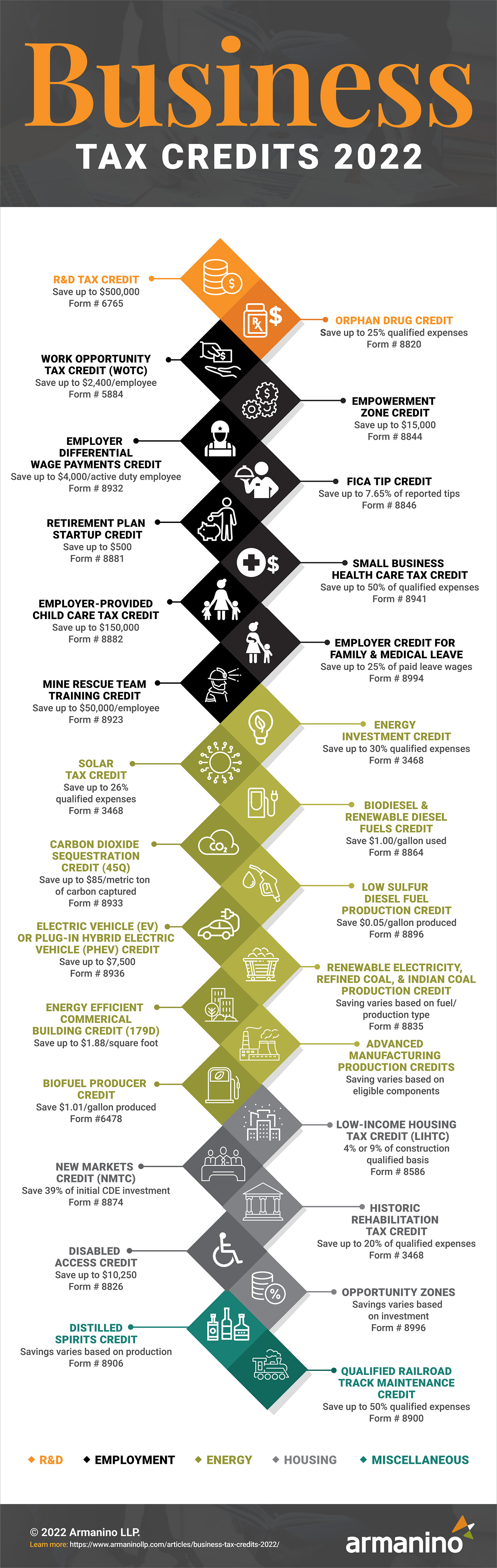

Business tax credits are money that can be subtracted, dollar for dollar, from owed business income taxes at state or federal levels. Business tax credits incentivize investment or provide assistance in these targeted areas:

For a complete list of current tax credits and incentives, please visit our Business Tax Credits 2023 page.

Want to display this infographic on your site? Copy and paste the following code. Be sure to include attribution to armaninollp.com with this graphic.

This federal tax credit provides tax savings to companies who employ individuals that face significant barriers to employment with savings up to $2,400/employee. Companies may qualify for this credit if they have first and/or second year wages paid to or incurred for targeted groups during the tax year.

WOTC-Eligible Worker Categories:

Type: Nonrefundable

Dates: Jan 1, 2015 - Dec 31, 2025

Claim Process: Request certification by filing IRS Form 8850, Pre-Screening Notice and

Certification Request for the Work Opportunity Credit with the state workforce agency within 28

days after eligible workers begin work. Calculate the credit using Form 5884, Work

Opportunity Credit, and include it when filing annual federal income tax returns.

This federal tax credit (also known as "Rehabilitation, Energy & Reforestation Investment Credit," "Energy Credit" or "Energy Investment Tax Credit (ITC)") saves up to 26% of the total purchase and installation costs of certain renewable energy properties. This includes credits for rehabilitation, energy, qualifying advanced coal projects, qualifying gasification projects and qualifying advanced energy projects – geothermal systems, solar technologies, fuel cells, small wind turbines, microturbines, waste energy recovery, and combined heat and power (CHP).

