From transactional processes to transformative workforce strategies, expert HR services are the essential enablers every thriving business requires.

Your Needs

Your most valuable asset is the collective talent across your business. For a sound financial structure and business strategy, you need the right human resources (HR) strategy, processes and expertise.

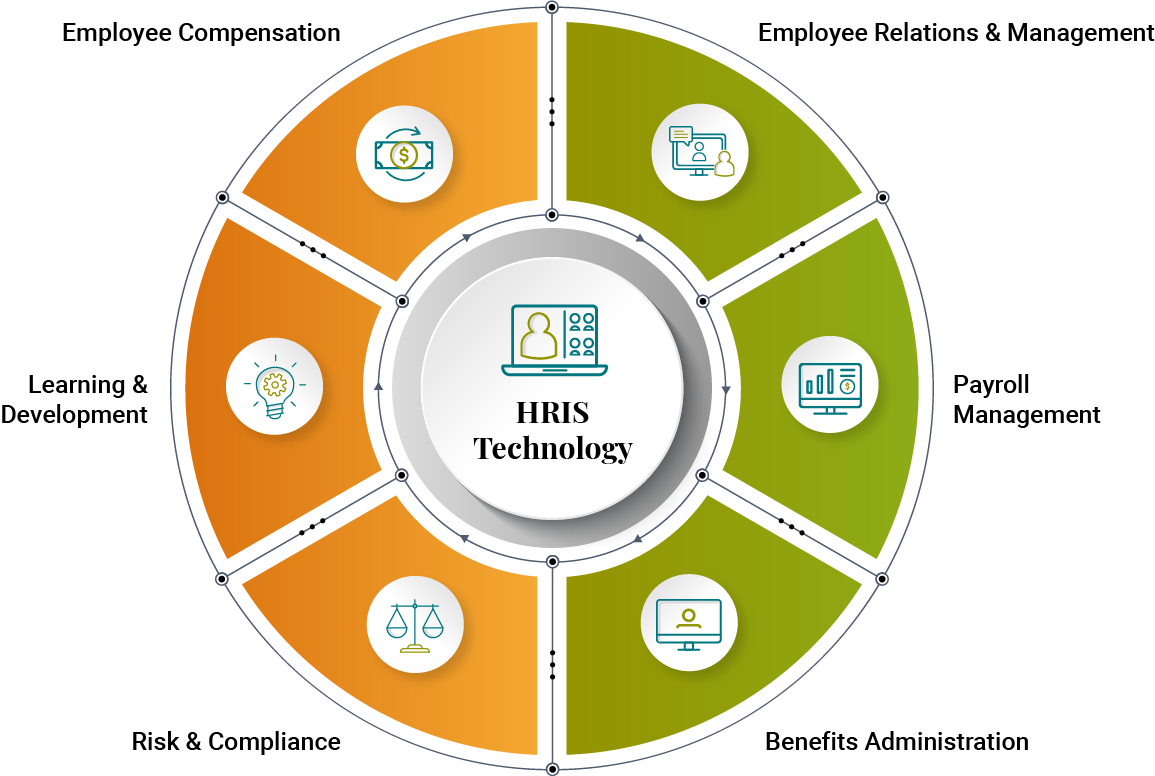

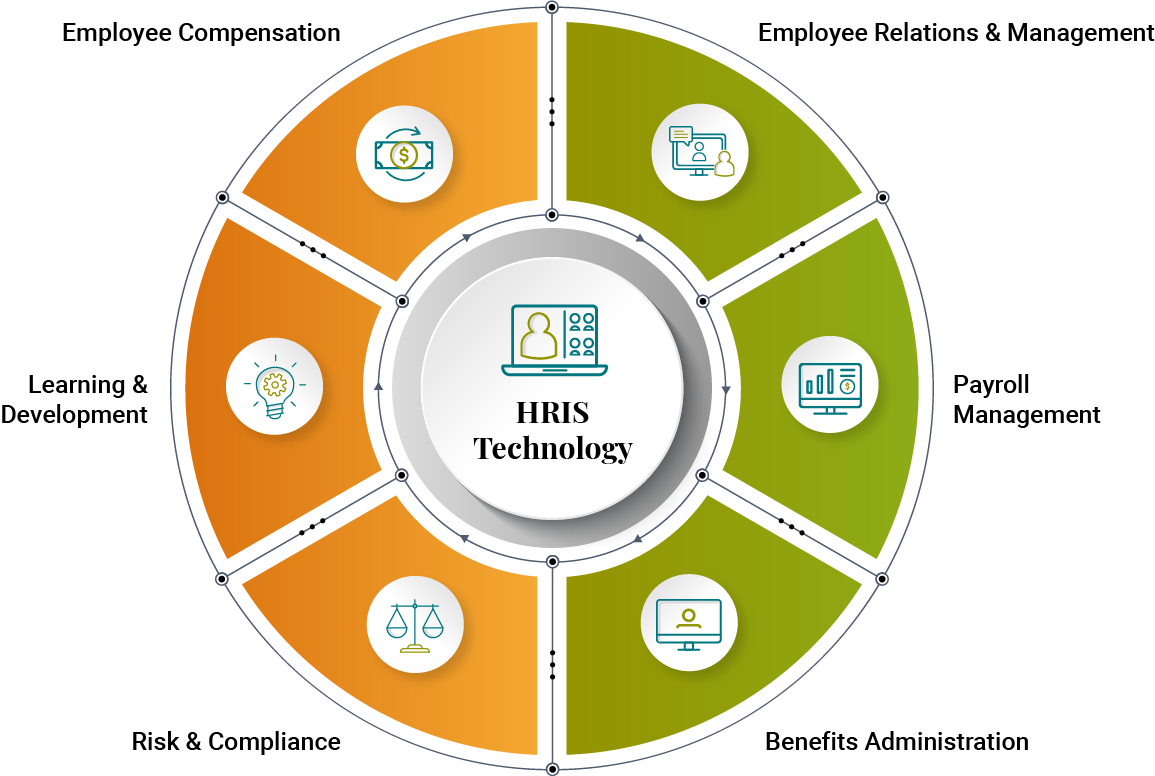

We can help with everything from compliance to payroll management, talent strategies to benefits, onboarding to offboarding. We’ll resolve day-to-day transactional issues while helping you shape your HR strategy and align it to your business objectives.

If you have any questions or just want to reach out to one of our experts, use the form and we'll get back to you promptly.