“The standard will eliminate the transaction- and industry-specific revenue recognition guidance under current U.S. GAAP and replace it with a principle

based approach for determining revenue recognition. This standard has the potential to affect every entity’s day-to-day accounting and, possibly, the way business is executed through contracts with customers.”

—“Revenue Recognition Task Force: Status of Implementation Issues,” American Institute of Certified Public Accountings (AICPA), July 2016.

The new revenue recognition standard is a historic, game-changing requirement that affects all entities—public, private, and not-for-profit— which have contracts with customers (with only a few exceptions). Replacing virtually all existing revenue recognition requirements, IFRS 15 Revenue from Contracts with Customers, issued in May 2014, together with FASB’s new revenue standard, Accounting Standards Update 2014-09, Revenue from Contracts with Customers, creates a single framework.

Are companies ready for this major change? The answer seems to be no. An informal poll at the AICPA National Conference on Current SEC and PCAOB Developments held in December of 2015 showed that only 17 percent had completed an initial analysis of the new revenue recognition standard’s impact. In his discussion of the new revenue recognition standard at the conference, Wesley Bricker, Deputy Chief Accountant of the Office of the Chief Accountant (OCA) cited a survey that indicated 75 percent of responding companies had not completed their initial impact assessment and, of those, a third had not begun [the assessment].

While the extended implementation date appears to provide businesses with plenty of time to get ready for the changes, that fact is that for many companies, it will soon be too late to ensure a smooth transition. “Waiting too long to assess the impact could result in investors losing confidence, delays in the year-end audit, lenders changing their terms and willingness to lend based on delayed revenue recognition, a company no longer qualifying for other methods of financing, and the board and executive suite losing confidence in the finance and accounting team,” says Ricardo Martinez, audit partner at Armanino.

Instead of sleepless nights for the CFO down the line, it’s time for companies to begin preparing now. Read on for why preparation sooner rather than later is critical and what steps CFOs and their teams need to take to guide their companies through this challenging transition.

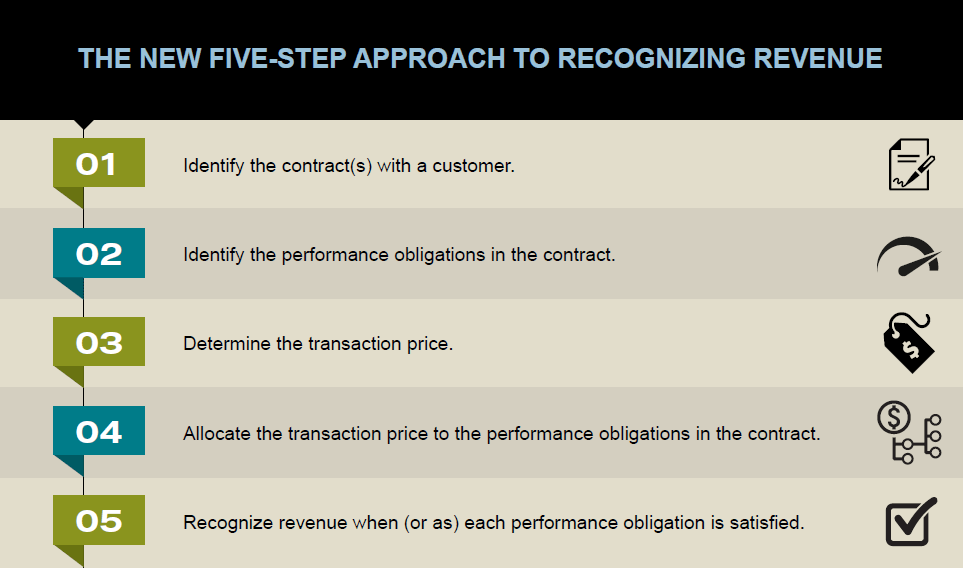

The new revenue recognition standards issued by FASB and the IASB represent the most significant accounting change for U.S. businesses since Sarbanes-Oxley. These standards eliminate the transaction- and industry-specific revenue recognition guidance under current GAAP and replace it with a principle-based approach for determining revenue recognition. The standards apply to all entities, except for certain items, including leases accounted for under FASB Accounting Standards Codification (ASC) 840, Leases; insurance contracts accounted for under FASB ASC 944, Financial Services—Insurance; most financial instruments; and guarantees (other than product or service warranties).

Originally slated for January 2017, the effective date of the new standard was deferred in 2015 by one year, moving the adoption date for U.S. GAAP public companies to January 1, 2018 and non-public companies to January 1, 2019. While the deferral gives companies more time to implement the new standard, for public entities that will adopt the standard on a full retrospective basis, the first annual period to which they will need to apply the standard is for fiscal years beginning on or after January 1, 2016.

