Housing tax credits (HTCs) incentivize affordable housing, new construction in opportunity zones, historic building rehabilitation and preservation, along with energy efficiency and disabled accessibility improvements. Companies can subtract the housing credits, dollar for dollar, from owed taxes.

Housing developers can achieve lower rents for tenants by using HTCs to offset income tax liability.

If you're developing new properties, strategically consider for whom and where you are building to take advantage of these tax savings.

Also known as the "Housing Credit," this federal business credit is an incentive for real estate developers and investors to build or renovate housing for low-income Americans. Typically taken over a 10-year period, the transferrable credit is administered by state housing finance authorities. The credit can't exceed the amount allocated to the building and can only be claimed for residential rental housing projects that meet specific income requirements.

Type: Nonrefundable

Dates: No expiration currently defined.

Claim Process: File Form 8586, Low-Income Housing Credit with your federal income tax return.

This federal credit (also known as "New Markets Credit") incentivizes economic growth and community development through the use of tax credits that attract private capital into low-income communities. The NMTC Program allows individual and corporate investors to receive a tax credit when they make investments in community development entities (CDEs). The credit is 39% of the initial investment amount and is claimed over a seven-year credit period.

Type: Nonrefundable

Dates: Dec 21, 2000 - Dec 31, 2025

Claim Process: File Form 8874, New Markets Credit with your federal income tax return.

You can help support economic development in qualified opportunity zones (low-income or distressed areas of the U.S.) and temporarily defer tax on eligible gains when you invest in a qualified opportunity fund (QOF). As an investor, you don’t have to pay taxes on your capital gains until 2026 if you timely invest the gain amounts in a QOF. The tax benefit you receive depends on how many years you hold onto the QOF investment. See Opportunity Zones for more details.

Type: Nonrefundable

Dates: December 31, 2047, is the final date to dispose of an opportunity zone investment.

Claim Process: Investors must file Form 8997 annually and file Form 8949 for the first year of the QOF investment. To become a QOF, an eligible corporation or partnership self-certifies by annually filing Form 8996, Qualified Opportunity Fund with its federal income tax return.

In addition to federal tax credits, many states also offer affordable housing tax credits. Visit your state’s official website to learn more housing tax credit (HTC) program details.

Are you involved in the preservation of a historic building? Don’t miss out on potential tax savings for your efforts.

This federal tax credit (also known as "Historic Preservation Tax Credit," "Rehabilitation, Energy & Reforestation Investment Credit," "Investment Credit" or "Historic Tax Credit (HTC)") provides a credit for 20% of the expenses incurred in renovating a historic building for business or for some income-generating use. The credit excludes building purchase costs and you must take the 20% credit spread out over five years, starting in the year you placed the building into service.

Taxpayers who own an interest in the historic building, or are lessees of the building in some cases, are eligible to claim this credit. Passthrough entities cannot claim the credit but their partners, members, shareholders and beneficiaries are eligible, as are individuals, corporations, estates and trusts. See IRS Rehabilitation Credit (Historic Preservation) FAQs for more details.

Type: Refundable

Dates: No expiration currently defined.

Claim: File Form 3468, Investment Credit with your federal income tax return.