Type: Nonrefundable

Dates: Energy properties where construction began after Jan 1, 2020

Claim Process: File Form 3468, Investment Credit with

annual federal income tax returns in the year the energy property was placed in service.

This federal tax credit (also referred to as the "Solar Investment Tax Credit (ITC)") saves up to 26% of costs for new solar energy systems where a non-tax-exempt business or individual owns (not leases) and uses the system in the United States.

The ITC savings percentage scales down as follows:

The IRS qualifies construction as “started” when 5% of project costs have been incurred. Solar-powered units that illuminate, heat/cool water, or generate electricity along with their respective storage equipment, installation, and labor costs are eligible. (Solar systems for heating swimming pools or hot tubs are not eligible.) See the U.S. Department of Energy Residential and Commercial ITC Factsheets for eligibility and savings specifics and exceptions.

Several U.S. states and territories additionally offer solar tax incentives or rebates. California, Minnesota, Texas, New York, Colorado, and Oregon offer over 100 solar incentives. Visit the Database of State Incentives for Renewables & Efficiency (DSIRE) for program details. If you’re considering solar lighting or solar panels, be sure to leverage both federal and state tax incentives.

Type: Nonrefundable

Dates: Solar properties where construction began after Jan 1, 2020

Claim Process: File Form 3468, Investment Credit with

annual federal income tax returns in the year the solar system was placed in service.

Note: The Solar Tax Credit (IRS Form 3468, ITC) applies for businesses while the Residential Solar Energy Credit (IRS Form 5695) applies for individual homeowners. The rules are similar, but differ slightly.

This is a Section 45Q federal tax credit available to businesses that purchase and use carbon capture and sequestration mechanisms. The credit amount is calculated per metric ton of carbon oxide or carbon dioxide captured – with savings up to $50/metric ton. There’s currently no limit on maximum savings. To determine the credit rates, refer to IRS Form 8933, Carbon Oxide Sequestration Credit instructions.

Type: Nonrefundable

Dates: No expiration currently defined

Claim Process: File Form 8933, Carbon Oxide Sequestration

Credit with annual federal income tax returns.

This provision provides a federal production tax credit (PTC) for the sale of renewable electricity, refined coal or Indian coal that is produced by certain renewable energy production property in the United States. The amount of the credit varies based on the production method and amount of energy produced and the reference price of the relevant fuel type.

Type: Nonrefundable

Dates: No expiration currently defined

Claim Process: File Form 8835, Renewable Electricity, Refined

Coal, and Indian Coal Production Credit with annual federal income tax returns.

This federal tax credit (also known as "Rehabilitation, Energy & Reforestation Investment Credit," "Investment Credit" or "Historic Tax Credit (HTC)") provides a credit for 20% of the expenses incurred in renovating a historic building for business or for some income-generating use. The credit excludes building purchase costs and you must take the 20% credit spread out over five years, starting in the year you placed the building into service.

Taxpayers who own an interest in the historic building, or are lessees of the building in some cases, are eligible to claim this credit. Passthrough entities cannot claim the credit but their partners, members, shareholders and beneficiaries are eligible, as are individuals, corporations, estates and trusts. See IRS Rehabilitation Credit (Historic Preservation) FAQs for more details.

Type: Refundable

Dates: No expiration currently defined

Claim: File Form 3468, Investment Credit with annual federal income tax returns.

Have you claimed savings for ALL tax credits for which your business is eligible?

Whether you’re investing in research, hiring new employees, expanding geographic reach, or making improvements to current location, your bottom line could be boosted with tax credit savings.

Many business tax credits are available at both state and federal levels, providing stacked savings opportunities. Planning for these credits is crucial, as some deadlines are time sensitive and triggered based on actions like hiring employees or selecting a specific location to move your business.

Don’t miss out. Take advantage of all eligible tax credits for your business and significantly reduce the taxes you owe to the government. Our business tax experts can help you identify federal and state credits and complete the claim process, so you can reinvest tax savings for sustaining and growing your business.

For assistance with claiming business tax credits, see our tax credit services.

Armanino has the industry expertise, tax credit experience and track record of customer satisfaction to best advise your tax credit incentive strategy and compliance needs.

Contact us today for a free assessment.