That’s why waiting until 2018, or 2019 in the case of private companies, can mean a mad scramble to understand the impact, prepare for implementation, and communicate the changes effectively to company executives as well as investors, auditors, lenders, and others. In fact, the reasons behind the extension are the very same issues that can keep CFOs awake at night:

While some organizations may be planning to delay dedicating resources and budget to implementing the new standard for as long as possible, doing so could result in higher costs and negative consequences for the business.

Global enterprises in industries such as technology or construction—where multi-year contracts or percentage of completion are the norm—are already well down the path to implementation of the new standard. They’ve analyzed the impact on their businesses and understand their potential exposure. In the process, they’ve created transition teams, started working with auditors, and begun updating systems and processes. Well in advance of the actual reporting change implementation date, these industry leaders are planning, acting, and communicating to ensure as smooth a transition as possible.

Unfortunately, these companies appear to represent only a very small minority of entities. Based on survey results and anecdotal evidence, most companies haven’t even taken the first step—analyzing the impact of the new standard on their business—so they don’t know what awaits them. They can’t predict whether they can implement on time because they don’t know the extent of the changes their businesses will have to make. Nor do they yet understand the potential impact on their company’s forecasting, metrics, accounting policies, financial reporting and budgeting.

“ Companies with multi-year contracts must start now with the transition to the new revenue recognition rules. You have to know what the revenue will look like for contracts you’re signing today."

–John Dunican, Partner and Leader, CFO Advisory Services, Armanino

Let's say your business has three-year contracts in place. Those contracts will have an impact on the reporting change. Very soon, two-year contracts will also impact how you recognize revenue under the new rules.

Here are more compelling reasons why your company needs to start addressing the new revenue recognition standards now if you haven’t begun already or haven’t progressed in your implementation:

Current terms and conditions. If your business doesn’t already understand the potential impact of the new standard, how do you know whether you should be changing terms and conditions in your contracts to minimize exposure?

Dual reporting requirements. Under the fullretrospective method, public entities would be required to restate two comparative years prior to the implementation date. Using the full retrospective approach may require systems to be ready to capture data to perform dual reporting now—far ahead of the actual compliance date. That could mean a substantial overhaul in business processes, accounting systems, or both—as well as employee training—in a short time frame.

Unknown impact and effort. Without beginning the process of analyzing the impact of the changes, how do you know what awaits your company? How large of an effort will be required to comply? Will you have the staff and budget required?

Scarcity of resources. The longer a company waits to conduct an assessment and build a plan and timeline, the more difficult it may become to gain assistance from experienced firms and consultants. Expert resources will likely become constrained and/or more expensive as demand increases.

It’s clear that the time for action is now. Waiting until 2018 or 2019 to worry about the new standards is a recipe for disaster.

CFOs should begin analysis and preparation immediately. Savvy organizations will likely turn to a trusted, third-party advisor with expertise in the new revenue recognition standard as well as experience helping companies resolve accounting issues and improve processes. These advisors can help them conduct a comprehensive gap analysis and create and execute an effective and expedient implementation plan.

CFOs should begin analysis and preparation immediately by:

1. Conducting an analysis. Identify where your company stands on revenue recognition today in comparison to where it needs to be. This gap analysis includes a side-by-side comparison of the new regulations versus current processes.

2. Planning and documenting. The next step is to write a technical memo with a plan to address the discrepancies between current and future states. The memo should include:

The new revenue standard gives entities the option of using either a full retrospective transition method or a modified retrospective transition method. In general, the greater the expected differences between a company’s legacy revenue accounting methods and the new standard, the stronger the argument is for using a full retrospective method.

Full retrospective: Companies choosing a full retrospective approach to adopting the new revenue standard would present three full years of financial data beginning with the adoption of the new standard in 2018 and going back to 2016, as if the company had been following the new standard for all three of those years.

Modified retrospective: Companies present historical data using cumulative-effectadjustments, initially applying the standard recognized at the date of initial application.

Based on the gap analysis, some businesses will determine that there is very little they need to change. The analysis gives them the peace of mind of knowing that there is little impact to their business and it frees them up to concentrate on other matters.

However, many companies will realize from the analysis that there will be a substantial impact to their business. These entities will need to move forward with an implementation plan as soon as possible. This requires dedicating resources and budget for the transition and establishing a transition team to guide the process.

A comprehensive implementation plan includes:

1. System changes. Your company will need to analyze system capabilities required, any shortcomings in the current system, and whether updates to the current system must be made or a new system deployed to support the transition to the new standard.

2. Accounting process changes. You will also need to identify and change relevant accounting processes and methods, including contract changes.

3. Changes to internal controls. Changes to governance, risk, and control processes should be identified and implemented.

4. Supplementing staff resources as needed. Your company may require outside help to handle the additional workload during the transition.

5. Training on new processes. Plan for training preparers, reporting staff, financial planning and analysis teams, and internal audit personnel impacted by the changes.

