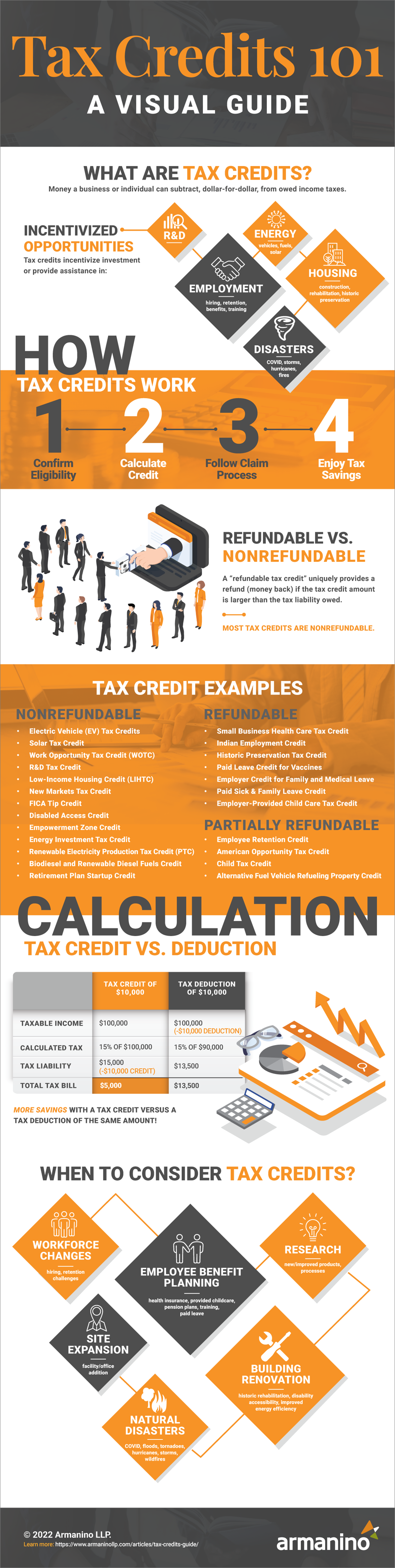

A tax credit is money you can subtract, dollar for dollar, from income taxes that a business or individual owes. Tax credits incentivize investment or provide assistance in these areas:

In this guide we'll cover the fundamentals of tax credits:

Want to display this infographic on your site? Copy and paste the following code. Be sure to include attribution to armanino.com with this graphic.

Tax credits are defined and updated throughout the year by both federal and state governments. Qualifying businesses and individuals must typically file a form to claim tax credits; the savings are not automatic. The claim process varies by tax credit.

Tax credit differences for consideration:

Tax credit types are designated as refundable, partially refundable, or nonrefundable – all offer a chance to lower the amount of taxes owed. “Refundable tax credits” will generate a refund (cash back to you) if the credit amount is larger than the tax amount you owe. If you don’t owe any taxes, you’ll receive a money-back refund for the amount of the refundable tax credit.

Most tax credits are nonrefundable. Some tax credits include both refundable and nonrefundable portions.

Refundable Tax Credit Examples:

Nonrefundable Tax Credit Examples:

Partially Refundable Tax Credit Examples:

For complete listings or details of these tax credits, see Business Tax Credits 2022 and California Tax Credits.

Tax credits reduce your tax liability (the amount of tax you owe), while tax deductions reduce your taxable income. Tax credits are usually more valuable than tax deductions of the same amount.

The example below shows how a tax credit and a tax deduction of the same amount impact your tax bill differently. (Note that this simplified example uses a flat tax rate of 15% and does not reflect the progressive income tax rate structure currently in effect in the U.S.)

| Tax Credit of $10,000 | Tax Deduction of $10,000 | |

|---|---|---|

| Total Income | $100,000 | $100,000 |

| Taxable Income | $100,000 | $100,000 (- $10,000 tax deduction) |

| Calculated Tax | 15% of $100,000 | 15% of $90,000 |

| Tax Liability | $15,000 (- $10,000 tax credit) | $13,500 |

| Total Tax Bill | $5,000 | $13,500 |

A tax write-off (also known as “tax deduction”) is an expense you can deduct from your taxable income, such as equipment and supplies for your business. Tax deductions or write-offs reduce your taxable income before the tax on it is calculated. Tax credits are subtracted, dollar for dollar, from the tax you owe after it has been calculated.

A tax exemption is a type of tax deduction (e.g., the standard deduction). Taxpayers can deduct the amount of the exemption from their taxable income. As with other types of tax deductions, tax exemptions are less valuable than tax credits, which can be subtracted from the amount of tax owed on a dollar-for-dollar basis.

When you pay more tax during the year than you owe, you can receive a refund for the amount you overpaid. Some tax credits are refundable, in which case if the tax credit exceeds the tax amount you owe, you’ll receive a tax refund for the difference.

On rare occasions, federal or state tax agencies give back some of the money that taxpayers have already paid in taxes as a rebate. Some states also offer rebates to taxpayers who purchase alternative energy products or other specified consumer goods.

A tax cut is when state or federal tax authorities reduce the tax rate that individuals or businesses must pay. For example, the Tax Cuts and Jobs Act of 2017 lowered the highest corporate income tax rate to 21% from 35%. Tax cuts reduce the tax rate for everyone in the impacted group, but tax credits only provide savings for qualified taxpayers.

A tax subsidy is money that a government pays to or for a business or individual for a specific purpose. Individual companies and industries often receive tax subsidies for locating in a specific area, creating jobs or many other reasons. For example, the Affordable Care Act’s cost-sharing subsidies reduce the cost of care for policy holders by requiring the federal government to pay some of the cost directly to the insurance company.

Strategic tax planning takes advantage of tax savings to help your business be more profitable, competitive, and financially successful. Many different business activities and events can trigger eligibility to claim business tax credits. Consider these events in advance to reap optimal tax credit savings.

Tax credit strategy can be confusing and complicated. Check out our tax credit services to help maximize your credits and ensure compliance.

Armanino has the industry expertise, tax credit experience and track record of customer satisfaction to best advise your tax credit incentive strategy and compliance needs.

Contact us today for a free assessment.