Depending on the size and nature of your business, you may be able to decrease your tax liability with one or more California business tax credits. As the cost of running a business in California continues to rise, it's important to discover if you qualify for any of these tax-saving opportunities.

Qualified businesses can save up to $150,000 with this credit. This credit (aka "Main Street Small Business Hiring Credit") provides financial relief to qualified small businesses for economic disruptions in 2020 and 2021 that resulted in job losses. This credit amount is equal to $1,000 for each net increase in qualified employees, measured by the monthly average full-time employee equivalents. You can carry over unused credits for five years or until exhausted. See 2021 Main Street Small Business Tax Credit II for details.

Type: Nonrefundable

Dates: 2020 - 2021

Claim Process: File Form 3866, Main Street Small Business Tax Credit (FTB 3866) with your California income tax return.

Save $20,000 or more if your business wants to relocate to California or stay and grow in the state. Also called "CalCompetes" this state tax credit is a five-year agreement with Go-Biz, or the Governor's Office of Business and Economic Development, in which the business owner agrees to meet full-time employment, salary and project investment milestones. Any unused credit may be carried over for up to six years. See California Competes Tax Credit (CCTC) for details.

Type: Nonrefundable

Dates: 2020 - 2021

Claim Process: File Form 3531, California Competes Tax Credit (FTB 3531) with your California income tax return.

This credit (prior to 2014 aka the "California Enterprise Zone Tax Credit [EZ or EZC]") is for employers that hire qualified full-time employees in California that perform work in specific geographic areas and in particular industries. To qualify, your business must have a net increase in full-time employees in California. There are numerous requirements to claim this credit. See New Employment Credit for details.

Type: Nonrefundable

Dates: January 1, 2014 - December 31, 2025

Claim Process: File a tentative credit reservation (TCR) within 30 days of a new hire and file Form 3554, New Employment Credit (FTB 3554) on a timely filed original tax return.

This credit is for employers who hire eligible homeless individuals and may save $2,500 to $10,000 per eligible employee based on the actual hours worked in the taxable year. Employers may claim up to $30,000 of credit per taxable year. Unused credit can be carried over for three taxable years. See Homeless Hiring Tax Credit for details.

Type: Nonrefundable

Dates: January 1, 2022 - December 31, 2026

Claim Process: Obtain an HHTC certificate for each eligible employee and an HHTC Tentative Credit Reservation (TCR). Then claim the credit on a timely filed original California income tax return.

Whether you're hiring or retaining employees, California has tax incentives to assist your workforce.

| Tax Credit Factors | Main Street Small Business Tax Credit II | California Competes Tax Credit | New Employment Credit |

|---|---|---|---|

| Business Size | Small Business 500 or fewer employees | ||

| Qualifiers | Job loss in 2020 and 2021 as result of economic disruption Decrease in gross receipts at least 20% |

Relocate to CA or stay and grow in state Expansion plans to create jobs in CA over the next 5 years or be at risk to leave CA |

Must have a net increase in full-time employees in CA |

| Dates | Must have started business prior to 2020 Tentative credit reservations closed November 30, 2021 |

Applications for 2021-2022 fiscal year closed March 28,2022 Three application periods each year |

January 1, 2014 – December 31, 2025 |

| Requirements | Tentative credit reservation required 2021 Main Street II credit reduced by any 2020 Main Street I credit |

Five-year agreement to meet full-time employment, salary and project investment milestones Create at least 500 new full-time jobs in CA or capital investment of at least $10M or project in a high unemployment/ poverty area | Hire qualified full-time employees in CA that perform and work at least 50% in specific geographic areas and in particular industries; must submit Tentative Credit Reservation (TCR) form within 30 days of completing the Employment Development Department (EDD) New Hire Reporting Requirements. |

| Credit | $1,000 for each net increase in qualified employees, measured by the monthly average full-time employee equivalents Credits elected to apply to sales and use tax or income/corporate tax |

Minimum credit a business owner can request is $20,000 Highly competitive |

The amount of credit is impacted by: • # of qualified employees • Qualified wages paid to those employees • Total # of full-time employees during your "base year" (qualified or not) • Total # of full-time employees during your current taxable year |

| Limits | No more than $150,000 in credit | Must submit request for amount of credit that it needs to be able to commit to implementing its proposed project $180 million per fiscal year 2018/2019 through 2022/2023 |

|

| Carryover | Can carry over unused credits for five years until exhausted | Unused credit may be carried over for up to six years | Unused credit may be carried over for 5 taxable years subsequent to the year generated |