6. Communicating the impact. You’ll want to communicate the impact of the new standard to:

“ Time is of the essence for companies to begin implementing their transition plans, particularly for those entities where systems, processes, and internal controls are significantly impacted or where additional complexities such as operating geographies, company size, or unusual product or service revenues can compound the effort required."

Ryan Prindiville, Strategy and Transformation Leader, Armanino

Even those industries whose requirements were relatively simple until now will have to pay close attention to their revenue recognition policies and contracts, and how they are handled in their systems. All entities will need to determine whether any changes will need to be made to IT systems or software applications, such as the enterprise resource planning (ERP) system, to capture information required by the new revenue recognition standard.

Does your ERP vendor provide robust capabilities for the new standard? Scott Schimberg, partner and leader of the Intaact consulting practice at Armanino, recommends asking your vendor if the software supports dual accounting, which allows you to apply both the old and new methods during the retrospective period and then report on the differences.

Depending on your vendor and its ability to support dual accounting and the reporting for the new standard, you may be better served by deploying a new system that already supports dual accounting. In any case, the important aspect of this part of the implementation plan is to determine your needs now and not wait until the deadline is looming. You’ll need time to upgrade or change your systems accordingly.

“ You’ll want the ability to apply both accounting methods so you can capture all the data you need at the time the contract is entered. There may be data—such as selling expenses—that you need for the new standard but isn’t being captured in your tracking system currently."

Scott Schimberg Partner and Leader, Intacct Consulting Practice Armanino<

Analyzing the impact, deciding on a transition method, evaluating technology, reviewing and revising processes and controls—for many companies, these will be non-trivial exercises that require considerable time and effort to accomplish.

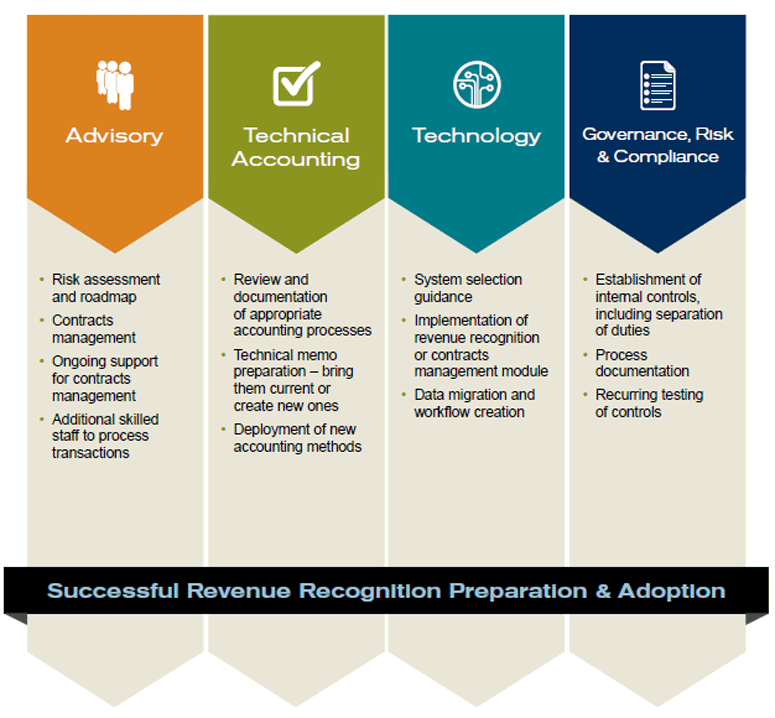

Turning to a trusted third-party with deep knowledge and industry experience as well as technology consulting expertise can help you reduce risk, streamline your implementation plan, identify opportunities for process and system improvements, and ensure on-time and accurate compliance with the new standard.

Depending on your organization’s needs, you should look for a partner with capabilities that include:

Armanino

Armanino LLP, the largest independent accounting and consulting firm in California and one of the largest in the U.S., offers an integrates set of audit, tax, consulting, business management and technology solutions to companies in the U.S. and globally. It is uniquely qualified to help your company analyze, prepare for, and implement the new revenue recognition standard.

Nearly every company is affected to some degree by the new revenue recognition standard. While it’s tempting to assume that the impact of the change and the effort required to transition will be minimal, many companies face significant changes that will require a much longer lead time than anticipated. In fact, many companies will need to begin capturing data for dual reporting immediately.

Regardless of where your company finds itself in the implementation process, Armanino can help you achieve a smooth transition. Armanino offers an integrated collection of services, covering the full spectrum from technology to new processes to people.

“ The new standards equate to multiple new and potentially complex disclosures. It’s critical to address the incremental disclosure requirements and consult with experts to identify and analyze the impact across all departments in your organization."

Ricardo Martinez, Partner, Audit Practice, Armanino

"

August 16, 2016