Configuration and setup of Dynamics AX bank transaction types (AX 2013 R3) can be very helpful and useful in bank reconciliation. This is especially helpful when the origination of transactions appearing on the bank statement cannot be traced back to the ERP system or when the system's setup requires a manual general ledger adjustment at the time of reconciliation for the charges that appear on the statement.

Different charges appearing on the bank statement that are either aggregated or do not appear at all in the accounting system (AX) can be configured as "bank transaction types." Natural accounts can be created in the chart of accounts to be associated with these transactions/charges. Thereafter, you can create the Ledger adjustment or distribution (for an aggregated charges) to different natural accounts right from the Bank Reconciliation form itself, instead of manually going to general ledger and making the record of adjustments.

Below I have demonstrated the configuration of Dynamics AX bank transaction types which is a very useful and potent tool in the business scenarios and procedure described above.

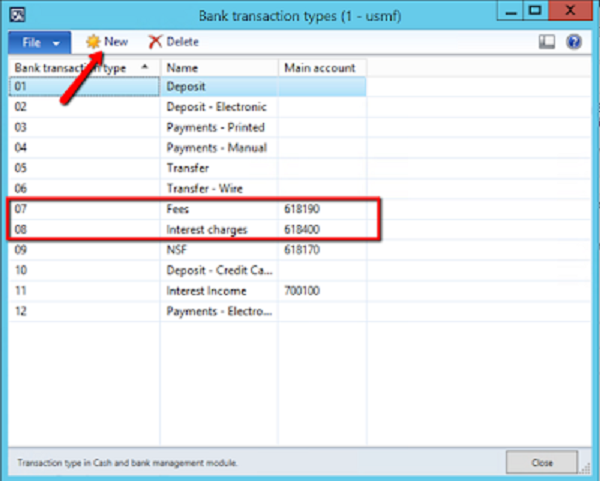

Step one is to define the Transaction type Ex. Credit Card Fee and the natural general ledger account it gets posted to.

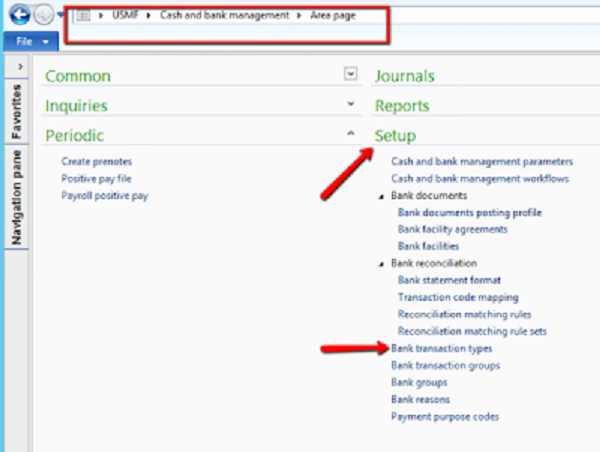

Navigation: AX > Cash & Bank Management > Area Page > Setup > Bank Transaction Types

For Bank Reconciliation navigate to:

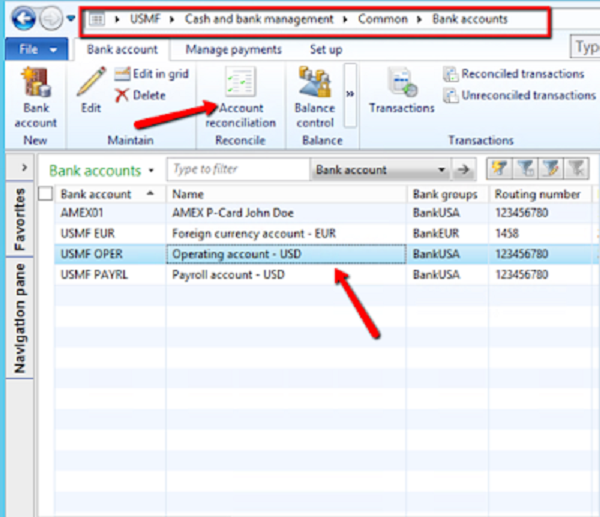

AX > Cash & Bank Management > Common > Bank accounts.