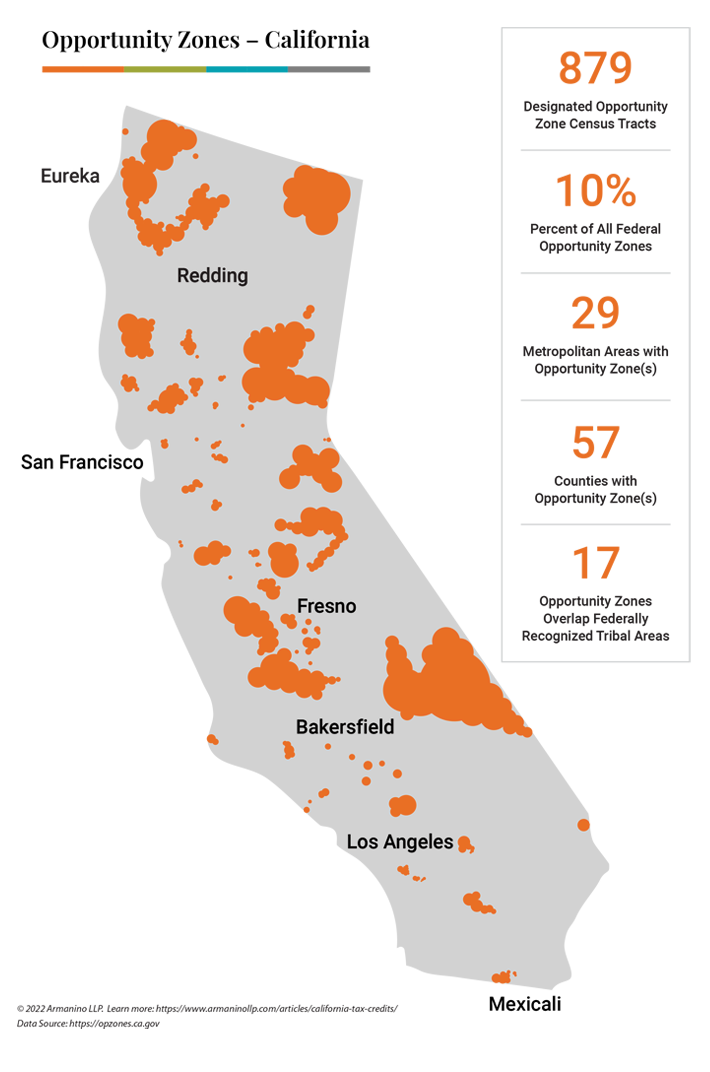

California Opportunity Zones are areas of the state based on census tracts that are low-income or in economic distress. The average poverty rate in a California Opportunity Zone is 20 percentage points higher than the statewide average.

Each zone has its own set of needs and community-based interests, which is why the Opportunity Zones are useful in helping various stakeholders determine what types of investments they could make in these communities. In addition, California Opportunity Zones provide a tax incentive for capital gains and preferential consideration in federal grants, loans and technical assistance programs, which can help support projects such as affordable housing and healthcare.

Use the map below to find Opportunity Zones across California.

You may qualify for this credit (also known as "California Research Credit") if you engaged in research activities in California. It is equal to the sum of 15% of qualified expenses that exceed a base amount and 24% of basic research payments. Any unused credit may be carried over until it is exhausted. Consider combining with the federal R&D tax credit for added savings.

Type: Nonrefundable

Dates: No expiration currently defined.

Claim Process: File Form 3523, Research Credit (FTB 3523) with your California income tax return.

Corporations and individuals may qualify for this credit (also known as "California Motion Picture and Television Production Credit" and "California Motion Picture and TV Credit") if they produced a motion picture or television show in California. See California Motion Picture and Television Production Credit for full details.

Type: Refundable

Dates: Taxpayers can apply for an allocation beginning in July of 2020, when Program 2.0 expires, and continue through June 30, 2025.

Claim Process: Create an account at California Film & Television Tax Credit Program and file Form 3541, California Motion Picture and Television Production Credit (FTB 3541) with your California income tax return.

Whether you have a family or are single living and working in California, there are a handful of tax credits that can help reduce your state taxes.

This credit (also called "CalEITC") gives you a refund or reduces the taxes you owe if you work in California and have a maximum income of $30,000. Many individuals and families are eligible, including those who file their taxes with an individual taxpayer identification number (ITIN). The credit saves hundreds or thousands depending on your income and family size.

