Our CFO Evolution® 2.0 is a complete transformation of the thinking and skills necessary for the CFO to navigate today’s turbulent environment and focus on the areas of their business that drive strategic value.

Armanino’s CFO Evolution 2.0 positions the CFO for a new transformational business model, one that requires the skills of an innovator and influencer to deal with the disruptive landscape. Armanino’s perspective can help finance leaders streamline their operations to achieve better accounting processes in less time—freeing the CFO to spend more time on the vital market disruptions impacting the organization’s strategy.

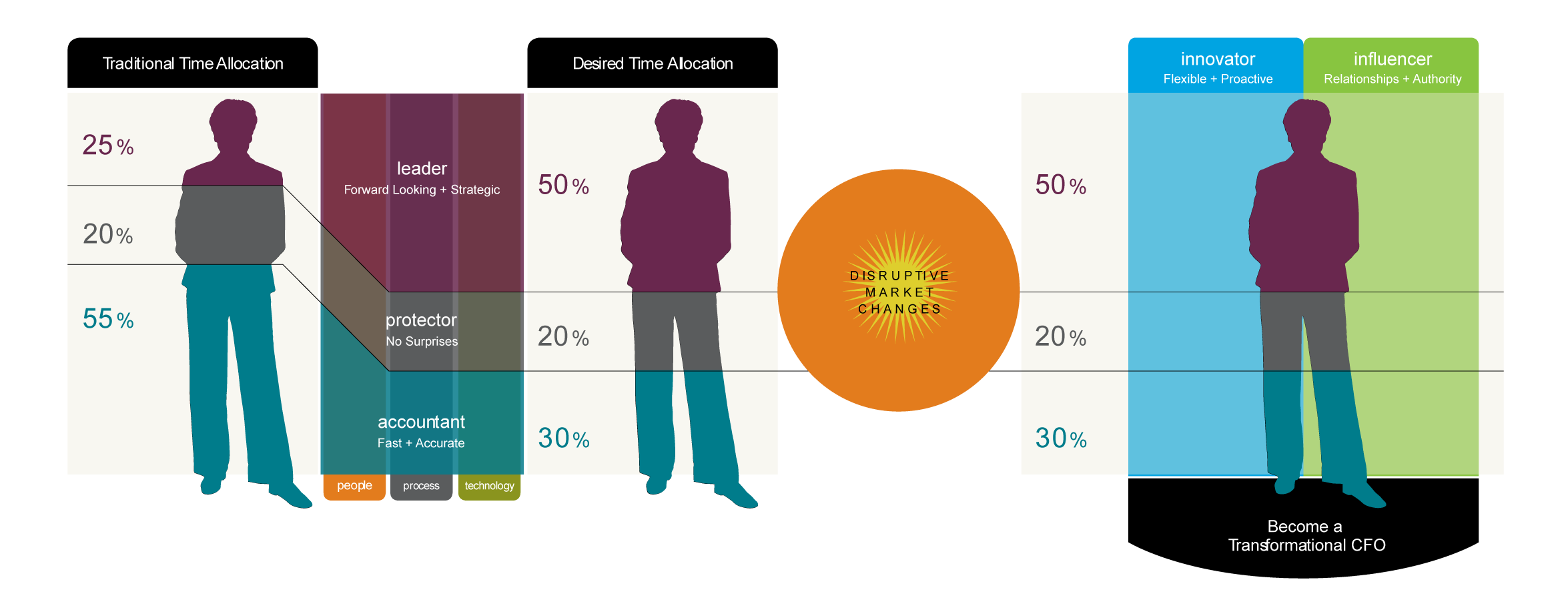

CFO Evolution 2.0 is a set of initiatives focused on the people, processes and technology needed to streamline the accounting function, optimize the protector role and elevate business leadership activities, thereby enhancing the value of the CFO organization. This framework was created to help organizations focus their time and energy on the areas that drive strategic value. Each of these core areas of responsibility requires a specific plan that includes goals, expected outcomes and required resources. The CFO Evolution provides a framework to migrate the CFO’s most limited resource—time—away from task-based activities to strategic leadership initiatives.

Continuous change is the new normal for companies in all industries. We and our surveyed CFOs believe that finance leaders must influence and innovate across the three core roles of accountant, protector and leader to evolve into the role of a transformational CFO. These skills, along with a relationship network of thought partners and subject matter experts, are necessary to combat disruptive market changes and broad-reaching, strategic challenges and take advantage of new opportunities.

Erin Sorgel, CFO of Peterson CAT, shares her story

If you have any questions or just want to reach out to one of our experts, use the form and we'll get back to you promptly.