year period, when it’s sold, you would still have to pay state capital gains tax on that. Depending on the size and nature of your investment, you may be eligible for other California Tax Credits.

Armanino has the industry expertise, tax credit experience and track record of customer satisfaction to best advise your tax credit incentive strategy and compliance needs.

Contact us today for a free assessment.