Updated January 11, 2023

Small businesses negatively affected by COVID-19 have multiple avenues to seek financial relief through the CARES Act (Coronavirus Aid, Relief, Economic Security) and American Rescue Plan Act of 2021 (ARP).

IRS Notice 2022-36 was released on August 24, 2022, providing penalty relief to most people and businesses who file certain 2019 or 2020 returns late. This relief allows the IRS to focus resources more effectively and provide relief to taxpayers affected by the COVID-19 pandemic.

This credit, worth up to $10,000 per employee, is intended to keep employees affected by the ongoing COVID-19 pandemic on the payroll even if they are not working during the covered period. To qualify, employers must prove that they either partially or fully suspended operations due to a COVID-19 shutdown, or that they experienced a significant decline in gross receipts. See Employee Retention Credit for more details.

Type: Refundable

Dates: Mar 13, 2020 - Jun 30, 2021

Claim Process: To claim the credit, report total qualified wages and the related health insurance costs on Form 941, Employer’s Quarterly Federal Tax Return.

This credit reimburses employers for the cost of providing paid sick and family leave for employees because of the COVID-19 pandemic. The sick leave credit is worth up to $511 per day per employee for up to two weeks, and the family leave credit is worth up to $200 per day for up to twelve weeks. To qualify, businesses must have fewer than 500 employees. See IRS Covid-19 Employee Paid Leave for more details.

Type: Refundable

Dates: Apr 1, 2021 - Sep 30, 2021

Claim Process: To claim this credit, report the amount of sick and family leave wages paid to employees and other required information on Form 941, Employer's Quarterly Federal Tax Return.

This credit allows qualified employers who employ fewer than 500 employees to be reimbursed for the cost of providing sick and family leave to employees due to COVID-19, including employees taking time off to receive or recover from COVID-19 vaccines. Employers can receive up to $511 per day for each vaccinated employee. See IRS Covid-19 Employee Paid Leave for more details.

Type: Refundable

Dates: Apr 1, 2021 - Sep 30, 2021

Claim Process: File Form 941, Employer's Quarterly Federal Tax Return to claim this credit.

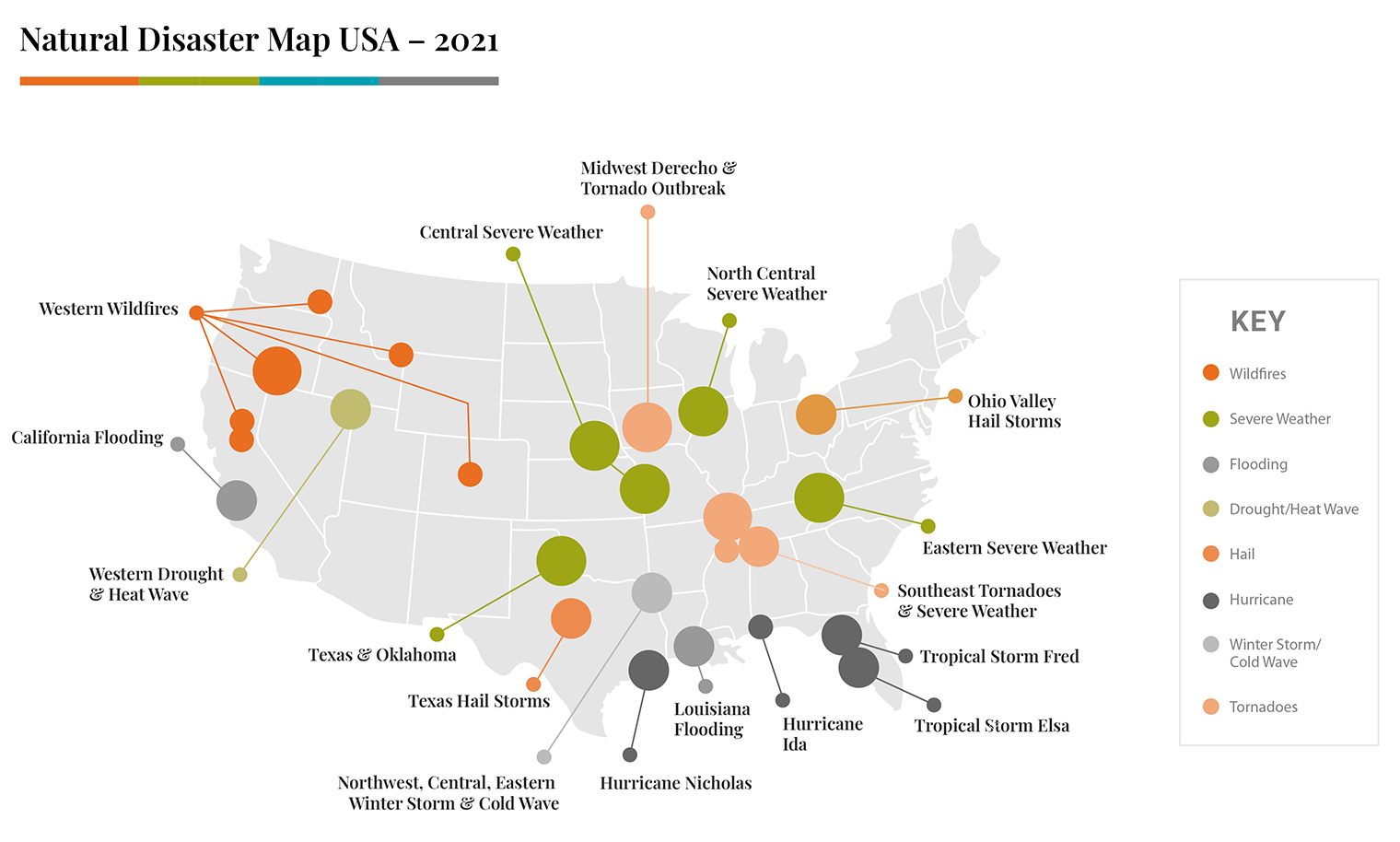

If you or your business has been adversely impacted by a hurricane, severe storm, tornado, flooding or other natural disaster, you could qualify for natural disaster tax credits. Relief for these extreme weather events comes in the form of filing and payment extensions, deductions for lost or damaged property, and fee waivers.

A qualified disaster zone or area is a geographical region impacted by major disaster that the President declares as eligible for individual and/or public assistance from the federal government.

The Federal Emergency Management Agency (FEMA) needs to authorize a major disaster declaration before the IRS can grant tax relief. Once FEMA has identified areas for assistance, and the President declares a federal disaster, these areas become IRS Designated Disaster Areas, and the IRS will grant filing and payment relief. See FEMA's website for a full list of these areas.

Common tax-related actions and authorizations after a major disaster include:

Details for specific types of disasters and respective tax relief are listed below with most recent disasters sorted first.

COVID Penalty Relief in Declared Disaster Areas (Oct 2022)

See IRS natural disaster tax relief for latest updates.

For help with disaster tax relief or other tax credits, please see our tax credit services.