Updated May 22, 2023

It is not unusual to see an uptick in financial fraud schemes during times of change and disruption. Business leaders should monitor their current situation, adjust processes and procedures as appropriate, and communicate an awareness of potential fraud schemes throughout their organizations. These actions will be critical for helping identify, prevent and mitigate financial fraud schemes.

What Is Occupational Fraud?

Occupational fraud is the use of one’s occupation for personal enrichment through the deliberate misuse or application of the employing organization’s resources/assets. There are three general types of occupational fraud:

Asset misappropriation – Employee steals or misuses an organization’s resources

Corruption – Employee’s use of influence in business transactions in a way that violates duty to the employer for the purpose of obtaining benefit for self or someone else

Financial statement fraud – Intentional misstatement or omission of material information in the organization’s financial reports

Fraud Stories

Here are just a few examples of real-life fraud that show how pervasive the problem is among organizations.

- Director of procurement reaped nearly $1.3 million from services that were never provided by her company by falsifying records

- CEO of a nonprofit focused on “at risk” children from low-income households received federal grant funding and electronically submitted fraudulent claims (over $250K) for reimbursement based on inflated attendance figures

- Misuse of fee program dollars ($125 million) in long-running diversion

- Nonprofit board member – self dealing, T&E and other issues identified

Types of Fraud

Financial fraud can take many forms, but the following list can help you protect your organization against potential risks:

Fraudulent disbursement schemes

During times when typical business practices are altered or disrupted, the risk of disbursement fraud may increase. Changes in purchasing levels or typical procurement processes can increase the likelihood that billing or expense reimbursement schemes occur without the proper oversight and monitoring. Don't take shortcuts around disbursement approvals — continue to exercise, or possibly increase your controls.

Insurance-related schemes

After natural disasters or other types of widespread business interruption, insurance-related fraud schemes may increase. Should you receive emails or other communication relating to insurance coverage or claims, be sure to use proper vetting, and conduct appropriate due diligence before sending information or making payments.

Donation-related schemes

You or your business may be targeted by nonexistent or fraudulent organizations seeking donations or financial contributions. Again, be sure to use proper vetting and conduct appropriate due diligence before sending information or donations. Make sure you review the organization's website and also consider using one of these organizations to help you research charities: BBB Wise Giving Alliance, Charity Navigator, CharityWatch and GuideStar.

Risks from additional access

With the closure of offices and businesses, you may have made changes to your typical business processes and allowed employees, vendors or other third parties access to locations and technology systems they might not have access to in normal situations. Be sure to review who should have access to your locations and systems and what level of access is appropriate and ensure that proper monitoring of that access is in place.

5 Keys to Fraud Prevention and Detection

Protect your business by practicing these five steps.

1. Establish a fraud risk governance program

- Make an organizational commitment to fraud risk management

- Establish a comprehensive fraud risk management policy

- Establish fraud risk governance roles and responsibilities

- Document the fraud risk management program

- Communicate fraud risk at all organizational levels and provide training

- Implement a fraud hotline

2. Conduct a fraud risk assessment

- Include board, executive management, departments/divisions, operating units and functional levels

- Analyze internal and external factors related to ACFE Fraud categories and schemes

- Consider using a survey tool or questionnaire

- Consider various types of fraud

- Consider the risk of management override of controls

- Estimate the likelihood and significance of risks identified

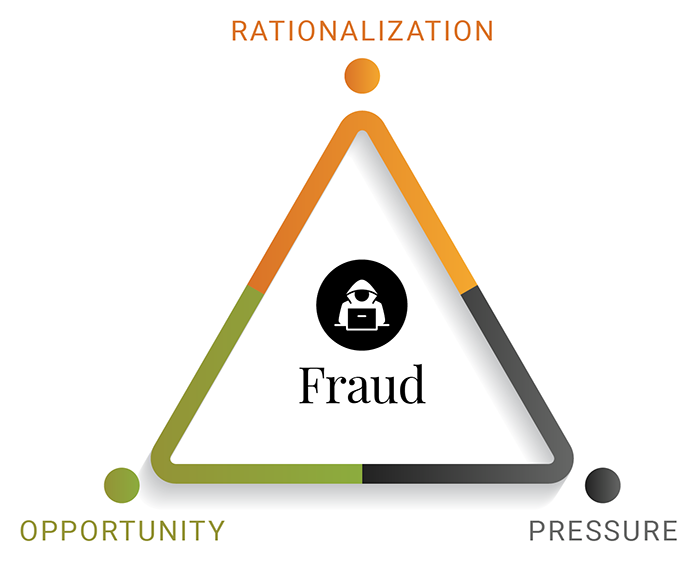

- Assess personnel/departments involved and the fraud triangle

- Identify existing fraud control activities and assess their effectiveness

- Determine how to respond to risks

- Perform periodic reassessments and assess changes to fraud risk

- Document the risk assessment

- Consider risk assessment when planning your audits

The fraud triangle highlights the three reasons behind a person's decision to commit fraud and can be used as a tool for employee education.

3. Implement fraud prevention and detection measures

- Promote fraud deterrence through preventative and detective control activities

- Integrate with the fraud risk assessment

- Consider organization-specific factors and relevant business processes

- Consider the application of control activities to different levels of the organization

- Utilize a combination of fraud control activities

- Preventative controls (e.g., segregation of duties, limited system access, etc.)

- Detective controls (e.g., bank reconciliations, surprise cash counts, etc.)

- Human resource procedures (e.g., background investigations, segregation of duties, whistleblower system, etc.)

- Consider management override of controls

- Use proactive data analytic procedures

- Deploy control activities through policies and procedures

4. Conduct fraud investigations and take corrective action

- Establish fraud investigation and response protocols

- Conduct investigations

- Communicate investigation results

- Take corrective action

- Evaluate investigation performance

5. Monitor fraud risk management

- Consider a mix of ongoing and separate evaluations

- Consider factors for setting scope and frequency of evaluations

- Establish appropriate measurement criteria

- Consider known fraud schemes and new fraud cases

- Evaluate, communicate and remediate deficiencies

Questions to Ask Today

Begin assessing your organization’s risk by asking these three questions.

- Do you know where fraud could occur in your organization?

- What is your risk?

- Do you have adequate policies, controls and processes in place designed to prevent fraud from occurring or detect it early to lessen your financial losses?

Have questions or need assistance with risk assessment, processes or monitoring? Reach out to our CFO Advisory team.