Select the bank account for which reconciliation needs to be performed, then click "Account reconciliation" on the Reconcile action tab.

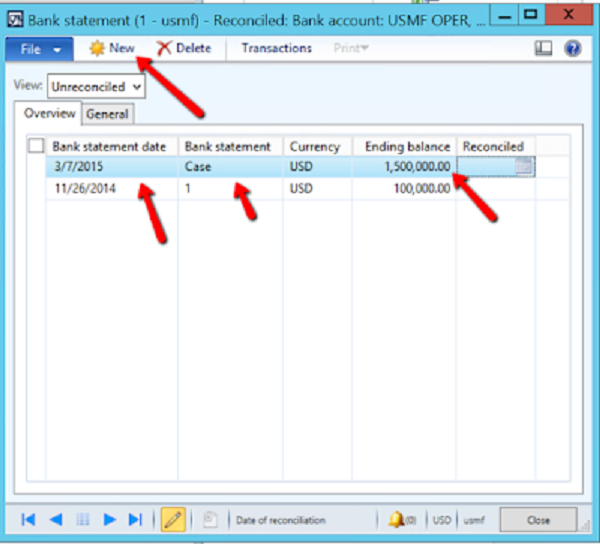

Click new on the Bank Statement form. Specify the Bank statement date, Bank statement number or any other identification, currency and the ending balance on the Bank statement that needs to be reconciled. Hit "Transactions" thereafter on the upper ribbon to open the account reconciliation form.

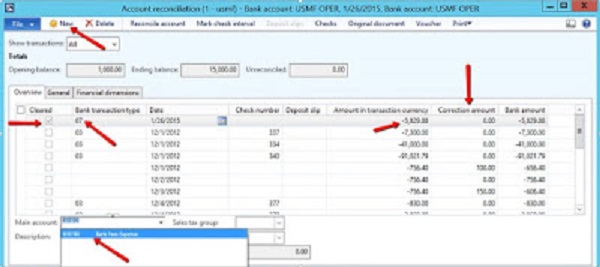

On the Bank Reconciliation form hit "new" to create the charge that appears on the Bank Statement. Or, you can also break the aggregated amount in AX through the collections column by specifying the difference and then recording the difference to a separate ledger account through Bank transaction type using the same process.

I created a new transaction in the account reconciliation form itself for the Fees specifying the "Bank transaction type." In this case, it is marked as credit for the purpose of reconciliation (usually it would be a debit) and the main account field gets populated on its own below.

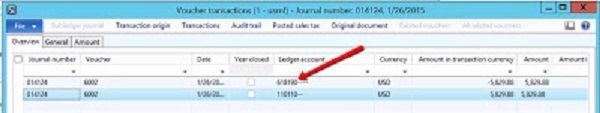

I reconciled the above reconciliation and you can see below that the charges (in this case, Fee) got posted to the correct ledger account.

This way you can create the adjustments and record any transaction that appears on the bank statement but not within AX straight from the reconciliation form itself rather than going through the general ledger and remembering all the natural accounts to which to post the transaction. One can also use Alpha character or alpha numeric characters too to better identify the transaction type.

This allows for each method of payment (e.g. check, credit card, ACH) could have their own corresponding bank transaction type ID. The entity could then pull reporting by the transaction types and have visibility on which methods of payment are most commonly used. For example, if the method of payment is credit card and there are numerous transactions, a company might decide to negotiate fee cuts or payment gateways using this data to back the negotiation. This simplifies business processes and allows for cost savings.

I hope you are able to use this information in bank reconciliations with Dynamics AX bank transaction types!

Learn more about Armanino's Dynamics AX Practice.