Type: Refundable

Dates: No expiration currently defined.

Claim Process: File Form 3514, California Earned Income Tax Credit (FTB 3514) with your California income tax return.

You may qualify for this refundable tax credit of up to $1,000 if you also qualify for CalEITC and have a child under age six. Qualifying children must be under age six as of December 31, 2021.

Type: Refundable

Dates: No expiration currently defined.

Claim Process: File Form 3514, California Earned Income Tax Credit (FTB 3514) and include it with your California income tax return.

This credit saves up to $2,500 per child (per tax year) adopted in California. You may qualify if you spent money on Department of Social Services or licensed adoption agency fees, medical costs not covered by insurance or travel expenses. The $2,500 maximum covers 50% of the adoption costs per tax year. If costs exceed $2,500, the credit can be carried over.

Type: Nonrefundable

Dates: No expiration currently defined.

Claim Process: File Form 8839, Qualified Adoption Expenses and include it with your Form 1040, U.S. Individual Income Tax Return, Form 1040-SR, U.S. Tax Return for Seniors or Form 1040-NR, U.S. Nonresident Alien Income Tax Return.

If you paid someone to take care of your child, dependent, spouse or registered domestic partner – and you have earned income during the year or you looked for work – you may qualify for this credit. You can claim expenses up to $3,000 for one person and $6,000 for two or more people and you'll receive a percentage of the amount you paid as a credit. See Child and Dependent Care Expenses Credit for more details.

Type: Nonrefundable

Dates: No expiration currently defined.

Claim Process: File Form 3506, Child and Dependent Care Expenses Credit with your California income tax return.

This credit can save 50% of your contribution to the California Access Tax Credit Fund, which helps provide financial aid to low-income college students. Any unused credit may be carried over for up to six years. Corporate and individual taxpayers are eligible.

Type: Nonrefundable

Dates: 2014 - 2022

Claim Process: Apply and donate through the California Educational Facilities Authority (CEFA). Enter your certification number on Form 3592, College Access Tax Credit (FTB 3592), and file with your California income tax return.

This credit saves a maximum of $484. You qualify if you have joint custody of a child, stepchild or grandchild and if you pay for more than half their expenses. Claim this credit if you were unmarried and not a registered domestic partner (RDP) at the end of the tax year (or if you were married/a RDP but lived apart from your spouse for the tax year) and you supplied more than half of the household expenses for your home.

Type: Nonrefundable

Dates: No expiration currently defined.

Claim Process: Follow instructions to calculate your credit and enter the amount on Form 540, California Resident Income Tax Return on line 35 or on Form 540NR, California Nonresident or Part-Year Resident Income Tax Return on line 51.

This credit saves up to $1,499. You may qualify if you are 65 or older, you qualified as head of household for at least one of the past two years, your qualifying person died in the past two years, and your income is less than $79,539.

Type: Nonrefundable

Dates: No expiration currently defined.

Claim Process: File Form 540, California Resident Income Tax Return, or Form 540NR, California Nonresident or Part-Year Resident Income Tax Return, with your California income tax return.

Save up to $491 if you provided care for an elderly parent, whether they live with you or not. You may be eligible if you were married or a registered domestic partner (RDP) but filed separately; your spouse/RDP didn't live with you the last six months of the year; and you paid over half the household expenses for your parent.

Type: Nonrefundable

Dates: No expiration currently defined.

Claim Process: File with your California income tax return: Form 540, California Resident Income Tax Return, or Form 540NR, California Nonresident or Part-Year Resident Income Tax Return.

You may be able to claim this credit if you paid rent in California for at least half the year and your income is $43,533 or less (single), or $87,066 or less (married). You'll get a $60 credit if you are single or married/a registered domestic partner (RDP) filing separately; or $120 if you are head of household, married/a RDP filing jointly, or a widow(er). See Nonrefundable Renter's Credit for more details.

Type: Nonrefundable

Dates: No expiration currently defined.

Claim Process: File on your California income tax return: Form 540, California Resident Income Tax Return line 46, Form 540 2EZ, California Resident Income Tax Return line 19, or Form 540NR, California Nonresident or Part-Year Resident Income Tax Return line 61.

California credits and respective federal tax credits can be daunting. Contact out tax credit consultants for assistance with qualifications, credit calculations, and compliance to maximize your savings today.

Armanino has the industry expertise, tax credit experience and track record of customer satisfaction to best advise your tax credit incentive strategy and compliance needs.

Contact us today for a free assessment.