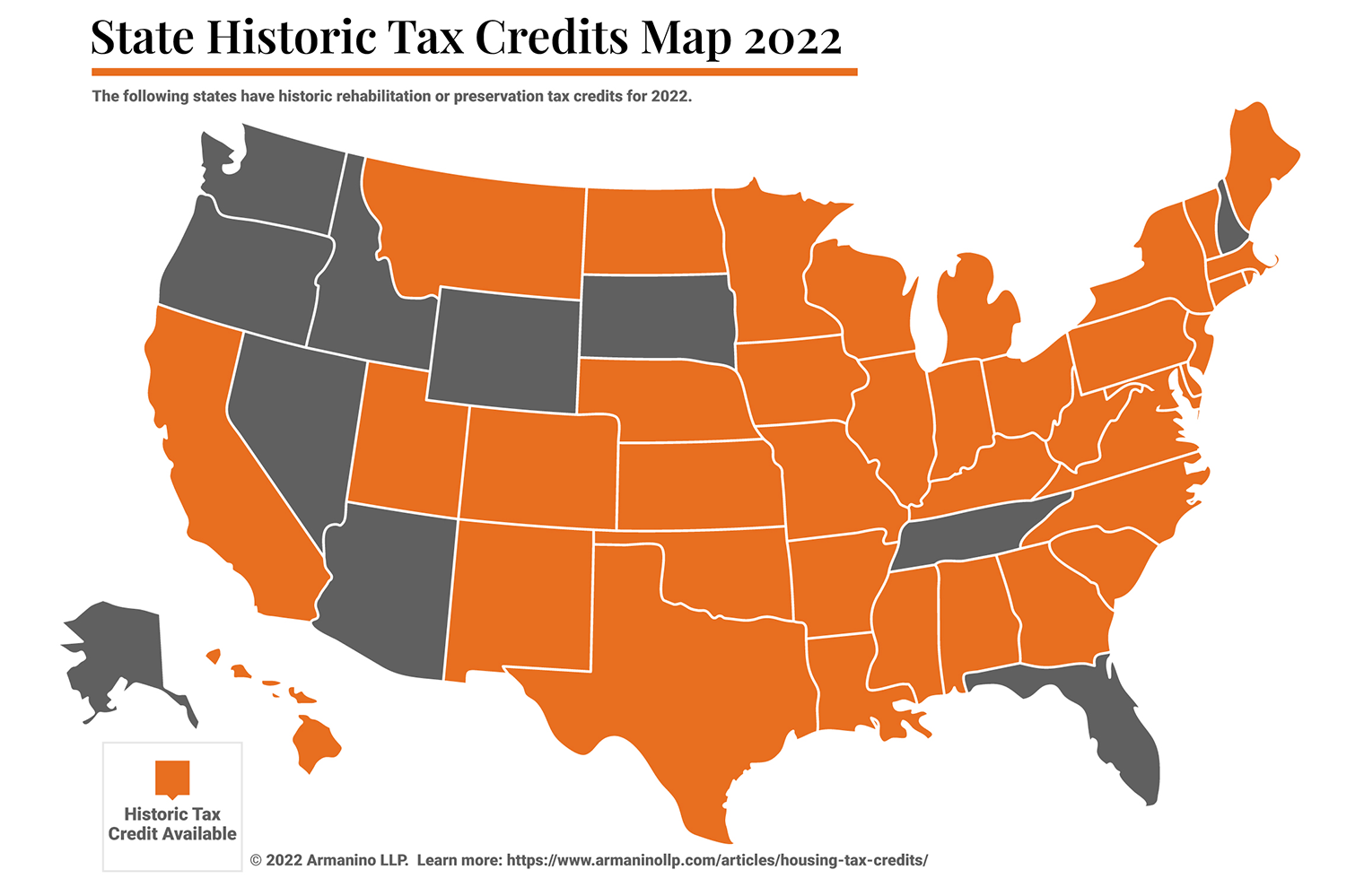

In addition to federal tax credits, as of 2022, there are 37 states with historic tax credits available for your income-producing rehabilitation project. Note that both federal and state HTCs can be claimed.

Making energy efficiency and disabled accessibility improvements can potentially come with tax savings.

This federal business tax credit can save $1,000 or $2,000 and is available to qualified contractors who sell or lease a home to someone planning to use it as a residence during the tax year. The credit is determined by how many of the specified energy saving requirements are met. See Instructions for Form 8908 for requirements.

Type: Nonrefundable

Dates: No expiration currently defined.

Claims Process: File Form 8908, Energy Efficient Home Credit with your federal income tax return.

Businesses are eligible for this federal credit if they spend money to make their building more accessible for employees, customers and other individuals with disabilities. The credit covers 50% of your expenses, up to $10,250. See Tax Benefits for Businesses Who Have Employees with Disabilities for further details.

Type: Nonrefundable

Dates: No expiration currently defined.

Claim Process: Calculate eligible access expenses using IRS Form 8826, Disabled Access Credit and attach it with your federal income tax return.

For assistance qualifying or claiming housing tax credits, see our tax credit services.

Armanino has the industry expertise, tax credit experience and track record of customer satisfaction to best advise your tax credit incentive strategy and compliance needs.

Contact us today for a free assessment.